Enlarge image

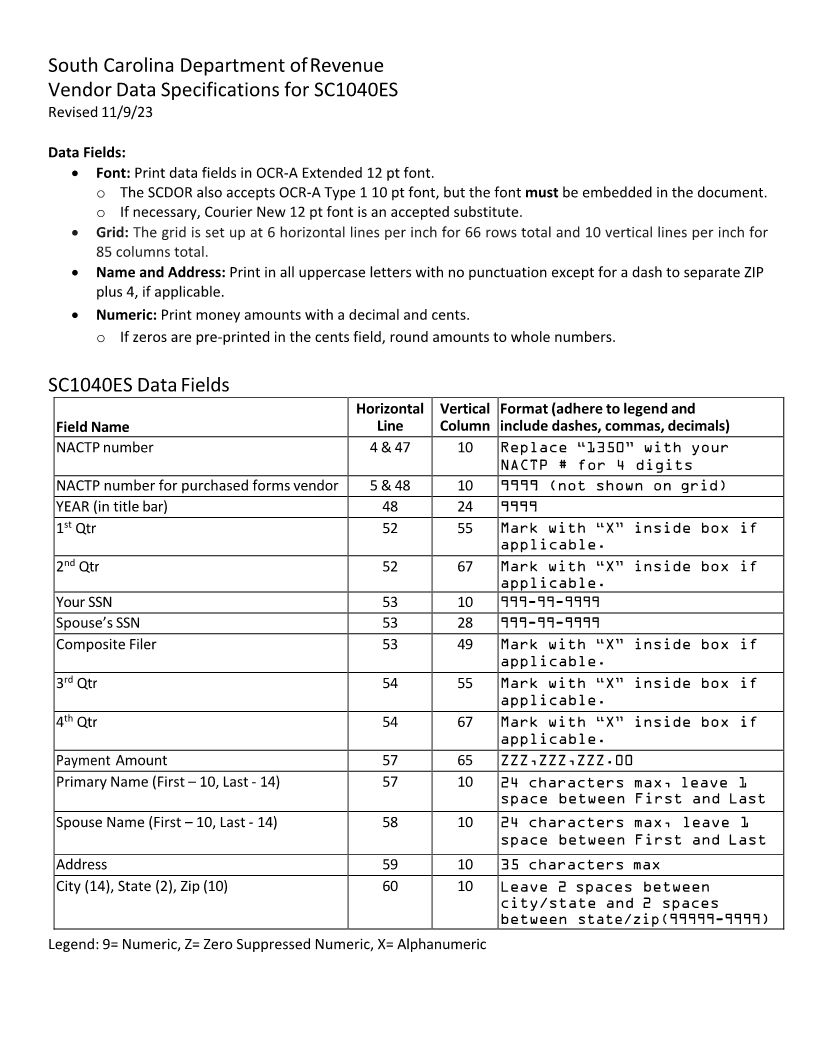

South Carolina Department ofRevenue Vendor Data Specifications for SC1040ES Revised 11/9/23 Data Fields: Font: Print data fields in OCR A Extended‐ 12 pt font. o The SCDOR also accepts OCR A Type‐ 1 10 pt font, but the font must be embedded in the document. o If necessary, Courier New 12 pt font is an accepted substitute. Grid: The grid is set up at 6 horizontal lines per inch for 66 rows total and 10 vertical lines per inch for 85 columns total. Name and Address: Print in all uppercase letters with no punctuation except for a dash to separate ZIP plus 4, if applicable. Numeric: Print money amounts with a decimal and cents. o If zeros are pre printed‐ in the cents field, round amounts to whole numbers. SC1040ES DataFields Horizontal Vertical Format (adhere to legend and Field Name Line Column include dashes, commas, decimals) NACTP number 4 & 47 10 Replace “1350” with your NACTP # for 4 digits NACTP number for purchased forms vendor 5 & 48 10 9999 (not shown on grid) YEAR (in title bar) 48 24 9999 st 1 Qtr 52 55 Mark with “X” inside box if applicable. nd 2 Qtr 52 67 Mark with “X” inside box if applicable. Your SSN 53 10 999-99-9999 Spouse’s SSN 53 28 999-99-9999 Composite Filer 53 49 Mark with “X” inside box if applicable. rd 3 Qtr 54 55 Mark with “X” inside box if applicable. th 4 Qtr 54 67 Mark with “X” inside box if applicable. Payment Amount 57 65 ZZZ,ZZZ,ZZZ.00 Primary Name (First – 10, Last 14) ‐ 57 10 24 characters max, leave 1 space between First and Last Spouse Name (First – 10, Last 14) ‐ 58 10 24 characters max, leave 1 space between First and Last Address 59 10 35 characters max City (14), State (2), Zip (10) 60 10 Leave 2 spaces between city/state and 2 spaces between state/zip(99999-9999) Legend: 9= Numeric, Z= Zero Suppressed Numeric, X= Alphanumeric