Enlarge image

1350 STATE OF SOUTH CAROLINA

DEPARTMENT OF REVENUE SC SCH.TC-59

(Rev. 5/15/18)

ALTERNATIVE FUEL PROPERTY CREDIT 3700

dor.sc.gov Attach to your Income Tax Return 20

Name As Shown On Tax Return SSN or FEIN

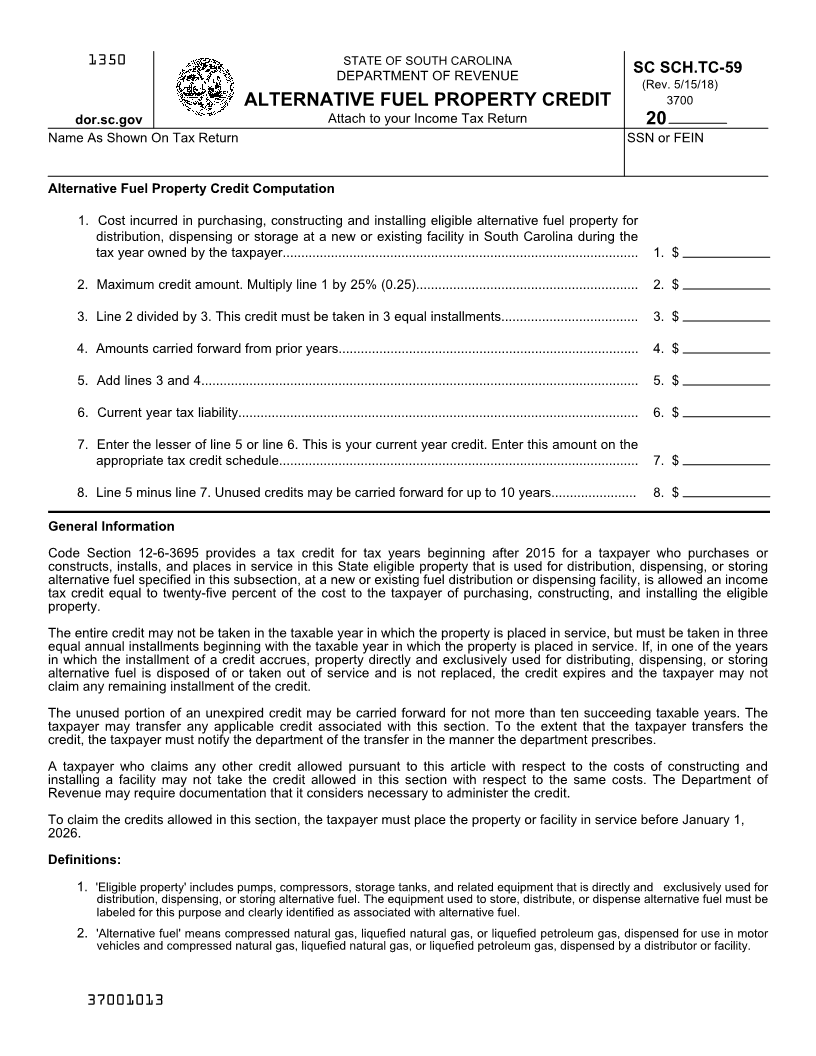

Alternative Fuel Property Credit Computation

1. Cost incurred in purchasing, constructing and installing eligible alternative fuel property for

distribution, dispensing or storage at a new or existing facility in South Carolina during the

tax year owned by the taxpayer................................................................................................ 1. $

2. Maximum credit amount. Multiply line 1 by 25% (0.25)............................................................ 2. $

3. Line 2 divided by 3. This credit must be taken in 3 equal installments..................................... 3. $

4. Amounts carried forward from prior years................................................................................. 4. $

5. Add lines 3 and 4...................................................................................................................... 5. $

6. Current year tax liability............................................................................................................ 6. $

7. Enter the lesser of line 5 or line 6. This is your current year credit. Enter this amount on the

appropriate tax credit schedule................................................................................................. 7. $

8. Line 5 minus line 7. Unused credits may be carried forward for up to 10 years....................... 8. $

General Information

Code Section 12-6-3695 provides a tax credit for tax years beginning after 2015 for a taxpayer who purchases or

constructs, installs, and places in service in this State eligible property that is used for distribution, dispensing, or storing

alternative fuel specified in this subsection, at a new or existing fuel distribution or dispensing facility, is allowed an income

tax credit equal to twenty-five percent of the cost to the taxpayer of purchasing, constructing, and installing the eligible

property.

The entire credit may not be taken in the taxable year in which the property is placed in service, but must be taken in three

equal annual installments beginning with the taxable year in which the property is placed in service. If, in one of the years

in which the installment of a credit accrues, property directly and exclusively used for distributing, dispensing, or storing

alternative fuel is disposed of or taken out of service and is not replaced, the credit expires and the taxpayer may not

claim any remaining installment of the credit.

The unused portion of an unexpired credit may be carried forward for not more than ten succeeding taxable years. The

taxpayer may transfer any applicable credit associated with this section. To the extent that the taxpayer transfers the

credit, the taxpayer must notify the department of the transfer in the manner the department prescribes.

A taxpayer who claims any other credit allowed pursuant to this article with respect to the costs of constructing and

installing a facility may not take the credit allowed in this section with respect to the same costs. The Department of

Revenue may require documentation that it considers necessary to administer the credit.

To claim the credits allowed in this section, the taxpayer must place the property or facility in service before January 1,

2026.

Definitions:

1. 'Eligible property' includes pumps, compressors, storage tanks, and related equipment that is directly and exclusively used for

distribution, dispensing, or storing alternative fuel. The equipment used to store, distribute, or dispense alternative fuel must be

labeled for this purpose and clearly identified as associated with alternative fuel.

2. 'Alternative fuel' means compressed natural gas, liquefied natural gas, or liquefied petroleum gas, dispensed for use in motor

vehicles and compressed natural gas, liquefied natural gas, or liquefied petroleum gas, dispensed by a distributor or facility.

37001013