Enlarge image

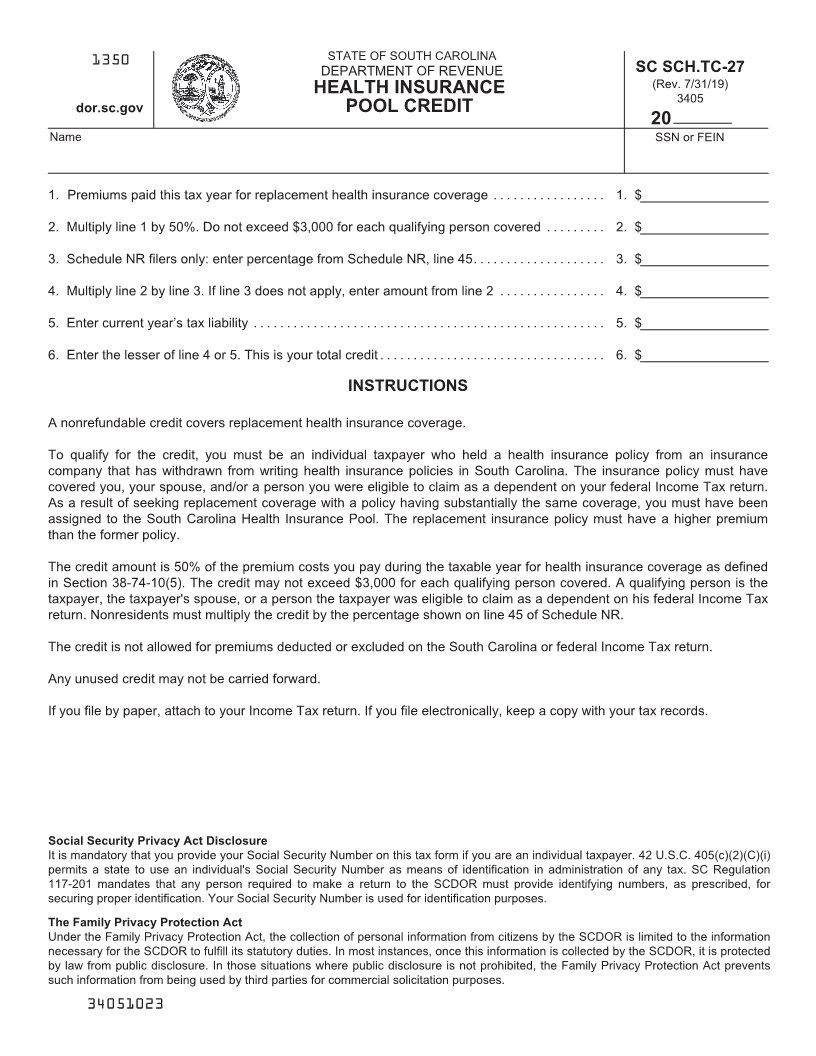

1350 STATE OF SOUTH CAROLINA

DEPARTMENT OF REVENUE SC SCH.TC-27

(Rev. 7/31/19)

HEALTH INSURANCE

3405

dor.sc.gov POOL CREDIT

20

Name SSN or FEIN

1. Premiums paid this tax year for replacement health insurance coverage ................. 1. $

2. Multiply line 1 by 50%. Do not exceed $3,000 for each qualifying person covered ......... 2. $

3. Schedule NR filers only: enter percentage from Schedule NR, line 45.................... 3. $

4. Multiply line 2 by line 3. If line 3 does not apply, enter amount from line 2 ................ 4. $

5. Enter current year’s tax liability ..................................................... 5. $

6. Enter the lesser of line 4 or 5. This is your total credit.................................. 6. $

INSTRUCTIONS

A nonrefundable credit covers replacement health insurance coverage.

To qualify for the credit, you must be an individual taxpayer who held a health insurance policy from an insurance

company that has withdrawn from writing health insurance policies in South Carolina. The insurance policy must have

covered you, your spouse, and/or a person you were eligible to claim as a dependent on your federal Income Tax return.

As a result of seeking replacement coverage with a policy having substantially the same coverage, you must have been

assigned to the South Carolina Health Insurance Pool. The replacement insurance policy must have a higher premium

than the former policy.

The credit amount is 50% of the premium costs you pay during the taxable year for health insurance coverage as defined

in Section 38-74-10(5). The credit may not exceed $3,000 for each qualifying person covered. A qualifying person is the

taxpayer, the taxpayer's spouse, or a person the taxpayer was eligible to claim as a dependent on his federal Income Tax

return. Nonresidents must multiply the credit by the percentage shown on line 45 of Schedule NR.

The credit is not allowed for premiums deducted or excluded on the South Carolina or federal Income Tax return.

Any unused credit may not be carried forward.

If you file by paper, attach to your Income Tax return. If you file electronically, keep a copy with your tax records.

Social Security Privacy Act Disclosure

It is mandatory that you provide your Social Security Number on this tax form if you are an individual taxpayer. 42 U.S.C. 405(c)(2)(C)(i)

permits a state to use an individual's Social Security Number as means of identification in administration of any tax. SC Regulation

117-201 mandates that any person required to make a return to the SCDOR must provide identifying numbers, as prescribed, for

securing proper identification. Your Social Security Number is used for identification purposes.

The Family Privacy Protection Act

Under the Family Privacy Protection Act, the collection of personal information from citizens by the SCDOR is limited to the information

necessary for the SCDOR to fulfill its statutory duties. In most instances, once this information is collected by the SCDOR, it is protected

by law from public disclosure. In those situations where public disclosure is not prohibited, the Family Privacy Protection Act prevents

such information from being used by third parties for commercial solicitation purposes.

34051023