Enlarge image

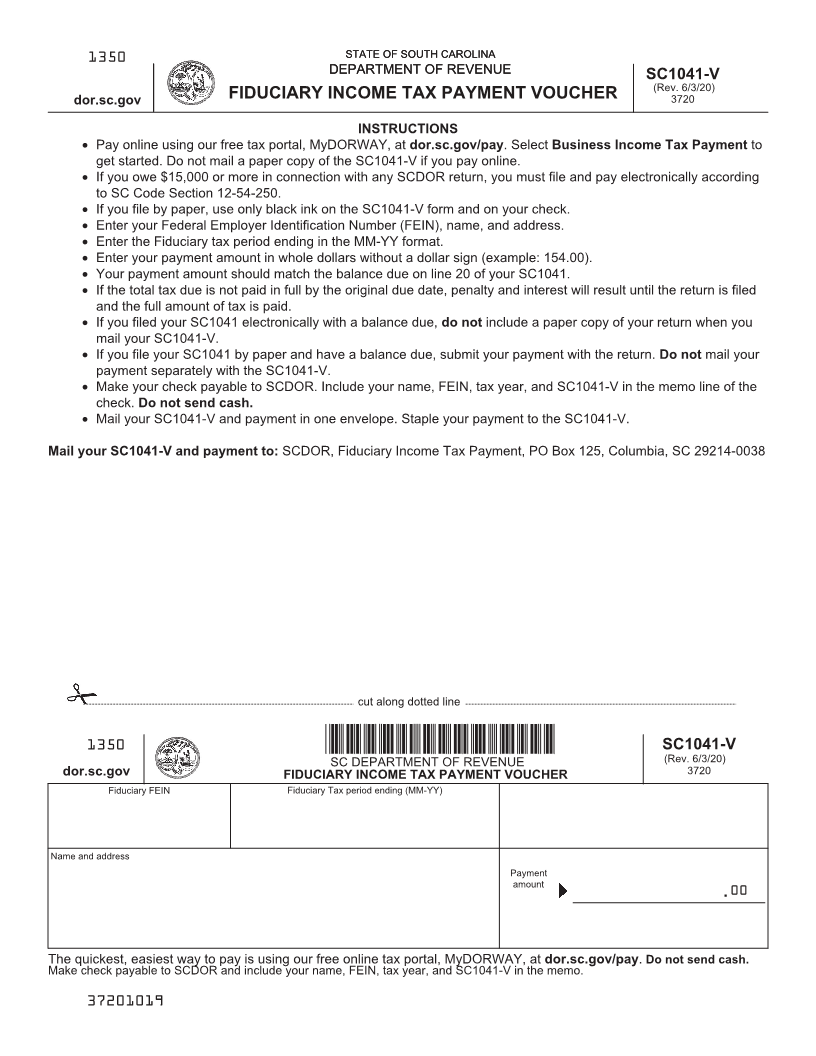

1350 STATE OF SOUTH CAROLINASTATE OF SOUTH CAROLINA

DEPARTMENT OF REVENUEDEPARTMENT OF REVENUE SC1041-V

(Rev. 6/3/20)

dor.sc.gov FIDUCIARY INCOME TAX PAYMENT VOUCHER 3720

INSTRUCTIONS

• Pay online using our free tax portal, MyDORWAY, at dor.sc.gov/pay. Select Business Income Tax Payment to

get started. Do not mail a paper copy of the SC1041-V if you pay online.

• If you owe $15,000 or more in connection with any SCDOR return, you must file and pay electronically according

to SC Code Section 12-54-250.

• If you file by paper, use only black ink on the SC1041-V form and on your check.

• Enter your Federal Employer Identification Number (FEIN), name, and address.

• Enter the Fiduciary tax period ending in the MM-YY format.

• Enter your payment amount in whole dollars without a dollar sign (example: 154.00).

• Your payment amount should match the balance due on line 20 of your SC1041.

• If the total tax due is not paid in full by the original due date, penalty and interest will result until the return is filed

and the full amount of tax is paid.

• If you filed your SC1041 electronically with a balance due, do not include a paper copy of your return when you

mail your SC1041-V.

• If you file your SC1041 by paper and have a balance due, submit your payment with the return. Do not mail your

payment separately with the SC1041-V.

• Make your check payable to SCDOR. Include your name, FEIN, tax year, and SC1041-V in the memo line of the

check. Do not send cash.

• Mail your SC1041-V and payment in one envelope. Staple your payment to the SC1041-V.

Mail your SC1041-V and payment to: SCDOR, Fiduciary Income Tax Payment, PO Box 125, Columbia, SC 29214-0038

cut along dotted line

1350 SC1041-V

SC DEPARTMENT OF REVENUE (Rev. 6/3/20)

dor.sc.gov FIDUCIARY INCOME TAX PAYMENT VOUCHER 3720

Fiduciary FEIN Fiduciary Tax period ending (MM-YY)

Name and address

Payment

amount

. 00

The quickest, easiest way to pay is using our free online tax portal, MyDORWAY, at dor.sc.gov/pay. Do not send cash.

Make check payable to SCDOR and include your name, FEIN, tax year, and SC1041-V in the memo.

37201019