Enlarge image

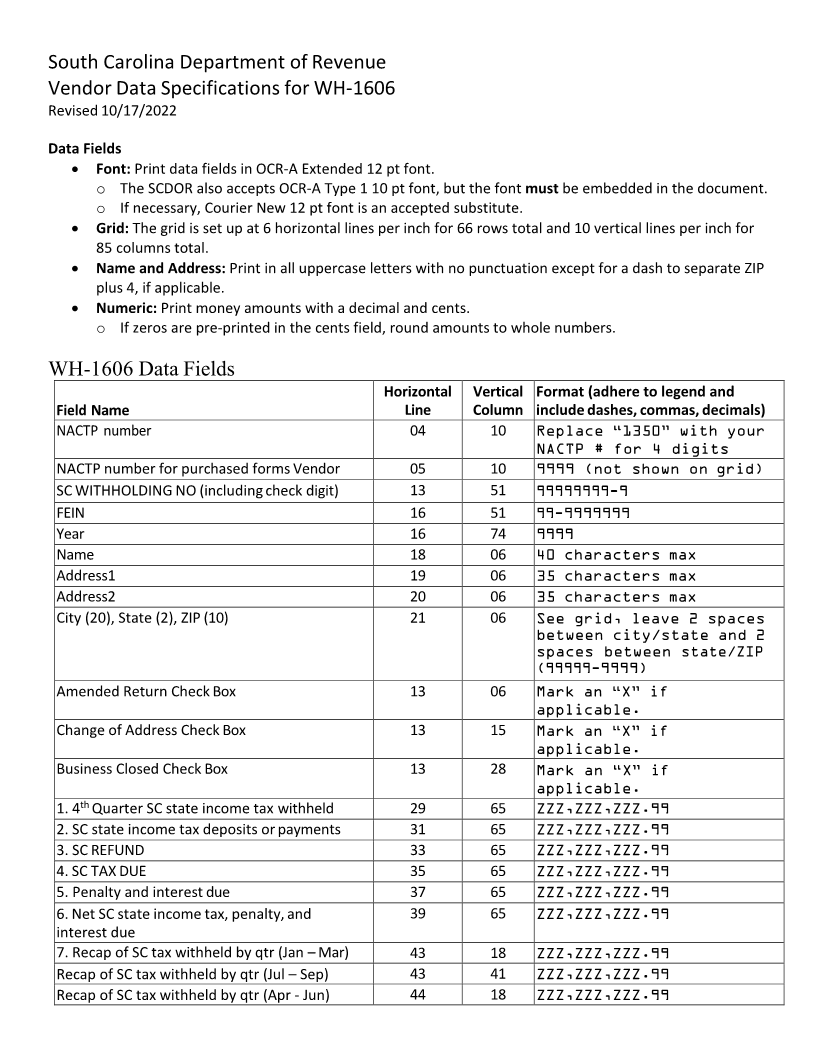

South Carolina Department of Revenue

Vendor Data Specifications for WH-1606

Revised 10/17/2022

Data Fields

• Font: Print data fields in OCR-A Extended 12 pt font.

o The SCDOR also accepts OCR-A Type 1 10 pt font, but the font must be embedded in the document.

o If necessary, Courier New 12 pt font is an accepted substitute.

• Grid: The grid is set up at 6 horizontal lines per inch for 66 rows total and 10 vertical lines per inch for

85 columns total.

• Name and Address: Print in all uppercase letters with no punctuation except for a dash to separate ZIP

plus 4, if applicable.

• Numeric: Print money amounts with a decimal and cents.

o If zeros are pre-printed in the cents field, round amounts to whole numbers.

WH-1606 Data Fields

Horizontal Vertical Format (adhere to legend and

Field Name Line Column include dashes, commas, decimals)

NACTP number 04 10 Replace “1350” with your

NACTP # for 4 digits

NACTP number for purchased forms Vendor 05 10 9999 (not shown on grid)

SC WITHHOLDING NO (including check digit) 13 51 99999999-9

FEIN 16 51 99-9999999

Year 16 74 9999

Name 18 06 40 characters max

Address1 19 06 35 characters max

Address2 20 06 35 characters max

City (20), State (2), ZIP (10) 21 06 See grid, leave 2 spaces

between city/state and 2

spaces between state/ZIP

(99999-9999)

Amended Return Check Box 13 06 Mark an “X” if

applicable.

Change of Address Check Box 13 15 Mark an “X” if

applicable.

Business Closed Check Box 13 28 Mark an “X” if

applicable.

th

1. 4 Quarter SC state income tax withheld 29 65 ZZZ,ZZZ,ZZZ.99

2. SC state income tax deposits or payments 31 65 ZZZ,ZZZ,ZZZ.99

3. SC REFUND 33 65 ZZZ,ZZZ,ZZZ.99

4. SC TAX DUE 35 65 ZZZ,ZZZ,ZZZ.99

5. Penalty and interest due 37 65 ZZZ,ZZZ,ZZZ.99

6. Net SC state income tax, penalty, and 39 65 ZZZ,ZZZ,ZZZ.99

interest due

7. Recap of SC tax withheld by qtr (Jan – Mar) 43 18 ZZZ,ZZZ,ZZZ.99

Recap of SC tax withheld by qtr (Jul – Sep) 43 41 ZZZ,ZZZ,ZZZ.99

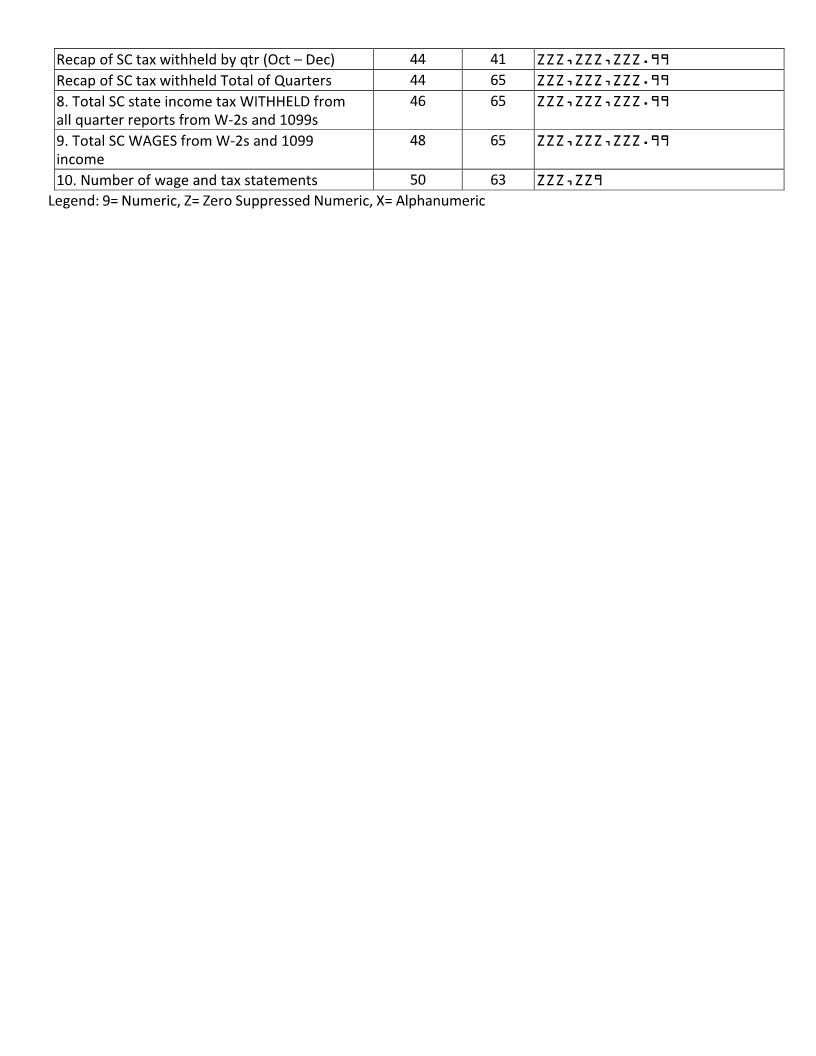

Recap of SC tax withheld by qtr (Apr - Jun) 44 18 ZZZ,ZZZ,ZZZ.99