Enlarge image

1350 STATE OF SOUTH CAROLINA

DEPARTMENT OF REVENUE SC2210

UNDERPAYMENT OF ESTIMATED TAX (Rev. 1/2/24)

BY INDIVIDUALS, ESTATES, AND TRUSTS 3098

dor.sc.gov 2023

Name SSN

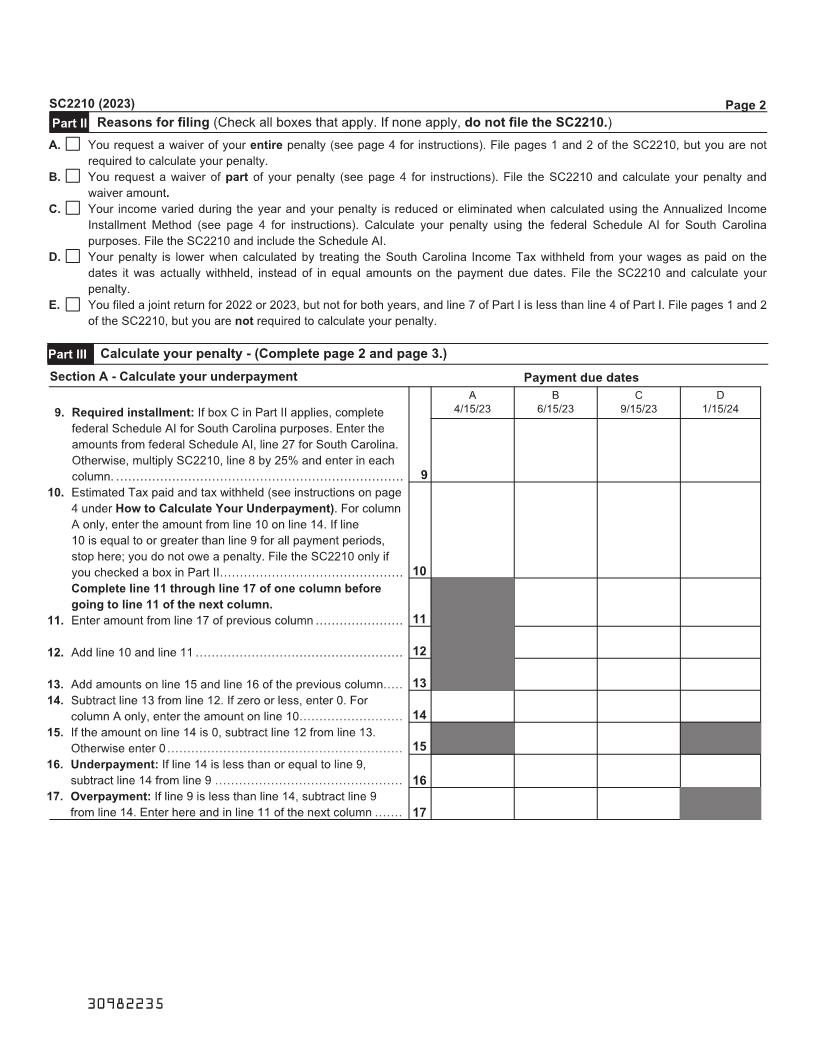

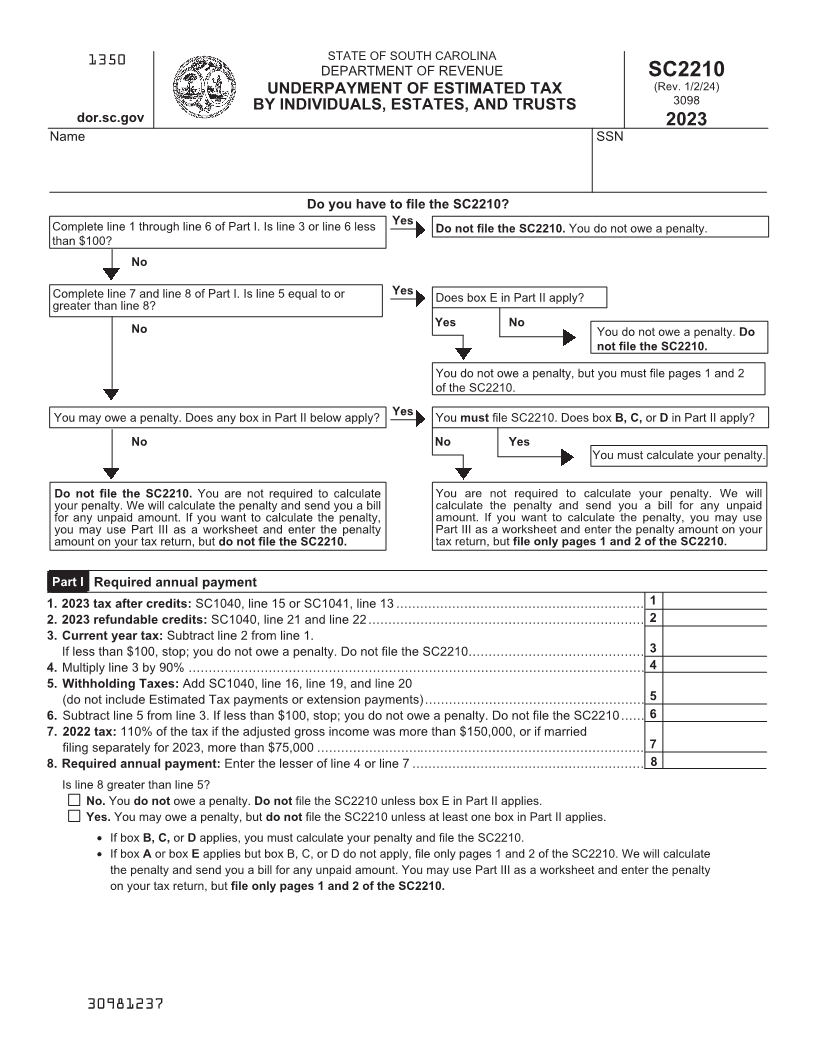

Do you have to file the SC2210?

Yes

Complete line 1 through line 6 of Part I. Is line 3 or line 6 less Do not file the SC2210. You do not owe a penalty.

than $100?

No

Yes

Complete line 7 and line 8 of Part I. Is line 5 equal to or Does box E in Part II apply?

greater than line 8?

Yes No

No You do not owe a penalty. Do

not file the SC2210.

You do not owe a penalty, but you must file pages 1 and 2

of the SC2210.

You may owe a penalty. Does any box in Part II below apply? Yes You must file SC2210. Does box B, C, or Din Part II apply?

No No Yes

You must calculate your penalty.

Do not file the SC2210. You are not required to calculate You are not required to calculate your penalty. We will

your penalty. We will calculate the penalty and send you a bill calculate the penalty and send you a bill for any unpaid

for any unpaid amount. If you want to calculate the penalty, amount. If you want to calculate the penalty, you may use

you may use Part III as a worksheet and enter the penalty Part III as a worksheet and enter the penalty amount on your

amount on your tax return, but do not file the SC2210. tax return, but file only pages 1 and 2 of the SC2210.

Part I Required annual payment

1. 2023 tax after credits: SC1040, line 15 or SC1041, line 13 .............................................................. 1

2. 2023 refundable credits: SC1040, line 21 and line 22..................................................................... 2

3. Current year tax: Subtract line 2 from line 1.

If less than $100, stop; you do not owe a penalty. Do not file the SC2210............................................ 3

4. Multiply line 3 by 90% .................................................................................................................. 4

5. Withholding Taxes: Add SC1040, line 16, line 19, and line 20

(do not include Estimated Tax payments or extension payments)....................................................... 5

6. Subtract line 5 from line 3. If less than $100, stop; you do not owe a penalty. Do not file the SC2210...... 6

7. 2022 tax: 110% of the tax if the adjusted gross income was more than $150,000, or if married

filing separately for 2023, more than $75,000 .................................................................................. 7

8. Required annual payment: Enter the lesser of line 4 or line 7 .......................................................... 8

Is line 8 greater than line 5?

No. You do not owe a penalty. Do notfile the SC2210 unless box E in Part II applies.

Yes. You may owe a penalty, but do not file the SC2210 unless at least one box in Part II applies.

• If box B, C, or Dapplies, you must calculate your penalty and file the SC2210.

• If box Aor box applies E but box B, C, or D do not apply, file only pages 1 and 2 of the SC2210. We will calculate

the penalty and send you a bill for any unpaid amount. You may use Part III as a worksheet and enter the penalty

on your tax return, but file only pages 1 and 2 of the SC2210.

30981237