Enlarge image

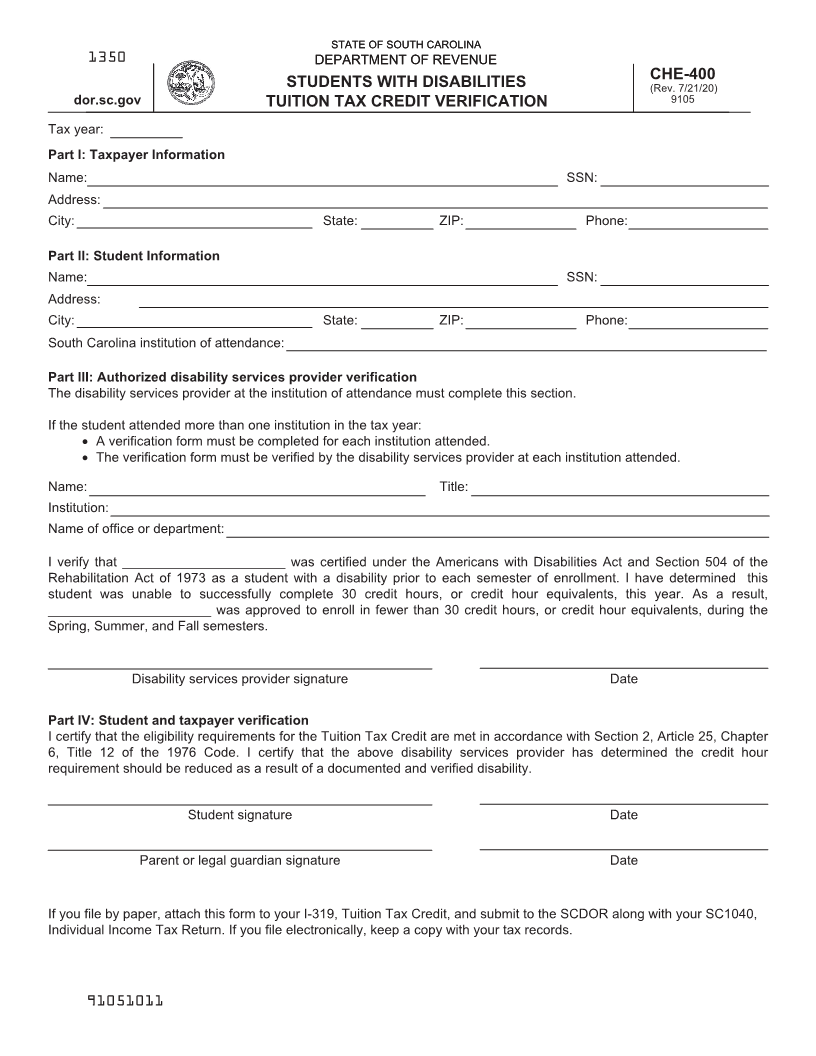

STATE OF SOUTH CAROLINASTATE OF SOUTH CAROLINA

1350 DEPARTMENT OF REVENUEDEPARTMENT OF REVENUE

CHE-400

STUDENTS WITH DISABILITIES (Rev. 7/21/20)

dor.sc.gov TUITION TAX CREDIT VERIFICATION 9105

Tax year:

Part I: Taxpayer Information

Name: SSN:

Address:

City: State: ZIP: Phone:

Part II: Student Information

Name: SSN:

Address:

City: State: ZIP: Phone:

South Carolina institution of attendance:

Part III: Authorized disability services provider verification

The disability services provider at the institution of attendance must complete this section.

If the student attended more than one institution in the tax year:

• A verification form must be completed for each institution attended.

• The verification form must be verified by the disability services provider at each institution attended.

Name: Title:

Institution:

Name of office or department:

I verify that ______________________ was certified under the Americans with Disabilities Act and Section 504 of the

Rehabilitation Act of 1973 as a student with a disability prior to each semester of enrollment. I have determined this

student was unable to successfully complete 30 credit hours, or credit hour equivalents, this year. As a result,

______________________ was approved to enroll in fewer than 30 credit hours, or credit hour equivalents, during the

Spring, Summer, and Fall semesters.

Disability services provider signature Date

Part IV: Student and taxpayer verification

I certify that the eligibility requirements for the Tuition Tax Credit are met in accordance with Section 2, Article 25, Chapter

6, Title 12 of the 1976 Code. I certify that the above disability services provider has determined the credit hour

requirement should be reduced as a result of a documented and verified disability.

Student signature Date

Parent or legal guardian signature Date

If you file by paper, attach this form to your I-319, Tuition Tax Credit, and submit to the SCDOR along with your SC1040,

Individual Income Tax Return. If you file electronically, keep a copy with your tax records.

91051011