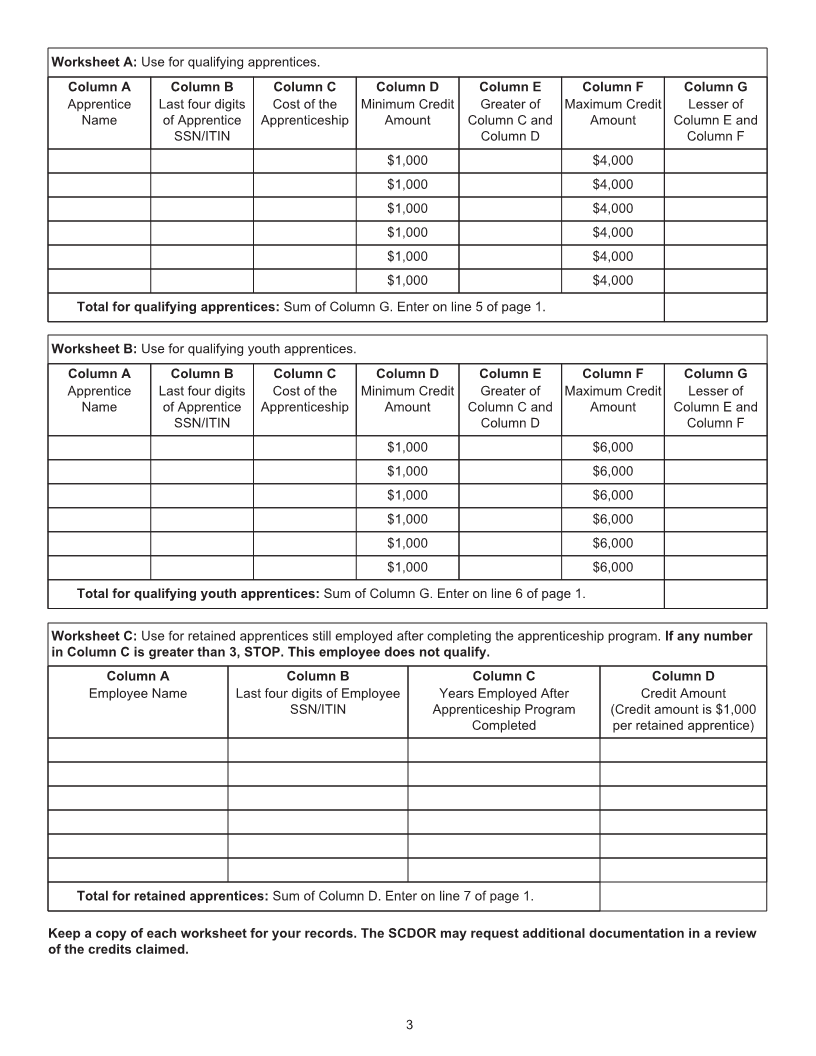

Enlarge image

1350 STATE OF SOUTH CAROLINA

SC SCH.TC-45

DEPARTMENT OF REVENUE

(Rev. 8/1/24)

3441

APPRENTICESHIP CREDIT

Use this form to claim a credit for tax years

dor.sc.gov ending May 21, 2024 and after 20____

Name SSN or FEIN

Check if you had:

Apprentice (Complete Worksheet A for each apprentice)

Youth Apprentice (Complete Worksheet B for each apprentice)

Apprentice retained upon program completion (Complete Worksheet C for each apprentice)

Complete the appropriate worksheets on page 3 and then continue below.

1. Total number of apprentices employed for at least seven months of the tax year 1.

2. Number of apprentices employed based on registered agreement (see

instructions) 2.

3. Number of youth apprentices (see instructions) 3.

4. Number of apprentices employed after completion of the apprenticeship program

(see instructions) 4.

5. Total credit earned from line 2 apprentices (enter the total from Column G of

Worksheet A) 5.

6. Total credit earned from line 3 youth apprentices (enter the total from Column G of

Worksheet B) 6.

7. Total credit earned from line 4 retained apprentices (enter the total from Column D

of Worksheet C) 7.

8. Total credit earned this tax year (add line 5, line 6, and line 7) 8.

9. Credit carried forward from prior tax years 9.

10. Total credit amount (add line 8 and line 9) 10.

11. Current year tax liability 11.

12. Available credit (lesser of line 10 or line 11)

Individuals: enter the credit on the SC1040TC

Corporations: enter the credit on the SC1120TC 12.

13. Credit carryforward (subtract line 12 from line 10)

Unused credit can be carried forward for three years 13.

34411017

1