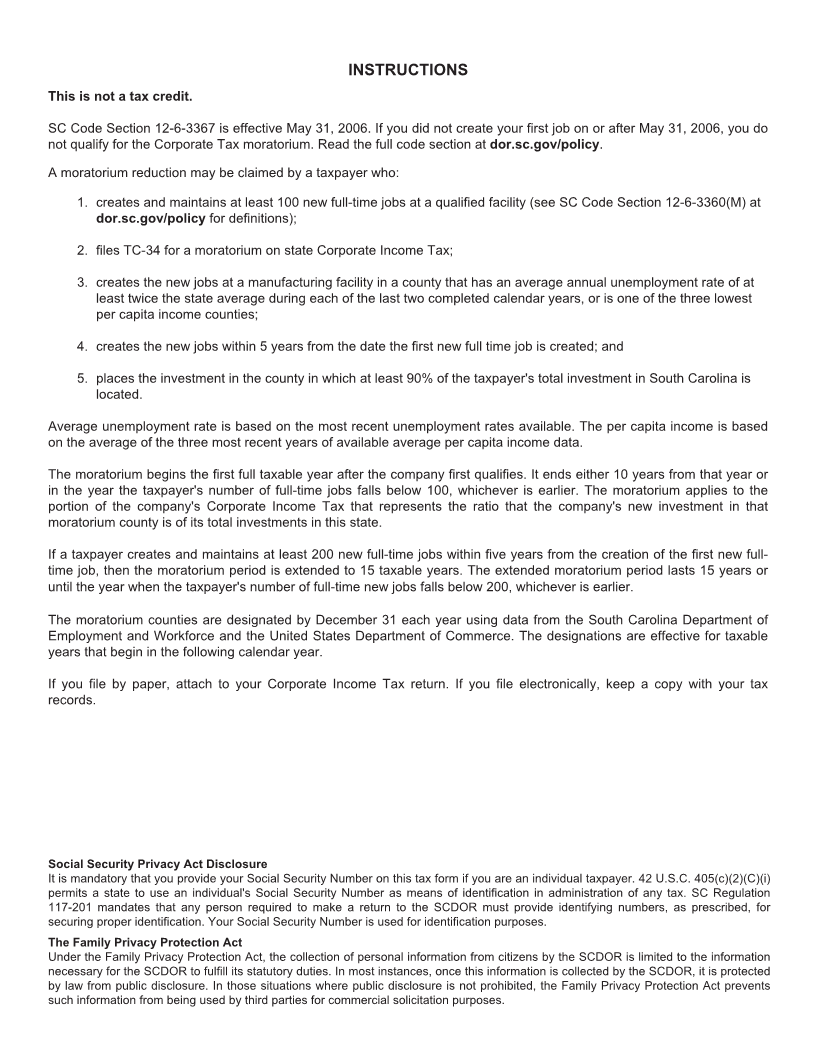

Enlarge image

1350 STATE OF SOUTH CAROLINA

DEPARTMENT OF REVENUE SC SCH.TC-34

(Rev. 7/30/19)

CORPORATE TAX MORATORIUM 3431

dor.sc.gov

20

Name FEIN

THIS IS NOT A TAX CREDIT

Qualifying Year Years Claimed Through Qualifying County

Column A Column B

Amount % of Total Investment

I. Computation of Required Investment in SC

1. Previous investment in qualifying county

2. New investment in qualifying county

3. Add line 1 and line 2

4. Investment in non-qualifying counties in South Carolina

5. Add line 3 and line 4

YES NO

6. Is the percentage on line 3, Column B at least 90%?

If you checked no, you do not qualify for the corporate moratorium.

II. Creation of Jobs

7. Did you create at least 100 new jobs as defined in SC Code Section 12-6-3360(M)

in the qualifying year in the qualifying county?

III. Qualifying County

8. Did you create jobs in a county with an average annual unemployment rate of at

least twice the state average during each of the last two completed calendar years,

based on the most recent unemployment rates available?

9. Did you create jobs in a county which is one of the three lowest per capita income

counties, based on the average of the three most recent years of available average

per capita income data?

If you checked no on lines 7, 8, or 9, you do not qualify for the

corporate moratorium under SC Code Section 12-6-3367.

IV. Moratorium Computation

10. Tax liability before moratorium $

11. Company's new investment percentage in qualifying county from line 2, Column B x

12. Moratorium reduction (multiply line 10 by line 11) $

Enter this amount on SC1120TC.

If you create at least 100 new full-time jobs within five years from the date you create the first new full-time job at the facility, the

moratorium period is 10 years. If you create at least 200 new full-time jobs within five years from the date you create the first new full-

time job at the facility, the moratorium period is 15 years. If the number of new jobs drops below the qualifying rate (100 or 200), the

moratorium no longer applies. You must have hired your first new full-time employee on or after May 31, 2006 to be eligible for either

the 10 year or 15 year moratorium.

Number of new jobs in qualifying year Number of new jobs maintained in current year

34311027