Enlarge image

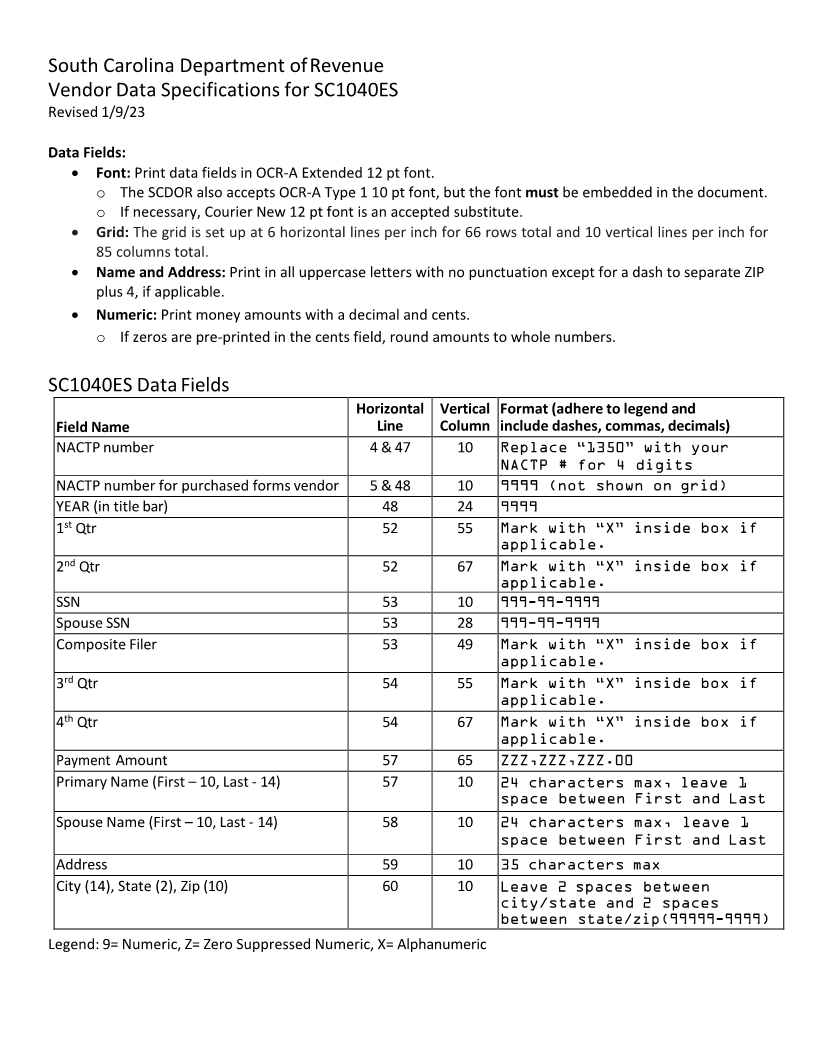

South Carolina Department of Revenue

Vendor Data Specifications for SC1040ES

Revised 1/9/23

Data Fields:

• Font: Print data fields in OCR-A Extended 12 pt font.

o The SCDOR also accepts OCR-A Type 1 10 pt font, but the font must be embedded in the document.

o If necessary, Courier New 12 pt font is an accepted substitute.

• Grid: The grid is set up at 6 horizontal lines per inch for 66 rows total and 10 vertical lines per inch for

85 columns total.

• Name and Address: Print in all uppercase letters with no punctuation except for a dash to separate ZIP

plus 4, if applicable.

• Numeric: Print money amounts with a decimal and cents.

o If zeros are pre-printed in the cents field, round amounts to whole numbers.

SC1040ES Data Fields

Horizontal Vertical Format (adhere to legend and

Field Name Line Column include dashes, commas, decimals)

NACTP number 4 & 47 10 Replace “1350” with your

NACTP # for 4 digits

NACTP number for purchased forms vendor 5 & 48 10 9999 (not shown on grid)

YEAR (in title bar) 48 24 9999

st

1 Qtr 52 55 Mark with “X” inside box if

applicable.

nd

2 Qtr 52 67 Mark with “X” inside box if

applicable.

SSN 53 10 999-99-9999

Spouse SSN 53 28 999-99-9999

Composite Filer 53 49 Mark with “X” inside box if

applicable.

rd

3 Qtr 54 55 Mark with “X” inside box if

applicable.

th

4 Qtr 54 67 Mark with “X” inside box if

applicable.

Payment Amount 57 65 ZZZ,ZZZ,ZZZ.00

Primary Name (First – 10, Last - 14) 57 10 24 characters max, leave 1

space between First and Last

Spouse Name (First – 10, Last - 14) 58 10 24 characters max, leave 1

space between First and Last

Address 59 10 35 characters max

City (14), State (2), Zip (10) 60 10 Leave 2 spaces between

city/state and 2 spaces

between state/zip(99999-9999)

Legend: 9 = Numeric, Z = Zero Suppressed Numeric, X = Alphanumeric