Enlarge image

Instructions for 2026 PT-300 Property Tax Return and Schedules General Information and Line Instructions South Carolina Department of Revenue | dor.sc.gov |August 2024

Enlarge image | Instructions for 2026 PT-300 Property Tax Return and Schedules General Information and Line Instructions South Carolina Department of Revenue | dor.sc.gov |August 2024 |

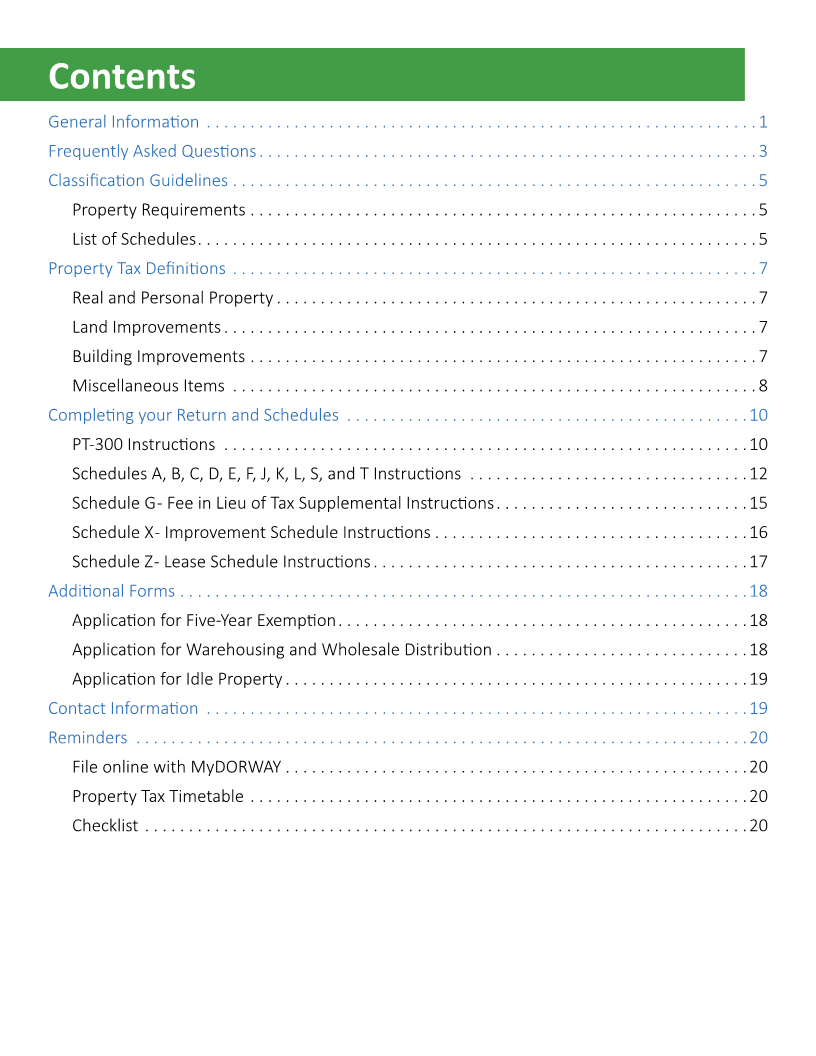

Enlarge image | Contents General Information � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �1 Frequently Asked Questions � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �3 Classification Guidelines � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �5 Property Requirements � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �5 List of Schedules � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �5 Property Tax Definitions � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �7 Real and Personal Property � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �7 Land Improvements � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �7 Building Improvements � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �7 Miscellaneous Items � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �8 Completing your Return and Schedules � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �10 PT-300 Instructions � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �10 Schedules A, B, C, D, E, F, J, K, L, S, and T Instructions � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �12 Schedule G - Fee in Lieu of Tax Supplemental Instructions � � � � � � � � � � � � � � � � � � � � � � � � � � � � �15 Schedule X - Improvement Schedule Instructions � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �16 Schedule Z - Lease Schedule Instructions � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �17 Additional Forms � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �18 Application for Five-Year Exemption � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �18 Application for Warehousing and Wholesale Distribution � � � � � � � � � � � � � � � � � � � � � � � � � � � � �18 Application for Idle Property � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �19 Contact Information � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �19 Reminders � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �20 File online with MyDORWAY � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �20 Property Tax Timetable � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �20 Checklist � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �20 |

Enlarge image |

General Information

These instructions are for:

● Manufacturing ● Research and Development Facilties

● Mining ● Leased Utilities

● Corporate Headquarters ● Leased Transportation for Hire

● Corporate Office Facilities ● Fee in Lieu of Tax Properties

● Distribution Facilities ● Manufacturing Warehouse

SC Code Sections

The codes and regulations mentioned in this document are available at dor.sc.gov/policy�

Manufacturing

A manufacturer is every person engaged in making, fabricating, or changing things into new forms or

in refining, rectifying, or combining different materials. Manufacturing and mining is further defined by

the classifications set out in Sectors 21 (Mining) and Sectors 31 - 33 (Manufacturing) of the most recent

North American Industrial Classification System (NAICS) manual, with the exception of publishers of

newspapers, books, and periodicals, which do not actually print their publications, in accordance with

SC Code Section 12-43-335.

Manufacturing Property Tax applies to owners of all real and/or personal property owned, used or

leased by Manufacturers, Mining Companies, or Industrial Development Projects. The Manufacturing

Property Tax also applies to the owners of all real and/or personal property used by or leased to the

following utility and transportation for hire companies: water, heat, light, and power, telephone, cable

television, sewer, railway, private carline, airline and pipeline companies.

Exemptions

See the application for exemption section on Page 18 of this document and the following SC Code

Sections for more information: 12-37-220(A)(7), (A)(8), (B)(32), (B)(34), (B)(52), and 12-37-220(C).

Appeal Procedures

If you dispute a new or amended value, assessment, or fee, you may appeal by filing a written protest

within 90 days of the date of the Property Assessment Notice. If your appeal is accepted, the SCDOR

will adjust the valuation to 80% of the original amount. Any valuation greater than 80% which you agree

to in writing may be accepted pending resolution of the appeal. You will be charged interest for the

unpaid amount� A written protest must be filed within 90 days and contain the following:

● Property owner's name, address, and phone number

● SID Suffix number as shown on the Property Assessment Notice

● Date of the Property Assessment Notice you are appealing

● Tax year

● Plant operation schedule identification number (For example, SCHD A00001)

● Any combination of the following, as the matters under appeal for each schedule:

■ Real property value, assessment, or fee

1 SCDOR | PT-300 and Schedules Instructions

|

Enlarge image |

■ Personal property value, assessment, or fee

■ Exemption assessment

■ Penalty assessment fee

● Your reasons or grounds for disagreeing with the valuation, assessment, or fee

● What you believe is the fair market value and assessment of the property

● Contact name and phone number

● Agreed-upon percentage valuation, assessment, or fee in excess of 80%, as described above

Taxpayer Representative

In order to authorize an individual as your representative, you must complete and file an SC2848,

Power of Attorney and Declaration of Representative, signed by you and the representative. You can

only be represented by an attorney, CPA, or enrolled agent. You must indicate on the SC2848 that the

representative has the authority to represent you in Property Tax matters, as well as Income Tax

matters as they relate to Property Tax. The SC2848 is available at dor.sc.gov/forms�

This is important, since many Property Tax issues reference information filed on your Income Tax

return. If this power is not granted, we will not be able to discuss these issues with your representative.

Authorization may be extended to registered, licensed, or certified real estate appraisers in questions of

real property value only. See SC Code Section 12-60-90 for more information.

Failure to File and Late Penalties

If you do not file returns on time, you may lose exemptions and be charged late filing penalties. See SC

Code Section 12-37-800 for more information.

You may appeal late filing penalties in writing in accordance with South Carolina Revenue Procedure

#98-3, available at dor.sc.gov/policy�

The request for a penalty waiver must come from the owner of the company. Otherwise, they must

have a Power of Attorney (POA). If the request is coming from the owner, they must sign the document

making it known that they are the owner. The request must be on company letterhead and contain the

following:

● Business name

● SID Suffix number for the business

● Year or years requesting the waiver

● A detailed reason with facts and circumstances that caused the failure to comply

● A copy of the PT-310, Property Assessment Notice

Local county auditors assess late payment penalties. You should appeal any penalties to the local county

auditor. All county auditor contact information is available on the Association of Counties website at

sccounties.org�

Millage Rates

Millage rates or tax levies are applied by local county auditors. All county auditor contact information is

available on the Association of Counties website at sccounties.org�

2 SCDOR | PT-300 and Schedules Instructions

|

Enlarge image |

Frequently Asked Questions

Who is required to file this return?

The owners of all real and/or personal property of which a Fee In Lieu of Tax (FILOT) agreement has

been negotiated with the county .

The owners of all real and/or personal property owned, used, or leased* by the following businesses:

● Manufacturing

● Mining

● Facilities that qualify for an exemption under SC Code Sections 12-37-220B(32), 12-37-220B(34),

or 12-37-220B(52):

■ Manufacturing/mining facility

■ Corporate headquarters

■ Corporate office facilities

■ Distribution facilities

■ Research and development facilities

The owners of all real and/or personal property used by or leased* to the following utility and

transportation for hire companies:

● Water, heat, light, and power

● Telephone

● Cable television

● Sewer

● Railway

● Private carline

● Airline

● Pipeline

*All leased property should be reported by the owner. When leased property is capitalized by the

lessee for Income Tax purposes, the lessee is considered the owner, in accordance with SC Revenue

Ruling #93-11�

When am I required to file?

You must file at least one return per year. Returns are normally due by the last day of the fourth month

following your accounting closing date used for Income Tax purposes. The following exceptions apply:

● Initial return: The initial return is due based on your accounting closing date or December 31,

whichever comes first. For example, if you start operation in July, after your June accounting

closing date, you should file based on assets as of December 31.

3 SCDOR | PT-300 and Schedules Instructions

|

Enlarge image |

● Change in account closing date: When you change your accounting closing date within a

calendar year, you must file a return for each accounting closing date. The SCDOR will determine

the assessment from each return and use the highest assessment.

● Property sold after the seller's account closing date: The seller is required to file a return

based on the accounting closing date. The purchaser is not required to file a return as of the

purchaser's accounting closing date during the calendar year of the sale.

● Property sold before the seller's account closing date: An initial return is required by the

purchaser, based on the purchaser's accounting closing date or December 31, whichever comes

first, after the purchase of the property.

Which tax year return should I file?

Property taxes are based on the status of the property as of your accounting closing date for the

previous year. Your 2020 tax year return should be based on the 2019 accounting closing date. For

example, if you are filing a return based on your March 2019 accounting closing date, you should file

your tax year 2020 return by July 31, 2019.

Can I file my PT-300 online with MyDORWAY?

The fastest, easiest way to file your PT-300, Property Tax Return, is using our free online tax portal,

MyDORWAY. You can only use MyDORWAY to file initial returns and returns beginning with tax year

2020. Managing your South Carolina tax accounts is easy on MyDORWAY, and tutorials are available

to help� Visit dor.sc.gov/mydorway-signup to get started. For more information and to view video

tutorials, visit dor.sc.gov/MyDORWAY�

Are extensions allowed?

Extensions are not allowed for filing Property Tax returns. Extensions granted for Income Tax purposes

do not apply to Property Tax returns�

Are amended returns accepted?

Yes, in accordance with SC Code Section 12-37-975 and 12-54-85(F)(1). Amended returns may be

accepted or rejected if filed after the due date. Claims for refunds must be filed within three years

of return being filed or two years of being paid. Amended returns filed after the due date may be

accepted or denied at the SCDOR's discretion.

4 SCDOR | PT-300 and Schedules Instructions

|

Enlarge image |

Classification Guidelines

Property Requirements

Use the guidelines described below to determine the correct plant/operation schedule to file based on

ownership, location, and use of the property. All properties reported on this return fall into one of the

following categories:

1� Manufacturing or Mining Properties: LOCATED ON the premises of or contiguous to the plant

site

2� Non-Contiguous Manufacturing or Mining Properties: NOT LOCATED ON the premises of or

contiguous to the plant site

3� Leased Utility and Transportation for Hire: All real and personal property used or leased to:

■ Utility companies, including water, heat, light, solar, power, telephone, cable television, and

sewer companies

■ Transportation for hire companies, including railway, private carline, airline, and pipeline This

category excludes property owned by utility companies.

4� Other Properties: All real and personal property NOT owned, used, or leased by a manufacturer,

miner, or utility company.

Use the property classification breakdown below to determine the correct schedule to file. If you have

a Multiple Property Classification, you should file the appropriate schedule for each classification. If

multiple classifications fall under the same schedule, report all assets on one schedule unless told

otherwise by the SCDOR.

List of Schedules

Schedule A: Manufacturing or Mining

All real and personal property owned or leased by a manufacturer or miner located on the premises

of or contiguous to the plant site. Includes warehouses used for storage of raw materials, equipment,

supplies, or for any manufacturing-related process or support function. A facility qualifying for

exemption under SC Code Sections 12-37-220(A)(7) and 12-37-220(B)(52).

Schedule B: Non-Contiguous Manufacturing

All real and personal property owned or leased by a manufacturer or miner NOT located on the

premises of or contiguous to the plant site (may include office facilities that are not located on the

premise of the plant site). A facility qualifying for exemption under SC Code Section 12-37-220(B)(52).

Schedule C: Manufacturing Research and Development

A facility classified by the SCDOR as a facility used by the manufacturer and devoted directly and

primarily to research and development. A facility qualifying for exemption under SC Code Sections 12-

37-220(B)(34) and 12-37-220(B)(52).

5 SCDOR | PT-300 and Schedules Instructions

|

Enlarge image |

Schedule D: Manufacturing Corporate Headquarters Distribution Facility

A facility classified by the SCDOR as a facility used by the manufacturer and is devoted directly and

primarily to being a corporate headquarters or a wholesale distribution center. A facility qualifying for

exemption under SC Code Sections 12-37-220(B)(32) and 12-37-220(B)(52) .

Schedule E: Leased Utility

Real or personal property used by Water, Heat, Light, Solar, Power, Telephone, Cable Television, and

Sewer Companies�

Schedule F: Leased Transportation for Hire

Real or personal property used by Railway, Private Carline, Airline, and Pipeline Companies.

Schedule G: Fee in Lieu of Tax Supplemental

Sent to the county auditor where the Fee in Lieu of Tax (FILOT) project is located when the PT300 is

filed with the SCDOR. Each Schedule S or Schedule T should have an accompanying Schedule G.

Schedule J: Non-Manufacturing Research and Development

A facility classified by the SCDOR as NOT used by the manufacturer and devoted directly and primarily

to research and development. A facility qualifying for exemption under SC Code Section 12-37-220(B)

(34).

Schedule K: Non-Manufacturing Corporate Headquarters Distribution Facility

A facility classified by the SCDOR as NOT used by the manufacturer and devoted directly and primarily

to being a corporate headquarters or a wholesale distribution center. A facility qualifying for exemption

under SC Code Section 12-37-220(B)(32).

Schedule L: Manufacturing Warehouse

Real property used primarily for the warehouse of finished goods.

Schedule S: Manufacturing Fee in Lieu of Tax

Manufacturing properties assessed under Fee in Lieu of Tax (FILOT) agreements in accordance with SC

Code Sections 4-12-30, 4-29-67, 4-29-69, and 12-44.

Schedule T: Non-Manufacturing Fee in Lieu of Tax

Non-manufacturing properties assessed under Fee in Lieu of Tax (FILOT) agreements in accordance with

SC Code Sections 4-12-30, 4-29-67, 4-29-69, and 12-44.

Schedule X: Improvement Schedule

A breakdown of improvements for each plant/operation. Each plant/operation should have its own

Schedule X.

Schedule Z: Lease Schedule

Report of all leases not previously reported�

The codes and regulations mentioned above are available at dor.sc.gov/policy�

6 SCDOR | PT-300 and Schedules Instructions

|

Enlarge image |

Property Tax Definitions

Real and Personal Property

SC Code of Regulations 117.1700.1 provides definitions of both real and personal property. Land,

buildings, items of property primarily used for those lands and buildings, and all other property that has

traditionally been considered real property are defined as real property� All other items of property are

defined as personal property�

More information can be found at dor.sc.gov/policy/index/sc-codes-regulations�

For tax purposes, the following items listed below for land and building improvements should be

classified as real property:

Land Improvements

Land improvements include:

● Bridges ● Piling and mats for improvement of site

● Culverts ● Private roads

● Dams ● Reservoirs

● Ditches and canals ● Retaining walls

● Drainage ● Sanitary and fire protection

● Dikes ● Storm and sanitary sewers

● Fencing ● Viaducts

● Fixed river, lake, or tidewater wharves and ● Walls forming storage yards or fire

docks protection dikes

● Paved areas ● Water lines for drinking

● Permanent standard guage railroad

trackage, bridges, and trestles

Building Improvements

Building improvements include:

● Areaways ● Partitionsv

● Building elevators and escalators ● Plumbing and drinking water

● Fixed fire protection ● Roof

● Floors ● Sanitation

● Foundations ● Systems for heating and air conditioning

● Insulation ● Stairways

● Lighting ● Ventilation

● Loading/unloading platforms and canopies ● Walls

7 SCDOR | PT-300 and Schedules Instructions

|

Enlarge image |

Miscellaneous Items

Below is a list of items identifying if they are real or personal property. This list is not inclusive.

● Air conditioning - building air conditioning, ● Coolers - portable walk-in coolers - Personal

including refrigeration equipment, for ● Cooling towers-primary use of manufacture

comfort of occupants - Real - Personal

● Air conditioning - window units and ● Cooling towers - primary use for building -

package units - Personal Real

● Air conditioning - for special process to ● Crane - moving crane - Personal

maintain controlled temperature and ● Crane runways, including supporting

humidity - Personal columns or structure - inside or outside of

● Aircraft - Personal building - Real

● Aluminum pot lines - Personal ● Crane runways-bolted to or hung on tresses

● Ash handling system, pit and - Personal

superstructure (see Boilers) ● Dock levelers - Personal

● Asphalt mixing plant - Personal ● Drying rooms structure - Real

● Auto-call and telephone system - Personal ● Drying rooms heating systems - Personal

● Automobile - Personal ● Dust catchers - Personal

● Bins permanently affixed for storage - Real ● Farm equipment - Personal

● Boats - Personal ● Fire alarm system - Personal

● Boilers for service of building - Real ● Fire walls - masonry - Real

● Boilers for service of building and ● Foundations for machinery and equipment

manufacture with primary use for - Personal

manufacture - Personal ● Furniture and fixtures of commercial

● Booths for welding - Personal establishments and professional - Personal

● Bucket elevator - open or enclosed ● Gasoline tanks - (see Tanks)

(including casing) - Personal ● Greenhouse - Real

● Bulkheads - making additional land area to ● Greenhouse - benches and heating system

be assessed with as part of the improved - Personal

land - Real ● Gravel plant - machinery and equipment -

● Building - special constructed building - Real Personal

● Cistern - Real ● Hoist pits - (see Pits)

● Coal handling systems (see boilers) ● Houses and sheds - portable or on skids -

● Cold storage - built-in cold storage rooms - Personal

Real ● Inventory of merchants - Personal

● Cold storage refrigeration equipment - ● Kilns - lumber drying kiln structure - Real

Personal ● Kilns - concrete block drying kiln structure

● Control booth - Personal - Real

● Conveyor or housing, structure or tunnels ● Kilns - circular down draft (beehive) - Real

- Real ● Kilns - heating or drying system - Personal

● Conveyor unit including belt and drives - ● Laundry steam generating equipment -

Personal Personal

8 SCDOR | PT-300 and Schedules Instructions

|

Enlarge image |

● Lighting-yard lighting - Real ● Stacks - steel servicing personal property

● Lighting-special purpose - Personal units or a process - Personal

● Lighting - service stations (except bldg.) - ● Steam electric generating plant and

Personal equipment - Personal

● Mixers and mixing houses - Personal ● Stone crushing plant, machinery and

● Mobile homes - Real equipment - Personal

● Monorail crane runways - Personal ● Storage bins, small portable - Personal

● Motors, outboard and inboard boat - ● Storage facilities, permanent, of masonry

Personal or wood - Real

● Movable structures - Personal ● Storage vaults and doors, including bank

● Ore bridge foundation - Real vaults and doors - Real

● Ovens-processing - Personal ● Substation building - Real

● Piping - process piping above or below ● Substation equipment - Personal

ground - Personal ● Tanks - all storage tanks above or below

● Pits for equipment or processing - Personal ground - Real

● Power lines and auxiliary equipment - ● Tanks - used as a manufacturing process -

Personal Personal

● Pumps and motors - Personal ● Tanks - underground gas tanks at service

● Pump house (including substructure) - Real station - Personal

● Racks and shelving (portable or removable) ● Tipples Structure - Personal

- Personal ● Towers - transmission - Personal

● Ready-mix concrete plant - Personal ● Towers - TV or radio broadcasting - Personal

● Recreational vehicles - Personal ● Trucks - Personal

● Refrigeration equipment (see Air ● Tunnels - Real

conditioning) - Personal ● Tunnels - waste heat or processing -

● Sanitary system - Real Personal

● Scale houses - Real ● Unit heaters - Real

● Scales - truck or railroad scales, including ● Unloader runway - Real

pit - Real ● Vaults, bank - Real

● Scales - dormat scales - Personal ● Ventilating - Real

● Silos - all storage silos - Real ● Ventilating system for manufacturing

● Silos - containing a manufacturing process - equipment - Personal

Personal ● Water lines- For process above or below

● Spray ponds - masonry reservoir - Real ground - Personal

● Spray ponds - piping and equipment - ● Water pumping station-building and

primary use classification sprinkler system structure - Real

- Real ● Water pumps and motors - PersonalWater

● Stacks - mounted on boilers (see Boilers) treating and softening plant building and

● Stacks - chimneys, concrete or masonry - structure - Real

Real ● Wells, pumps, motors and equipment -

● Stacks - steel-supported individually and Personal

servicing heating boilers - Real ● Wiring-power wiring - Personal

9 SCDOR | PT-300 and Schedules Instructions

|

Enlarge image |

Completing your Return and Schedules

PT-300 Instructions

Round all entries to the nearest dollar. You and your preparer must sign and date the return. Refer

to the Frequently Asked Questions section on page 3 of this document to determine when to file. You

must complete all sections on the return and schedules.

SID Suffix - Enter your Single Identification Number (SID) as assigned by the SCDOR. Use the entire SID

Suffix on all correspondence.

County - Enter the name of the county where the property is located.

Return Filing Status - Indicate the filing status of this return by selecting one of the options below:

● Initial Return: Filed your first calendar year in business based on your accounting closing date or

December 31, whichever comes first.

● Annual Return: Filed each calendar year after your initial return, based on your accounting

closing date.

● Amended Return: Filed to correct a previously-filed return. A three-year statute of limitations

exists for the abatement or refund of property taxes.

● Final Return: Filed after all operations have ended or the property is sold. The filing of a final

return will initiate a review of the property prior to closure. (Note: If still in operation on your

accounting closing date, the "annual" return filing status should be used.) If the final return is

the result of a change in ownership, complete the change in ownership section on the PT-300.

Also, complete the appropriate plant/operation schedule reporting the reason and the date of

occurrence.

● Return due to change in accounting closing date: Filed when you change your accounting

closing date within a calendar year. You must file a return for each accounting closing date. The

SCDOR will determine the assessment from each return and use the highest assessment. Only

the return reporting the new accounting closing date should be filed under this filing status. The

return for the original accounting closing date should be filed under the annual or initial filing

status�

Owner name and mailing address - Enter the property owner's name and mailing address. To update

the mailing address, mark the new address box on page 1 of the PT-300. Corporations should only

report name changes that have been recorded with the South Carolina Secretary of State's office

(SCSOS).

Name changes resulting from a change in ownership should be reported under Section E: Ownership

Changes�

The mailing address reported on this return will be used for all future correspondence issued by the

SCDOR and the county.

10 SCDOR | PT-300 and Schedules Instructions

|

Enlarge image |

Section A: Account Information

1� FEIN or SSN: Enter your FEIN or SSN.

2� Account closing date and Start up date: Enter your accounting closing date used for Income Tax

purposes (MM/YYYY) and the date that the operation started at this location (MM/DD/YYYY).

3� Property location: Enter the exact property location (street address, city, state, and zip).

4� Type of ownership: Select the ownership classification for the business.

5� Contact person: Enter the name of the contact person.

6� Contact phone: Enter the contact person's telephone number.

7� Contact email: Enter the contact person's email address.

8� Name used to file Income Tax return: If you are filing a Consolidated Income Tax return or filing

under another name for any other reason, enter the name used to file that return.

Section B: Names of Business Owner, General Partners, Officers, or Members

Provide the FEIN/SSN, Names/Titles, Home addresses, and % Ownership of the top 4 business owners,

general partners, officers, or members of the company.

Section C: Schedule Summary

Complete each schedule according to the appropriate plant/operation schedule instructions in this

document. Enter the schedule letter, schedule number, plant/operation name and the total gross cost

reported on each schedule. If you are no longer reporting assets on a schedule previously reported,

file the schedule stating the reason for no assets. Enter a zero for the total gross cost on the plant/

operation schedule and the schedule summary. If you are filing an initial return or adding new

schedules to an existing account, do not enter a schedule number. The SCDOR will assign a schedule

number as each operation is registered.

Additional Schedules:

Schedule X: Check when Schedule X is attached, reporting the breakdown of real property, leasehold,

and pollution control improvements.

Schedule Z: Check when Schedule Z is attached, reporting additional leases.

Section D: Associated Leases: Schedule Z Required

List the names of the companies that lease any assets to or from the company. Provide the details on

the Schedule Z.

Section E: Ownership Changes

If there has been a change in ownership of this facility, complete this portion of the return. The

purchaser of an existing facility should review SC Code Section 12-37-220(C) and the Application for

Exemption section on page 18 of this document. The seller and purchaser should refer to page 3 of this

document for due dates.

Signature and Date

You and your preparer (or an officer of the company) must sign and date all returns. Property Tax

returns must be mailed separately from the Income Tax return or any other type tax return filed with

the SCDOR�

11 SCDOR | PT-300 and Schedules Instructions

|

Enlarge image |

Schedules A, B, C, D, E, F, J, K, L, S, and T Instructions

You must provide a schedule for each plant/operation reporting the fixed assets at that location. Use

the classification guidelines to determine the correct schedule(s) for new operations. If the property

location has multiple operations that fall into more than one classification, you must file separate

plant/operation schedules for each. Ledgers, computer printouts, or fixed asset listings will not be

accepted in place of a schedule.

The items covered below are only required on schedules that specifically request them. For example,

net book value is only required on Schedules B, C, D, J, K, and T.

Schedule number

The schedule number is used to designate multiple schedules for a given classification of property.

When filing your initial return or adding a new schedule to an existing account, leave this area blank.

The SCDOR will assign a schedule number as each plant/operation is registered. Keep a record of the

schedule letter and number assigned to each plant/operation as a reference for future correspondence.

If you have multiple Fee in Lieu of Tax (FILOT) agreements, complete a separate schedule for each one.

Plant/Operation name

List the plant/operation name on each schedule when you file your return. The plant/operation name

must be unique for each taxpayer statewide. The name on each schedule should correspond to the

plant/operation name in the schedule summary on the PT-300. Space is limited to 40 alphanumeric

characters. Examples of plant/operation names are:

● Plant No 13

● Corporate Headquarters

● Smith Inc Fiber Plant Spartanburg

NAICS code

Enter your NAICS code.

Owner name

Enter the property owner's name as reported on the PT-300.

SID Suffix

Enter the SID Suffix as reported on the PT-300. If you are setting up a new account, the SCDOR will

assign the SID Suffix when the return is processed.

No Longer Reporting Any Assets

If you are no longer reporting any assets on a schedule, check the applicable reason and enter the

month and year of the occurrence. Then enter zero as the total gross cost on the schedule and in the

schedule summary on the PT-300.

12 SCDOR | PT-300 and Schedules Instructions

|

Enlarge image |

Property Listings

Enter the gross capitalized cost and net book value (when applicable) for all fixed assets by year of

acquisition. Each year listed represents the year when an accounting period ended. For example, the

year 2025 should include all assets acquired during the 2025 accounting year. The last year listed for

each property type should include all assets acquired for that year and all previous years.

Gross cost

The total cost of all fixed assets, including amortized costs and capitalized leases, interest, installation,

and labor as shown by your records for Income Tax purposes. Do not use depreciated values. This cost

must be the same cost as reported for Income Tax. The SCDOR applies depreciation for all taxable

properties in accordance with SC Code Section 12-37-930. Cost less depreciation applies to Schedules

A, E, F, L, and S.

Net book

The total cost of machinery and equipment, furniture and office equipment, less Income Tax

depreciation, as used for Income Tax purposes. No item should be depreciated more than 90%� See SC

Revenue Ruling #05-2 for State and Federal Tax Conformity and Exceptions. Net book values only apply

to Schedules B, C, D, J, K, and T.

Machinery and Equipment (Refer to Property Tax Regulation 117-1700.1 on page 7 of this document.)

Includes but not limited to: Does not include:

● Air conditioning - special process (not ● Inventory

employee comfort) ● Licensed vehicles

● Alarm systems ● Water, air pollution, and noise equipment

● Foundations for machinery and equipment required by state or federal government

● Leasehold improvement - classified as

personal property

● Machinery and equipmen

● Process related computer hardware and

software

● Special plumbing and electrical work

● Special purpose lighting

● Tools and dies

Furniture and Office Equipment

Includes but not limited to:

● Office furniture and equipment

● Non-process related computer hardware and software

13 SCDOR | PT-300 and Schedules Instructions

|

Enlarge image |

Real Property Improvement (Refer to Property Tax Regulation 117-1700.1 on page 7 of this document.)

Includes but not limited to:

● Air conditioning - employee comfort ● Partitions

● Canopies ● Railroads

● Elevators ● Retaining walls

● Fencing ● Roads

● Loading platforms ● Structural improvements

● Parking lots

Attach Schedule X to identify all new real property investments not previously reported.

Land

Includes the gross capitalized cost of all land acquisitions at the plant site. Enter the acreage associated

with each acquisition. Round all acreage to two decimal points. (For example, 1.75 acres, not 1 3/4

acres.) If acreage is not available, enter the number of lots.

Leasehold Improvements

Includes the gross capitalized cost of all real property improvements made by the lessee and should

be reported by the lessee. Any leasehold improvements considered as personal property by Property

Tax Regulation 117-1700.1 should be reported as machinery and equipment or furniture and office

equipment. Refer to Property Tax Regulation 117-1700.1 on page 7 of this document for a complete

listing. Attach Schedule X identifying all new leasehold improvements not previously reported.

Pollution

Includes the gross capitalized cost of all facilities or equipment of industrial plants which are designed

for the elimination, mitigation, prevention, treatment, abatement or control of water, air or noise

pollution, both internal and external, required by the state or federal government and used in

the conduct of their business. Attach Schedule X and a detailed list, identifying all new pollution

investments not previously reported. A copy of this list should be maintained at the plant site.

Vehicles

Includes the gross capitalized cost of all licensed vehicles registered or capitalized as a part of this

plant/operation. Licensed vehicles are taxed locally by the county and are not included in the SCDOR's

assessment�

Total Gross Cost Reported on this Schedule

Enter the total gross capitalized cost for all property types reported on this schedule. Do not include

net book values. Also, enter this total gross capitalized cost in Section C, Schedule Summary, on the PT-

300. You must include the schedule letter, schedule number, and plant/operation name associated with

the total�

Jobs Created

Applies to Schedule D and K only - Enter the number of new full-time jobs created for the current

14 SCDOR | PT-300 and Schedules Instructions

|

Enlarge image |

accounting year as of your accounting closing date. Refer to SC Code Section 12-37-220B(32) for more

information.

Applies to Schedules S and T only - Enter the total number of jobs (cumulative) at the project for the

current accounting year as of your accounting closing date. Refer to SC Code Sections 12-44-30(7),

4-29-67D(3)(4)(a), 4-12-30D(3)(4)(a) for more information.

Schedule G - Fee in Lieu of Tax Supplemental Instructions

All companies receiving the benefits of a Negotiated FILOT Agreement must complete a Schedule G.

Complete the Schedule G and send to the appropriate county auditor for the FILOT project in which the

Schedule S or Schedule T relates. For example, if you have a FILOT project in Spartanburg County and

filing a Schedule S, and a FILOT project in Cherokee County where you are filing a Schedule T, then you

should complete a Schedule G for both the Spartanburg Schedule S and the Cherokee Schedule T.

Owner name

Enter the property owner’s name as reported on the PT-300.

SID Suffix

Enter the SID Suffix as reported on the PT-300.

Schedule letter and number

Enter the Schedule letter and Schedule number from the associated plant/operation schedule.

Date of agreement

Enter the date of the Negotiated FILOT Agreement for the associated plant/operation schedule.

Plant location

Enter the property owner’s location address as reported on the PT-300.

Fair Market Value of Real Property

Enter the appraised value of the real property of the project.

Assessment Ratio for Real Property

Enter the ad valorem assessment ratio for the real property. This assessment ratio can be 6% to 10.5%,

depending on the nature of the business.

Total Assessed Value for Real Property

Multiply the fair market value of real property by the assessment ratio for real property.

Fair Market Value for Personal Property

Enter the fair market value of the personal property using the Income Tax basis less depreciation

allowable by law.

Total Assessed Value of Personal Property

Multiply the personal property fair market value by 10.5%, the assessment ratio for personal property.

15 SCDOR | PT-300 and Schedules Instructions

|

Enlarge image |

Signature Required

Sign the form to declare the information provided is correct and complete. Provide a printed name,

email, and phone number. If a preparer is completing the form on your behalf, the preparer should

complete this section.

Schedule X - Improvement Schedule Instructions

Each plant/operation reporting real, leasehold, or pollution control improvements not reported in

previous years must complete Schedule X. Attach Schedule X and a detailed list of pollution control

improvements behind the associated plant/operation schedule.

Owner name

Enter the property owner's name as reported on the PT-300.

SID Suffix

Enter your SID Suffix as reported on the PT-300.

Schedule letter and number, Plant/Operation name

Enter the schedule letter, the schedule number, and the plant/operation name from the associated

plant/operation schedule.

Real Property Improvements

Enter the investments for all new buildings, improvements, or additions to existing buildings and all

land or site improvements not previously reported in the categories provided. Use the Other category

for improvements that do not fit the categories provided.

Leasehold Improvements

Enter the leasehold investments not reported in previous years in the categories provided. Use the

Other category for any other investments.

Pollution Control Improvements

Enter the real and personal pollution control investments not reported in previous years in the

categories provided. Use the Other category for any other investments. Attach a detailed list identifying

all new pollution control investments. This list should be maintained at the plant site

16 SCDOR | PT-300 and Schedules Instructions

|

Enlarge image |

Schedule Z - Lease Schedule Instructions

Schedule Z must be filed to report information on leases not previously reported. When Schedule Z

has been completed, include it with the submitted PT-300 or add it under attachments when filed on

MyDORWAY. Leases capitalized by the lessee for Income Tax purposes are not required to be listed on

Schedule Z. In this case, the lessee is considered the owner and should include the leased property as

assets on their PT-300�

Owner name

Enter the property owner's name as reported on the PT-300.

SID Suffix

Enter the SID Suffix as reported on the PT-300.

Schedule letter and number, Plant/operation name

Enter the schedule letter, schedule number, and the plant/operation name from the plant/operation

schedule associated with each lease.

Lessee/Lessor, FEIN/SSN, Address

Enter the lessee/lessor's name, FEIN/SSN, and mailing address.

Type property leased

Check the type of property being leased.

Property leased

Check the To or From box to indicate whether the property is leased to or from the lessee/lessor being

reported�

Lease start date

Enter the date that the lease started.

Annual Rent

Enter the annual rent paid or received

17 SCDOR | PT-300 and Schedules Instructions

|

Enlarge image |

Additional Forms

Application for Five-Year Exemption

Change in Ownership

The purchaser of an existing facility is required to obtain approval from the local county governing body

for an extension of the five-year partial exemption. The purchaser must submit a completed PT-444,

Five Year Exemption Extended To Unrelated Purchaser, to the SCDOR within the time stated by law

for applying for exemption for the existing facility that has been purchased. The PT-444 is available at

dor.sc.gov/forms�

New investments in real and/or personal property made after the purchase of the existing facility

may qualify for the exemption as an addition. This may require the filing of separate schedules for the

purchase of the existing facility and the additions. Separate schedules will only be necessary if the

county governing body denies your request for the extension of the five-year exemption. You must

file an application for exemption within three years of your timely-filed PT-300. For more information

regarding changes in ownership, see SC Code Sections 12-37-220(C), 12-37-220(A)(7), 12-4-720(A)(1),

and 12-54-85(F)(1).

Do not wait for the PT-444 to be accepted before filing your PT-300.

No Change in Ownership

Owners of existing facilities that have not been purchased within this reporting period are not required

to obtain approval from the local county governing body. The PT-300 and applicable schedules filed

within the time prescribed by law for filing an application for exemption is considered your application

for the partial exemption under SC Code Sections 12-37-220(A) (7),(A)(8), (B)(32), and (B)(34).

Application for Warehousing and Wholesale Distribution

To request a special assessment of warehousing, you must file a PT-465, Application for Finished Goods

Warehouse & Wholesale Distribution Facilities, with the SCDOR by July 1 of the tax year for which you

are requesting the special classification. The PT-465 is available at dor.sc.gov/forms�

See SC Code Sections 12-43-220 (a)(4) for qualifications and application procedures.

18 SCDOR | PT-300 and Schedules Instructions

|

Enlarge image |

Application for Idle Property

To request property be considered Idle Property and receive the exemption, you must reach out

to the SCDOR to request a site inspection. Contact the SCDOR at 803-898-5055 or email us at

Manufacturing.Propertytax@dor.sc.gov�

12-37-900 (Second Paragraph): A manufacturer not under a fee agreement is not required to

return personal property for ad valorem tax purposes if the property remains in South Carolina at a

manufacturing facility that has not been operational for one fiscal year and the personal property has

not been used in operations for one fiscal year. The personal property is not required to be returned

until the personal property becomes operational in a manufacturing process or until the property has

not been returned for ad valorem tax purposes for four years, whichever is earlier. A manufacturer must

continue to list the personal property annually and designate on the listing that the personal property is

not subject to tax pursuant to this section.

Contact Information

Mail the PT-300 Return and Schedules to:

SCDOR, Manufacturing Section, Columbia, SC 29214-0302

Mail correspondence to:

SCDOR, Manufacturing Section, PO Box 125, Columbia, SC 29214-0740

Questions? We're here to help!

Call us at 803-898-5055 or email Manufacturing.Propertytax@dor.sc.gov�

SCDOR Taxpayer Service Centers are located across the state. Visit dor.sc.gov/contact/in-person for

locations and hours.

To contact the Association of Counties, visit sccounties.org�

19 SCDOR | PT-300 and Schedules Instructions

|

Enlarge image |

Reminders

File online with MyDORWAY

Filing online is faster and more accurate.

The fastest, easiest way to file your PT-300, Property Tax Return, is using our free online tax portal,

MyDORWAY. You can only use MyDORWAY to file initial returns and returns beginning with tax year

2020. Managing your South Carolina tax accounts is easy on MyDORWAY, and tutorials are available

to help� Visit dor.sc.gov/mydorway-signup to get started. For more information and to view video

tutorials, visit dor.sc.gov/MyDORWAY�

Property Tax Timetable

● Return Due Date: Returns are due by the last day of the fourth month following your accounting

closing date.

● Notice of Assessment: Taxpayers are notified of assessments and exemptions in August of each

year�

● Tax Bills: Assessments are furnished to counties, local millage rates are applied, and tax bills are

issued�

● Appeal Period: Must be filed within 90 days from the date on the PT-310, Property Assessment

Notice.

Checklist

Check the following items before mailing in your return:

● SID Suffix number is included on all forms.

● Schedule Summary is completed with information from attached schedules.

● Schedule X is attached to the associated schedule.

● Schedule Z is attached after page 2 of the PT-300.

● Pollution detail list is attached to the associated schedule with a copy maintained at the plant

site�

● Returns are signed by you and your preparer.

Under the provisions of SC Code Section 12-4-340 of the 1976 code of laws, any outstanding liabilities

due and owed to the SCDOR for more than six months may be assigned to a private collection agency

for collecting actions.

20 SCDOR | PT-300 and Schedules Instructions

|