Enlarge image

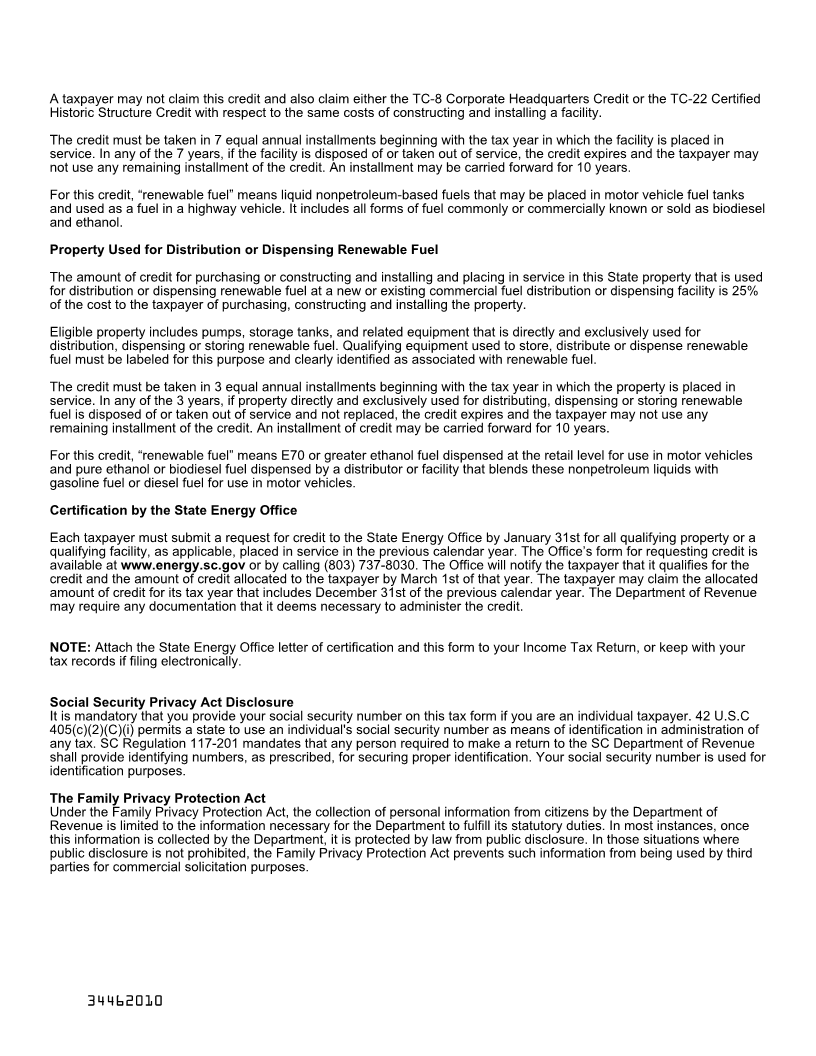

13501350 STATE OF SOUTH CAROLINA

DEPARTMENT OF REVENUE SC SCH.TC-41

RENEWABLE FUEL (Rev. 6/27/12)

FACILITY CREDITS 3446

Attach to your Income Tax Return

20

Name As Shown On Tax Return SSN or FEIN

Production property credit

1. Enter the amount of production facility credit allocated by the State Energy

Office (attach form) ............................…………………………………………………….…… 1. $

2. Line 1 divided by 7. This credit must be taken in 7 equal annual installments ……………. 2. $

3. Amounts carried forward from prior years …………………………………………………….. 3. $

4. Add lines 2 and 3 ………………………………………………………………………………… 4. $

Distribution and dispensing property credit

5. Enter the amount of distribution or dispensing property credit allocated by the State

Energy Office (attach form) ...…………………………………………………………………… 5. $

6. Line 5 divided by 3. This credit must be taken in 3 equal annual installments ……………. 6. $

7. Amounts carried forward from prior years …………………………………………………….. 7. $

8. Add lines 6 and 7 ………………………………………………………………………………… 8. $

Total credit

9. Add lines 4 and 8 ………………………………………………………………………………… 9. $

10. Enter your current year tax liability …………………………………………………………….. 10. $

11. Enter the lesser of line 9 or line 10. This is your credit for the current year. Enter this

amount on the appropriate tax credit schedule ...…………………….……………………… 11. $

General Instructions

NOTE: The Code section providing these credits was amended effective May 29, 2008.

For property and facilities placed in service after 2006 and before 2020, Code Section 12-6-3610 provides corporate or

individual income tax credits to taxpayers that:

(A) purchase or construct and install and place in service in this State property that is used for distribution or dispensing

renewable fuel at a new or existing commercial fuel distribution or dispensing facility; or

(B) construct and place in service in this State a commercial facility for the production of renewable fuel.

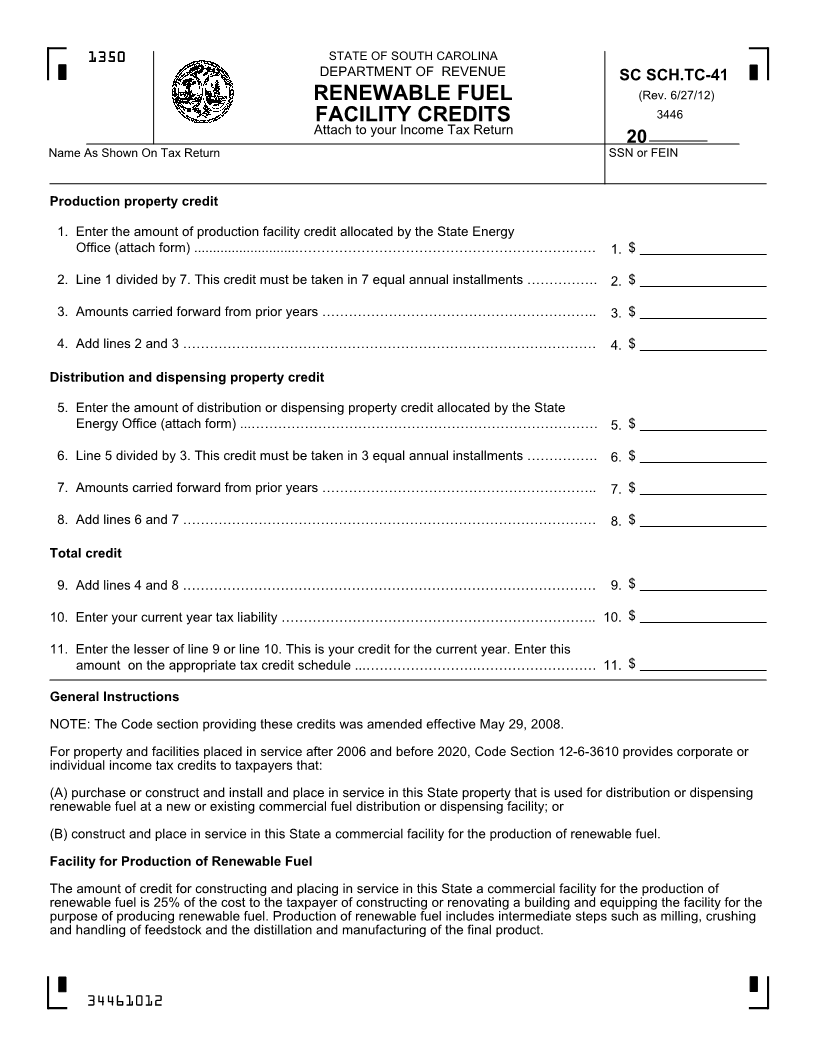

Facility for Production of Renewable Fuel

The amount of credit for constructing and placing in service in this State a commercial facility for the production of

renewable fuel is 25% of the cost to the taxpayer of constructing or renovating a building and equipping the facility for the

purpose of producing renewable fuel. Production of renewable fuel includes intermediate steps such as milling, crushing

and handling of feedstock and the distillation and manufacturing of the final product.

34461012