Enlarge image

1350

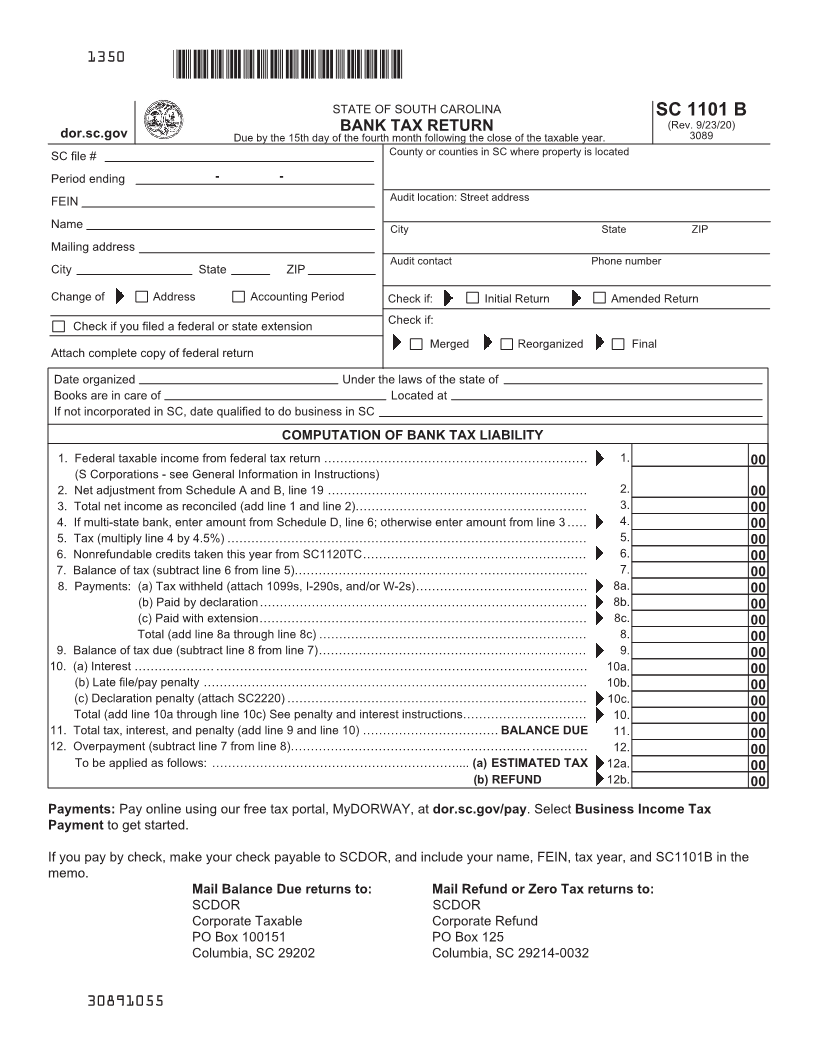

STATE OF SOUTH CAROLINA SC 1101 B

dor.sc.gov BANK TAX RETURN (Rev. 9/23/20)

Due by the 15th day of the fourth month following the close of the taxable year. 3089

SC file # County or counties in SC where property is located

Period ending - -

Audit location: Street address

FEIN

Name City State ZIP

Mailing address

Audit contact Phone number

City State ZIP

Change of Address Accounting Period Check if: Initial Return Amended Return

Check if you filed a federal or state extension Check if:

Merged Reorganized Final

Attach complete copy of federal return

Date organized Under the laws of the state of

Books are in care of Located at

If not incorporated in SC, date qualified to do business in SC

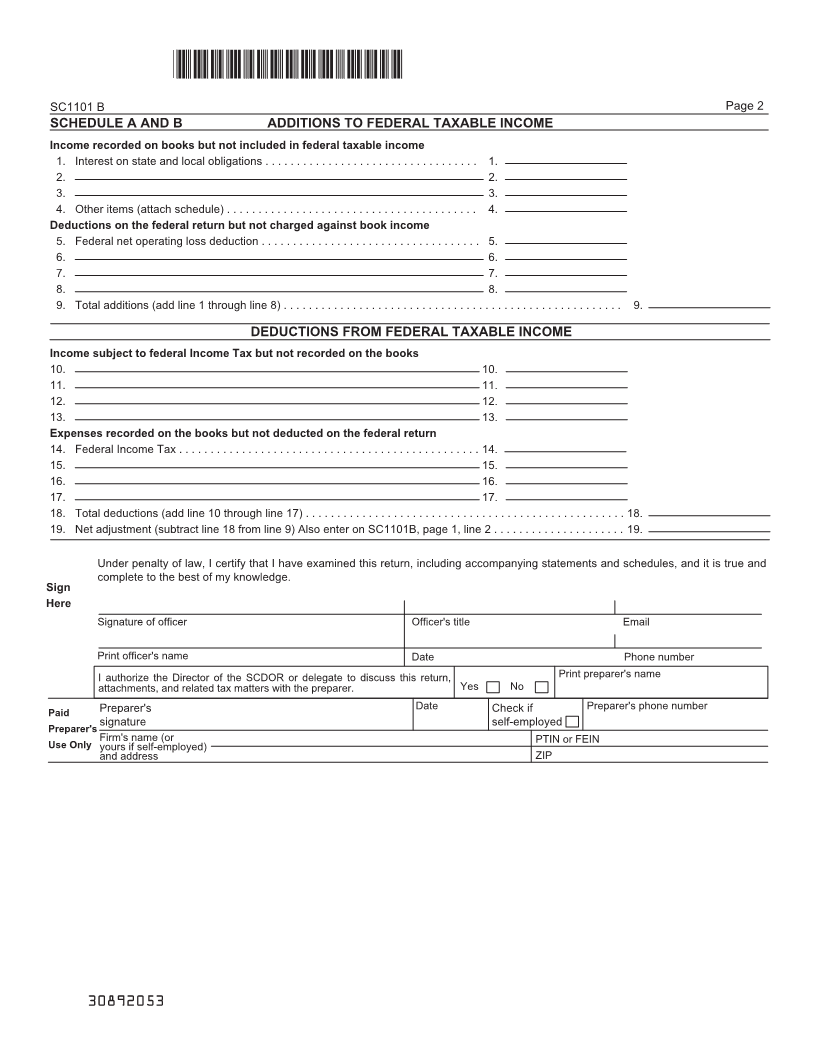

COMPUTATION OF BANK TAX LIABILITY

1. Federal taxable income from federal tax return .................................................................. 1. 00

(S Corporations - see General Information in Instructions)

2. Net adjustment from Schedule A and B, line 19 ................................................................. 2. 00

3. Total net income as reconciled (add line 1 and line 2).......................................................... 3. 00

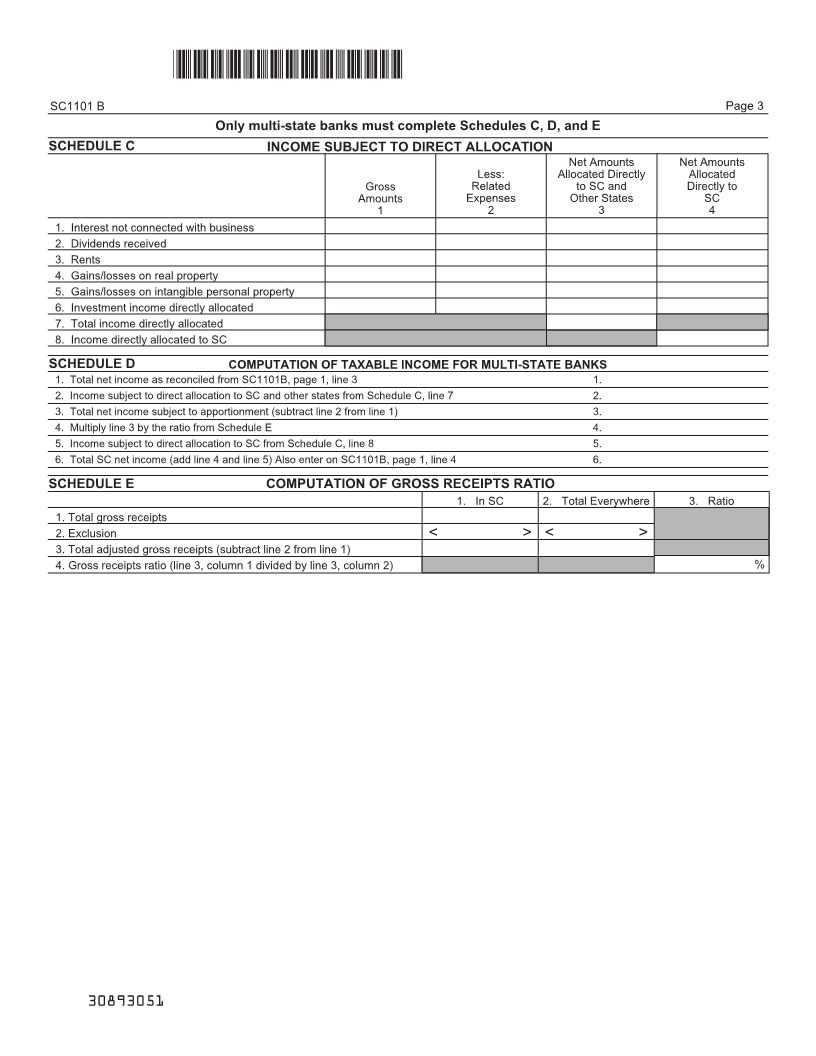

4. If multi-state bank, enter amount from Schedule D, line 6; otherwise enter amount from line 3 ..... 4. 00

5. Tax (multiply line 4 by 4.5%) .......................................................................................... 5. 00

6. Nonrefundable credits taken this year from SC1120TC........................................................ 6. 00

7. Balance of tax (subtract line 6 from line 5).............................................. ........................... 7. 00

8. Payments: (a) Tax withheld (attach 1099s, I-290s, and/or W-2s)........................................... 8a. 00

(b) Paid by declaration.................................................................................. 8b. 00

(c) Paid with extension.................................................................................. 8c. 00

Total (add line 8a through line 8c) ................................................................... 8. 00

9. Balance of tax due (subtract line 8 from line 7)................................................................... 9. 00

10. (a) Interest .................... ............................................................................................. 10a. 00

(b) Late file/pay penalty ................................................................................................ 10b. 00

(c) Declaration penalty (attach SC2220) ........................................................................... 10c. 00

Total (add line 10a through line 10c) See penalty and interest instructions............................... 10. 00

11. Total tax, interest, and penalty (add line 9 and line 10) .................................. BALANCE DUE 11. 00

12. Overpayment (subtract line 7 from line 8)............................................................ .............. 12. 00

To be applied as follows: ................................................................. (a) ESTIMATED TAX 12a. 00

(b) REFUND 12b. 00

Payments: Pay online using our free tax portal, MyDORWAY, at dor.sc.gov/pay. Select Business Income Tax

Payment to get started.

If you pay by check, make your check payable to SCDOR, and include your name, FEIN, tax year, and SC1101B in the

memo.

Mail Balance Due returns to: Mail Refund or Zero Tax returns to:

SCDOR SCDOR

Corporate Taxable Corporate Refund

PO Box 100151 PO Box 125

Columbia, SC 29202 Columbia, SC 29214-0032

30891055