Enlarge image

1350 STATE OF SOUTH CAROLINA

DEPARTMENT OF REVENUE SC2220

(Rev. 12/07/22)

UNDERPAYMENT OF ESTIMATED TAX

3099

BY CORPORATIONS

dor.sc.gov 2022

Name FEIN

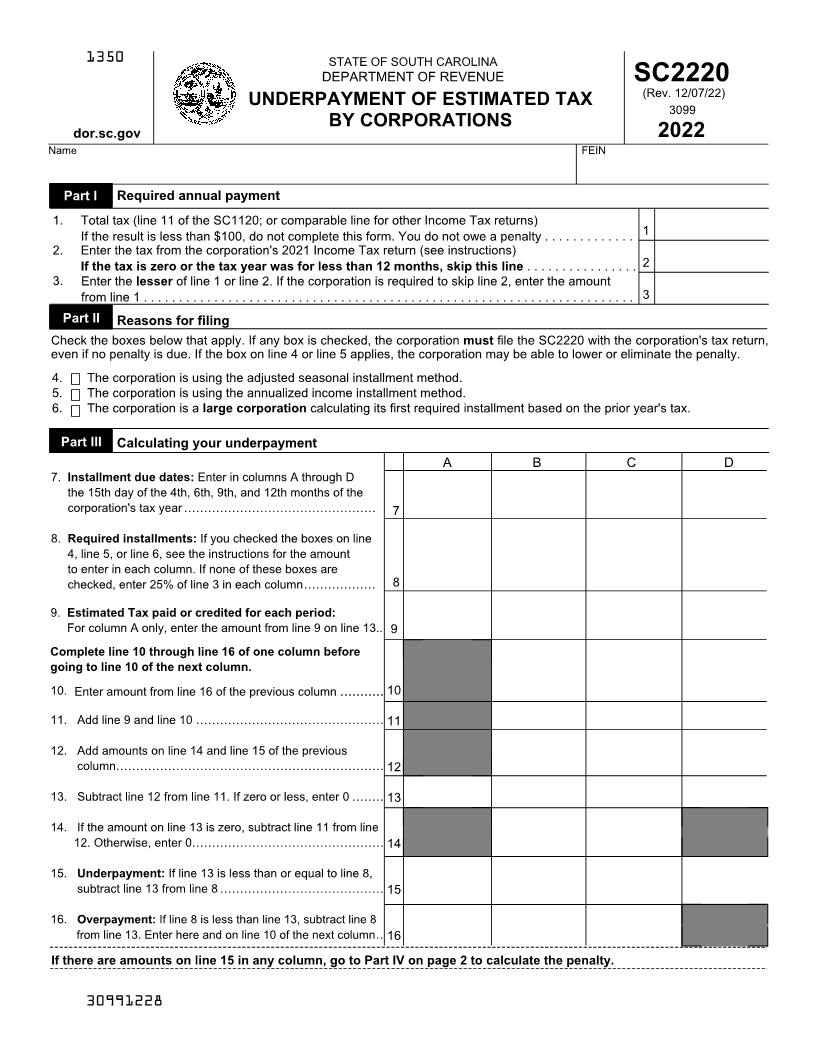

Part I Required annual payment

1. Total tax (line 11 of the SC1120; or comparable line for other Income Tax returns)

If the result is less than $100, do not complete this form. You do not owe a penalty . . . . . . . . . . . . . 1

2. Enter the tax from the corporation's 2021 Income Tax return (see instructions)

If the tax is zero or the tax year was for less than 12 months, skip this line . . . . . . . . . . . . . . . . 2

3. Enter the lesser of line 1 or line 2. If the corporation is required to skip line 2, enter the amount

from line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

Part II Reasons for filing

Check the boxes below that apply. If any box is checked, the corporation must file the SC2220 with the corporation's tax return,

even if no penalty is due. If the box on line 4 or line 5 applies, the corporation may be able to lower or eliminate the penalty.

4. The corporation is using the adjusted seasonal installment method.

5. The corporation is using the annualized income installment method.

6. The corporation is a large corporation calculating its first required installment based on the prior year's tax.

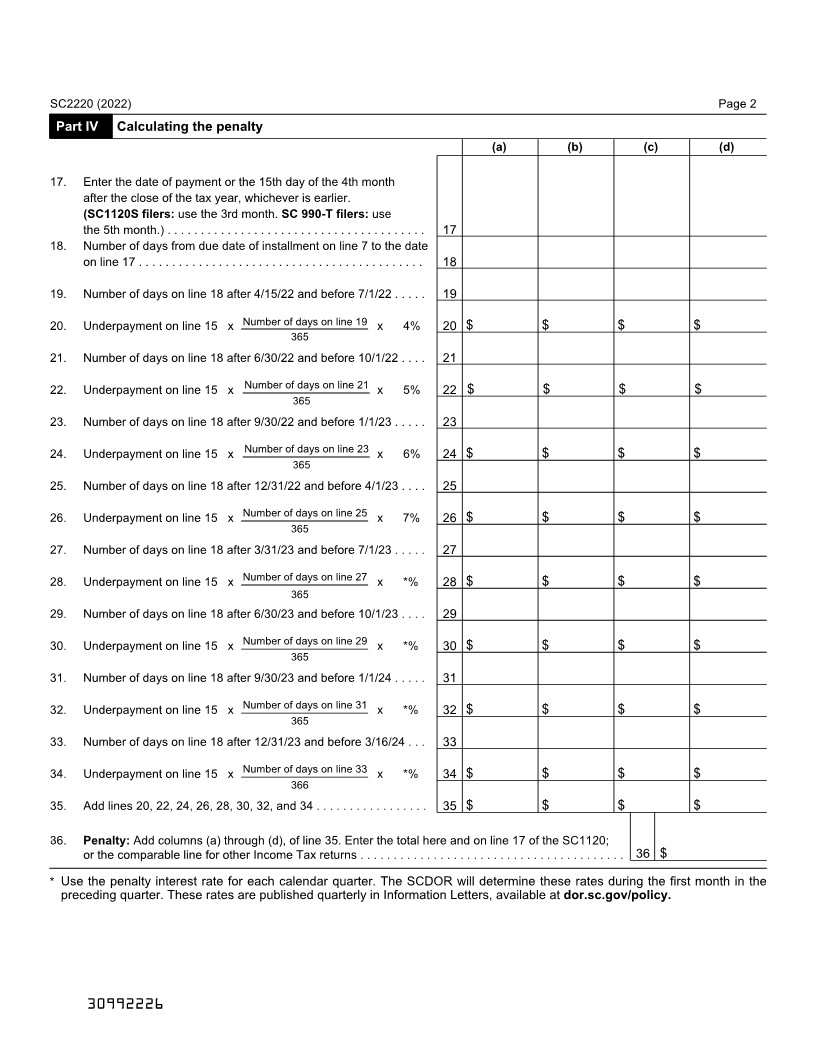

Part III Calculating your underpayment

AB C D

7. Installment due dates: Enter in columns A through D

the 15th day of the 4th, 6th, 9th, and 12th months of the

corporation's tax year ................................................ 7

8. Required installments: If you checked the boxes on line

4, line 5, or line 6, see the instructions for the amount

to enter in each column. If none of these boxes are

checked, enter 25% of line 3 in each column.................. 8

9. Estimated Tax paid or credited for each period:

For column A only, enter the amount from line 9 on line 13.. 9

Complete line 10 through line 16 of one column before

going to line 10 of the next column.

10. Enter amount from line 16 of the previous column ........... 10

11. Add line 9 and line 10 ............................................... 11

12. Add amounts on line 14 and line 15 of the previous

column................................................................... 12

13. Subtract line 12 from line 11. If zero or less, enter 0 ........ 13

14. If the amount on line 13 is zero, subtract line 11 from line

12. Otherwise, enter 0................................................ 14

15. Underpayment: If line 13 is less than or equal to line 8,

subtract line 13 from line 8 ......................................... 15

16. Overpayment: If line 8 is less than line 13, subtract line 8

from line 13. Enter here and on line 10 of the next column.. 16

If there are amounts on line 15 in any column, go to Part IV on page 2 to calculate the penalty.

30991228