Enlarge image

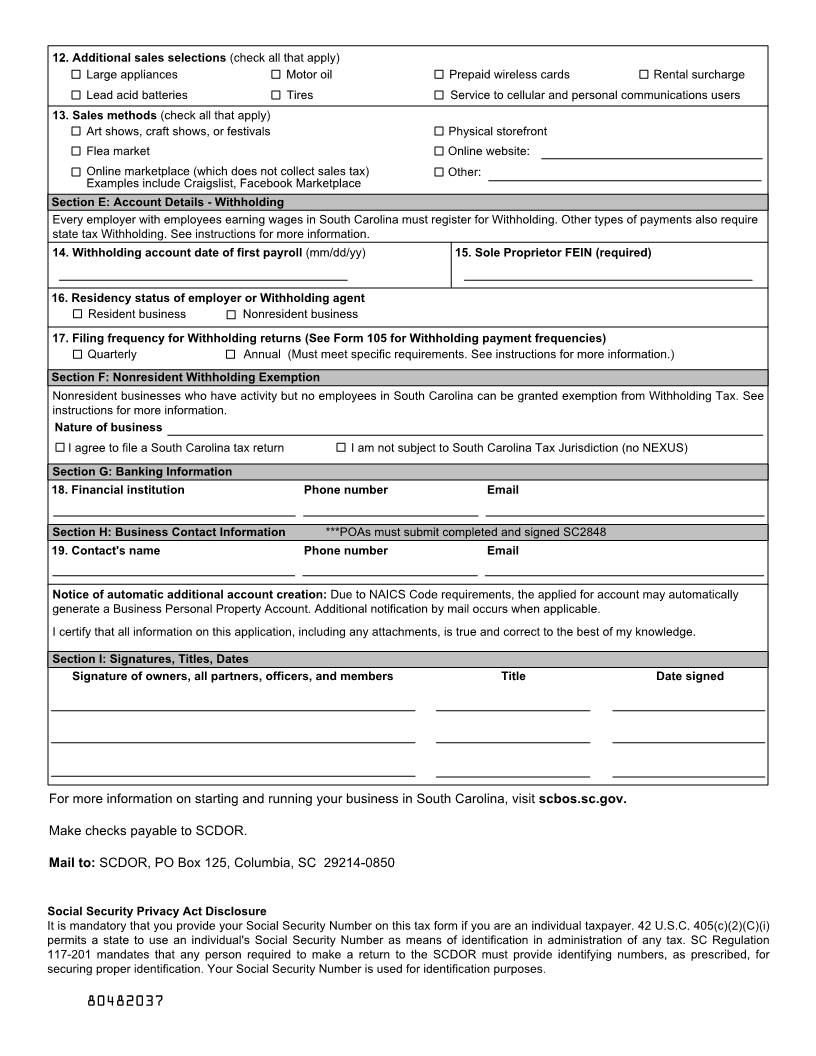

Print Form Reset Form

1350 STATE OF SOUTH CAROLINA

DEPARTMENT OF REVENUE SCDOR-111

(Rev. 8/9/23)

BUSINESS TAX APPLICATION 8048

dor.sc.gov Save time by registering online at dor.sc.gov/register.

See SCDOR-111 Instructions, available at dor.sc.gov/forms, for additional details and assistance with completing this application.

Section A: Entity Registration Information

Registration selection Sales & Use Tax Withholding Tax Nonresident Withholding Exemption

(Section D) (Section E) (Section F)

1. Type of ownership

Corporation Partnership

Limited Liability Company Professional Association

Corporation Partnership Single Member Sole Proprietor

Limited Liability Partnership SC Resident Non-Resident

Corporation Partnership years & months lived in SC

Limited Partnership

2. ID type (required) 3. Business names

FEIN Legal

SSN DBA

4. $25 CL-1 fee (This is not applicable for Sole Proprietors.) 5. State and date incorporated (mm/dd/yy)

Not paid Paid at SOS N/A

Section B: Owner, Partner, Officer, and Member Information

Social Security Name Title Phone Home address Ownership

Number percentage

Section C: Business Addresses

Mailing address Physical address (No PO Box)

Street address Street address

Unit type Unit City State Unit type Unit City

ZIP In care of ZIP County Municipality (required)

Section D: Account Details Retail License - $50 Artist & Craftsman's License - $20 Use Tax Certificate - No Fee

The SCDOR will not issue a Retail License to a person or entity with any outstanding state tax liability.

6. Nature of business (Provide a brief description of your business activity.) 7. Sales & Use Account commence date (mm/dd/yy)

8. Filing frequency (Zero return must be filed for active periods with no sales.)

Monthly Seasonal - list active months:

9. Account subtype Accommodations Artist & Craftsman Aviation Tax Max Tax Retail Use Tax

10. Does your business sell tobacco products? Yes No

Tobacco products include but are not limited to electronic smoking devices, e-cigarettes, e-cigars, e-pipes, vape pens, e-hookah,

and tobacco items that may or may not contain nicotine. For more information on the definitions of tobacco products, see SC

Code Section 16-17-501, available at dor.sc.gov/policy.

11. NAICS Code categories

Agriculture, Forestry, Max Tax (Vehicles) (44) Real Estate, Rental & Health Care & Social

Fishing, & Hunting (11) Leasing (53) Assistance (62)

Retail Trade (44-45)

Mining (21) Professional, Scientific, Arts, Entertainment, &

Artists & Craftsman (45) & Technical Services (54) Recreation (71)

Utilities (22)

Transportation & Management of Companies Accommodation & Food

Construction (23) Warehouse (48-49) & Enterprises(55) Services (72)

Manufacturing (31-33) Information (51) Administrative & Support, Other Services (81)

Waste Management &

Wholesale Trade (42) Finance & Insurance (52) Remediation Services (56) Public Administration (92)

Durable Medical Education Services (61)

Equipment (44)

80481039