Enlarge image

1350

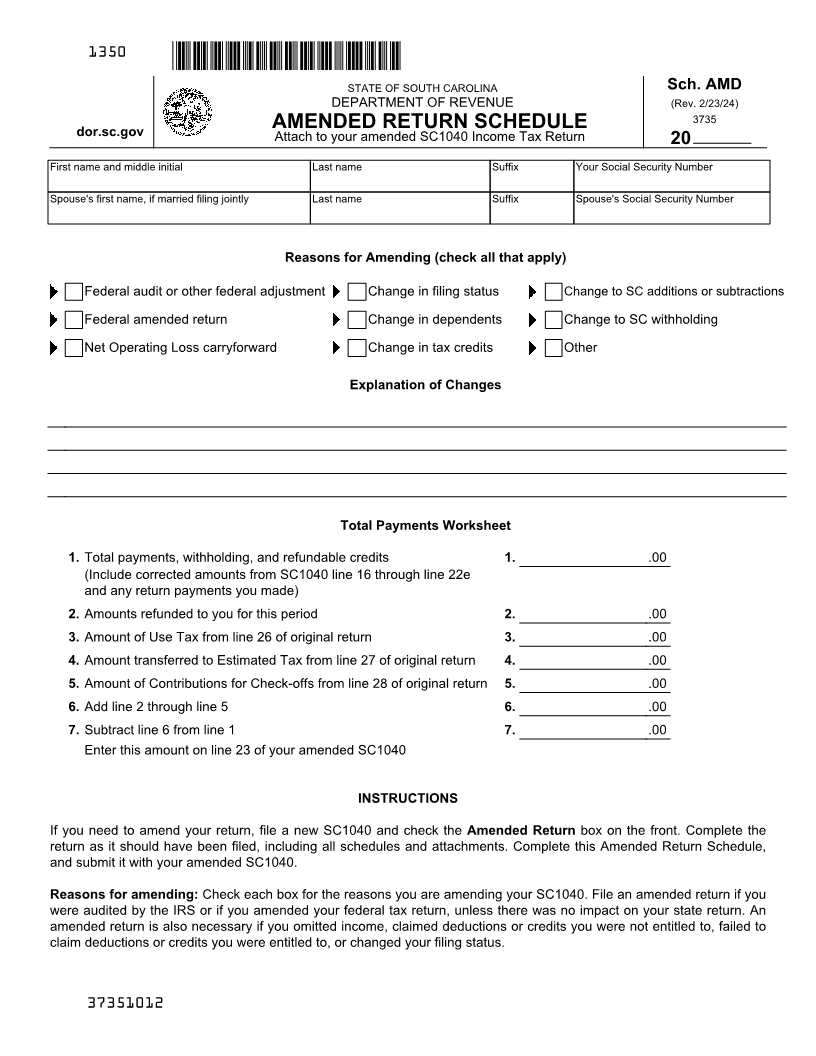

STATE OF SOUTH CAROLINA Sch. AMD

DEPARTMENT OF REVENUE (Rev. 2/23/24)

3735

dor.sc.gov AMENDED RETURN SCHEDULE

Attach to your amended SC1040 Income Tax Return 20

First name and middle initial Last name Suffix Your Social Security Number

Spouse's first name, if married filing jointly Last name Suffix Spouse's Social Security Number

Reasons for Amending (check all that apply)

Federal audit or other federal adjustment Change in filing status Change to SC additions or subtractions

Federal amended return Change in dependents Change to SC withholding

Net Operating Loss carryforward Change in tax credits Other

Explanation of Changes

Total Payments Worksheet

1. Total payments, withholding, and refundable credits 1. .00

(Include corrected amounts from SC1040 line 16 through line 22e

and any return payments you made)

2. Amounts refunded to you for this period 2. .00

3. Amount of Use Tax from line 26 of original return 3. .00

4. Amount transferred to Estimated Tax from line 27 of original return 4. .00

5. Amount of Contributions for Check-offs from line 28 of original return 5. .00

6. Add line 2 through line 5 6. .00

7. Subtract line 6 from line 1 7. .00

Enter this amount on line 23 of your amended SC1040

INSTRUCTIONS

If you need to amend your return, file a new SC1040 and check the Amended Return box on the front. Complete the

return as it should have been filed, including all schedules and attachments. Complete this Amended Return Schedule,

and submit it with your amended SC1040.

Reasons for amending: Check each box for the reasons you are amending your SC1040. File an amended return if you

were audited by the IRS or if you amended your federal tax return, unless there was no impact on your state return. An

amended return is also necessary if you omitted income, claimed deductions or credits you were not entitled to, failed to

claim deductions or credits you were entitled to, or changed your filing status.

37351012