Enlarge image

13501350 STATE OF SOUTH CAROLINA

DEPARTMENT OF REVENUE SC SCH.TC-50

BIOMASS RESOURCE (Rev. 8/1/14)

CREDIT 3440

Attach to your Income Tax Return 20

Name As Shown On Tax Return FEIN SC SCH.TC-50

(Rev. 11/18/08)

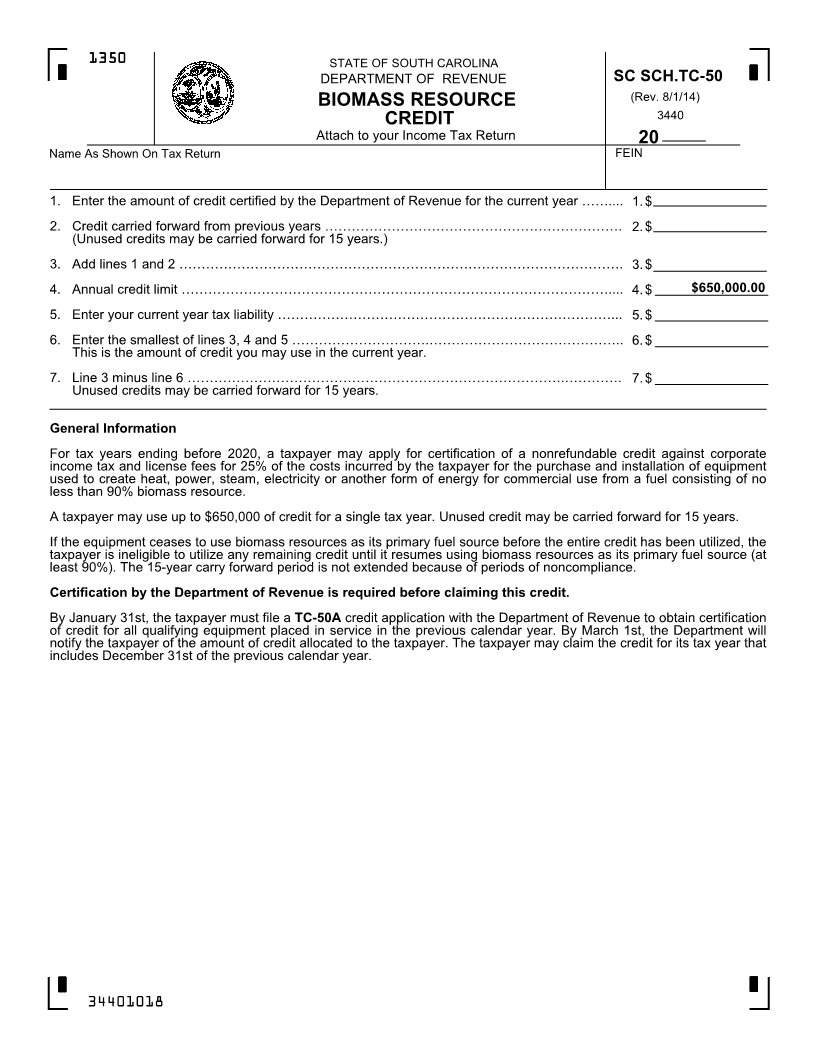

1. Enter the amount of credit certified by the Department of Revenue for the current year …….... 1.$ 3440

2008

2. Credit carried forward from previous years …………………………………………………………. 2.$

(Unused credits may be carried forward for 15 years.)

3. Add lines 1 and 2 ………………………………………………………………………………………. 3.$

4. Annual credit limit …………………………………………………………………………………….... 4.$ $650,000.00

5. Enter your current year tax liability …………………………………………………………………... 5.$

6. Enter the smallest of lines 3, 4 and 5 ………………………….…………………………………….. 6.$

This is the amount of credit you may use in the current year.

7. Line 3 minus line 6 ………………………………………………………………………….…………. 7.$

Unused credits may be carried forward for 15 years.

General Information

For tax years ending before 2020, a taxpayer may apply for certification of a nonrefundable credit against corporate

income tax and license fees for 25% of the costs incurred by the taxpayer for the purchase and installation of equipment

used to create heat, power, steam, electricity or another form of energy for commercial use from a fuel consisting of no

less than 90% biomass resource.

A taxpayer may use up to $650,000 of credit for a single tax year. Unused credit may be carried forward for 15 years.

If the equipment ceases to use biomass resources as its primary fuel source before the entire credit has been utilized, the

taxpayer is ineligible to utilize any remaining credit until it resumes using biomass resources as its primary fuel source (at

least 90%). The 15-year carry forward period is not extended because of periods of noncompliance.

Certification by the Department of Revenue is required before claiming this credit.

By January 31st, the taxpayer must file a TC-50A credit application with the Department of Revenue to obtain certification

of credit for all qualifying equipment placed in service in the previous calendar year. By March 1st, the Department will

notify the taxpayer of the amount of credit allocated to the taxpayer. The taxpayer may claim the credit for its tax year that

includes December 31st of the previous calendar year.

34401018