Enlarge image

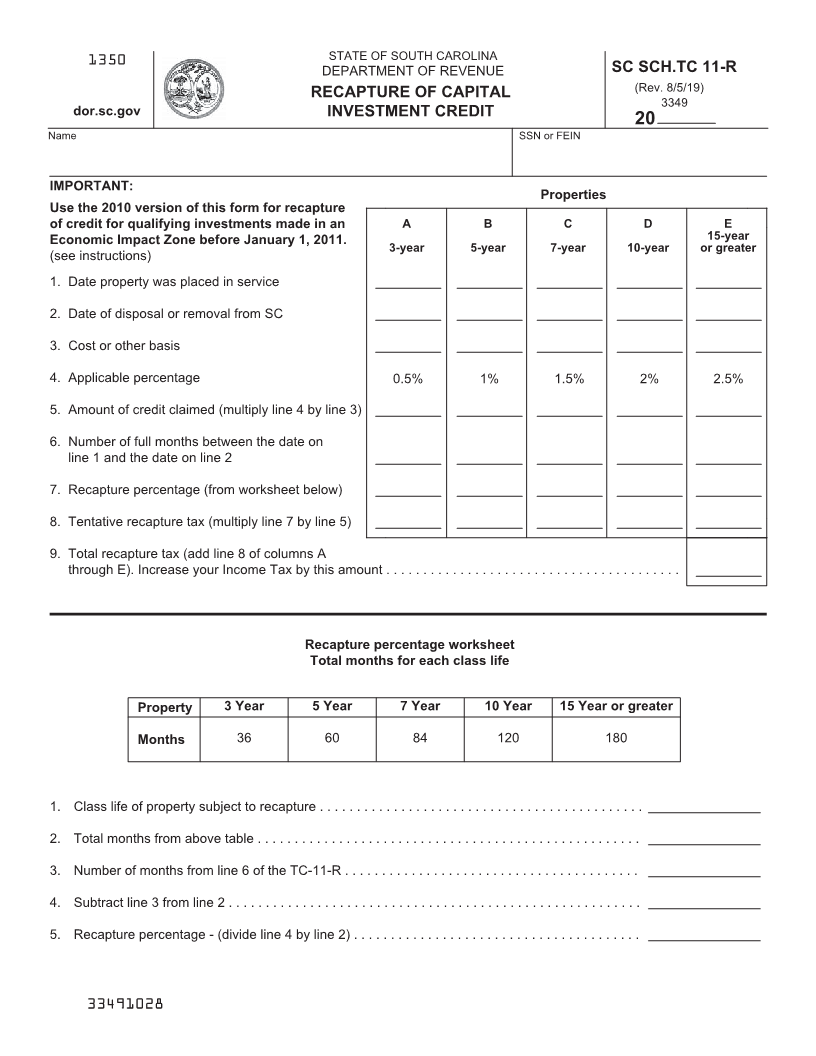

1350 STATE OF SOUTH CAROLINA

DEPARTMENT OF REVENUE SC SCH.TC 11-R

RECAPTURE OF CAPITAL (Rev. 8/5/19)

3349

dor.sc.gov INVESTMENT CREDIT

20

Name SSN or FEIN

IMPORTANT:

Properties

Use the 2010 version of this form for recapture

of credit for qualifying investments made in an A B C D E

Economic Impact Zone before January 1, 2011. 15-year

3-year 5-year 7-year 10-year or greater

(see instructions)

1. Date property was placed in service

2. Date of disposal or removal from SC

3. Cost or other basis

4. Applicable percentage 0.5% 1% 1.5% 2% 2.5%

5. Amount of credit claimed (multiply line 4 by line 3)

6. Number of full months between the date on

line 1 and the date on line 2

7. Recapture percentage (from worksheet below)

8. Tentative recapture tax (multiply line 7 by line 5)

9. Total recapture tax (add line 8 of columns A

through E). Increase your Income Tax by this amount . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Recapture percentage worksheet

Total months for each class life

Property 3 Year 5 Year 7 Year 10 Year 15 Year or greater

Months 36 60 84 120 180

1. Class life of property subject to recapture . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2. Total months from above table . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3. Number of months from line 6 of the TC-11-R . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4. Subtract line 3 from line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5. Recapture percentage - (divide line 4 by line 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

33491028