Enlarge image

1350 STATE OF SOUTH CAROLINA

DEPARTMENT OF REVENUE SC SCH.TC 9

(Rev. 9/16/19)

CREDIT FOR CHILD CARE PROGRAM 3291

dor.sc.gov 20

Name SSN or FEIN

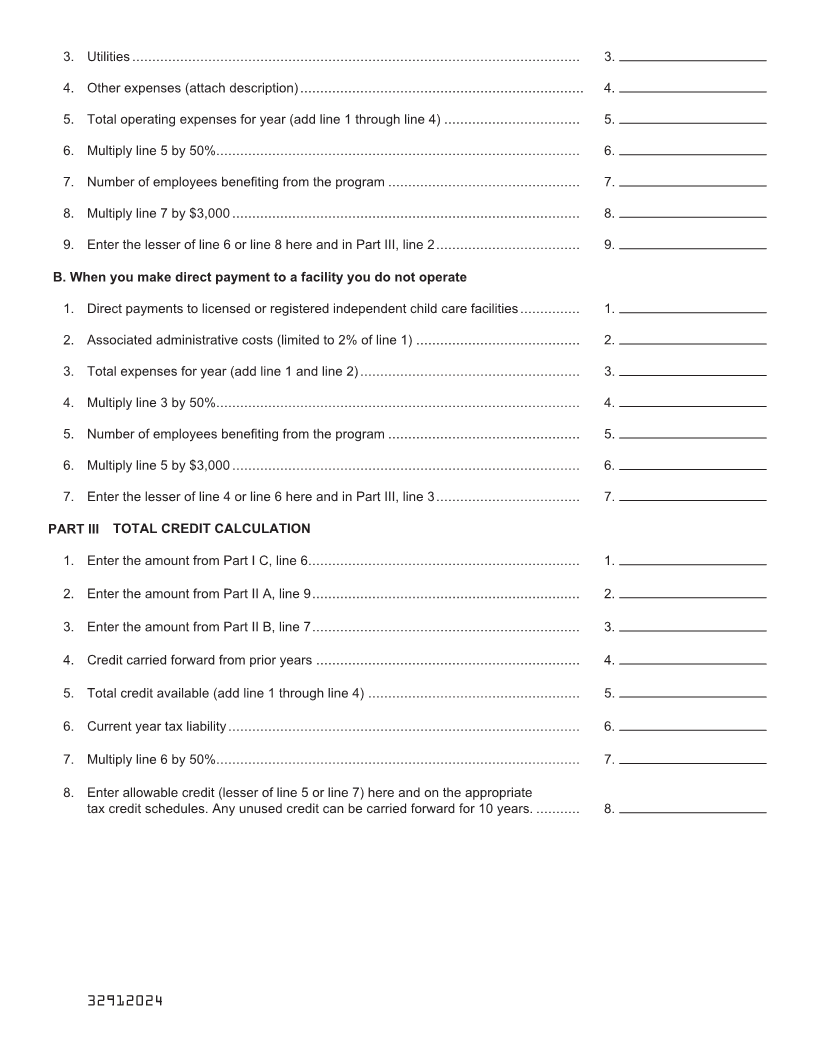

PART I CREDIT FOR ESTABLISHING A PROGRAM

A. When you operate the program

1. Playground and classroom equipment...................................................................... 1.

2. Kitchen appliances and cooking equipment.............................................................. 2.

3. Real property and property improvements................................................................ 3.

4. Mortgage and lease payments................................................................................. 4.

5. Donations to a nonprofit corporation in South Carolina that provides childcare

services to your employees..................................................................................... 5.

Nonprofit Name

Nonprofit FEIN

6. First-year organization and administration expenses................................................. 6.

7. Other start-up expenses (attach a description).......................................................... 7.

8. Total start-up expenses for year (add line 1 through line 7)........................................ 8.

B. When you make direct payments to a facility you do not operate

1. First-year organization and administration expenses.................................................. 1.

C. Total expenses for establishing a child care program

1. Total expenses (add Part I A, line 8 and Part I B, line 1)............................................ 1.

2. Multiply line 1 by 50%.............................................................................................. 2.

3. Credit claimed in prior years for start-up expenses.................................................... 3.

4. Credit limit.............................................................................................................. 4. $100,000

5. Subtract line 3 from line 4........................................................................................ 5.

6. Enter current year credit (lesser of lines 2, 4, or 5) here and in Part III, line 1.............. 6.

PART II CREDIT FOR OPERATING A PROGRAM

A. When you operate the program

1. Salaries and wages...................................................................................................1.

2. Supplies...................................................................................................................2.

32911026