Enlarge image

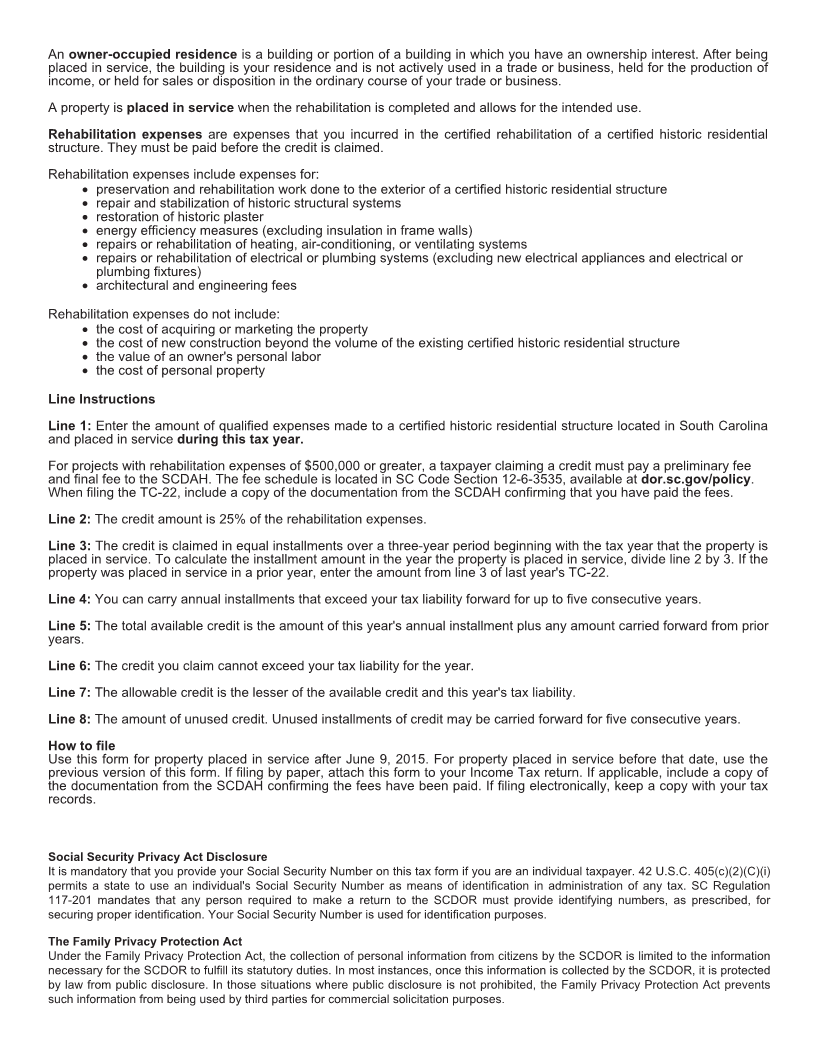

1350 STATE OF SOUTH CAROLINA

DEPARTMENT OF REVENUE SC SCH.TC-22

(Rev. 12/8/20)

CERTIFIED HISTORIC 3382

RESIDENTIAL STRUCTURE CREDIT

dor.sc.gov 20

Name SSN

1. Rehabilitation expenses made to a property located in South Carolina and placed in service

during this tax year ................................................................................................................1.

(If rehabilitation expenses are $500,000 or greater, attach documentation that the preliminary

and final fees were paid to the South Carolina Department of Archives and History.)

2. Credit amount earned (multiply line 1 by 25%) ........................................................................2.

3. Annual installment amount (divide line 2 by 3 for property placed in service this year, or

enter the previous year's installment amount) .........................................................................3.

4. Amount carried forward from prior tax years ...........................................................................4.

5. Add line 3 and line 4 .............................................................................................................5.

6. Current year tax liability .........................................................................................................6.

7. Current year credit (lesser of line 5 and line 6) ........................................................................7.

Enter here and on the SC1040TC.

8. Unused credits (subtract line 7 from line 5) .............................................................................8.

Unused credits can be carried forward for five years.

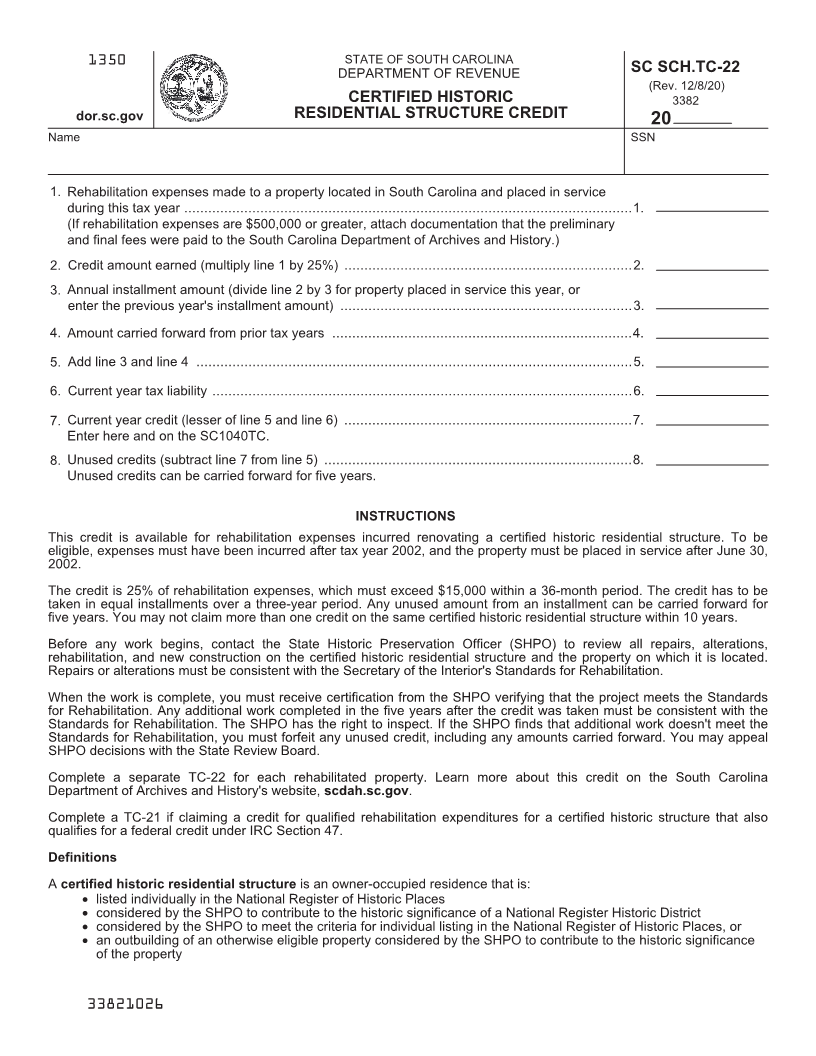

INSTRUCTIONS

This credit is available for rehabilitation expenses incurred renovating a certified historic residential structure. To be

eligible, expenses must have been incurred after tax year 2002, and the property must be placed in service after June 30,

2002.

The credit is 25% of rehabilitation expenses, which must exceed $15,000 within a 36-month period. The credit has to be

taken in equal installments over a three-year period. Any unused amount from an installment can be carried forward for

five years. You may not claim more than one credit on the same certified historic residential structure within 10 years.

Before any work begins, contact the State Historic Preservation Officer (SHPO) to review all repairs, alterations,

rehabilitation, and new construction on the certified historic residential structure and the property on which it is located.

Repairs or alterations must be consistent with the Secretary of the Interior's Standards for Rehabilitation.

When the work is complete, you must receive certification from the SHPO verifying that the project meets the Standards

for Rehabilitation. Any additional work completed in the five years after the credit was taken must be consistent with the

Standards for Rehabilitation. The SHPO has the right to inspect. If the SHPO finds that additional work doesn't meet the

Standards for Rehabilitation, you must forfeit any unused credit, including any amounts carried forward. You may appeal

SHPO decisions with the State Review Board.

Complete a separate TC-22 for each rehabilitated property. Learn more about this credit on the South Carolina

Department of Archives and History's website, scdah.sc.gov.

Complete a TC-21 if claiming a credit for qualified rehabilitation expenditures for a certified historic structure that also

qualifies for a federal credit under IRC Section 47.

Definitions

A certified historic residential structure is an owner-occupied residence that is:

• listed individually in the National Register of Historic Places

• considered by the SHPO to contribute to the historic significance of a National Register Historic District

• considered by the SHPO to meet the criteria for individual listing in the National Register of Historic Places, or

• an outbuilding of an otherwise eligible property considered by the SHPO to contribute to the historic significance

of the property

33821026