Enlarge image

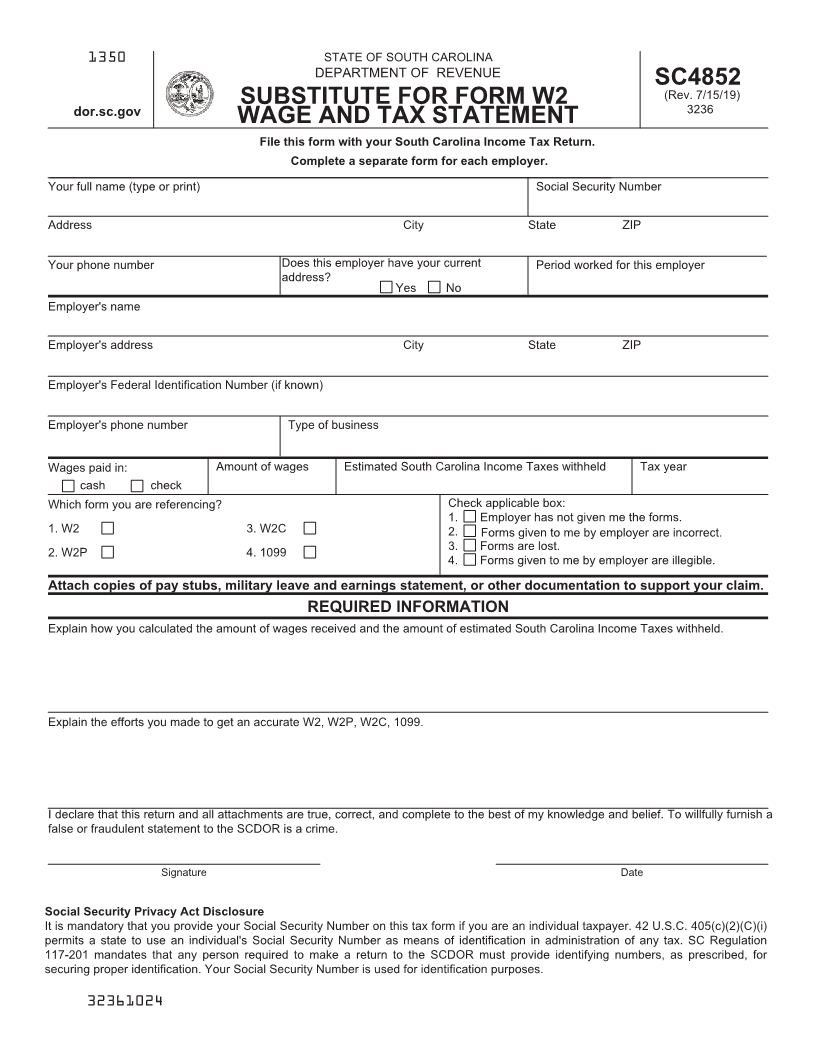

1350 STATE OF SOUTH CAROLINA

DEPARTMENT OF REVENUE

SC4852

(Rev. 7/15/19)

SUBSTITUTE FOR FORM W2

dor.sc.gov 3236

WAGE AND TAX STATEMENT

File this form with your South Carolina Income Tax Return.

Complete a separate form for each employer.

Your full name (type or print) Social Security Number

Address City State ZIP

Your phone number Does this employer have your current Period worked for this employer

address?

Yes No

Employer's name

Employer's address City State ZIP

Employer's Federal Identification Number (if known)

Employer's phone number Type of business

Wages paid in: Amount of wages Estimated South Carolina Income Taxes withheld Tax year

cash check

Which form you are referencing? Check applicable box:

1. Employer has not given me the forms.

1. W2 3. W2C 2. Forms given to me by employer are incorrect.

2. W2P 4. 1099 3. Forms are lost.

4. Forms given to me by employer are illegible.

Attach copies of pay stubs, military leave and earnings statement, or other documentation to support your claim.

REQUIRED INFORMATION

Explain how you calculated the amount of wages received and the amount of estimated South Carolina Income Taxes withheld.

Explain the efforts you made to get an accurate W2, W2P, W2C, 1099.

I declare that this return and all attachments are true, correct, and complete to the best of my knowledge and belief. To willfully furnish a

false or fraudulent statement to the SCDOR is a crime.

Signature Date

Social Security Privacy Act Disclosure

It is mandatory that you provide your Social Security Number on this tax form if you are an individual taxpayer. 42 U.S.C. 405(c)(2)(C)(i)

permits a state to use an individual's Social Security Number as means of identification in administration of any tax. SC Regulation

117-201 mandates that any person required to make a return to the SCDOR must provide identifying numbers, as prescribed, for

securing proper identification. Your Social Security Number is used for identification purposes.

32361024