Enlarge image

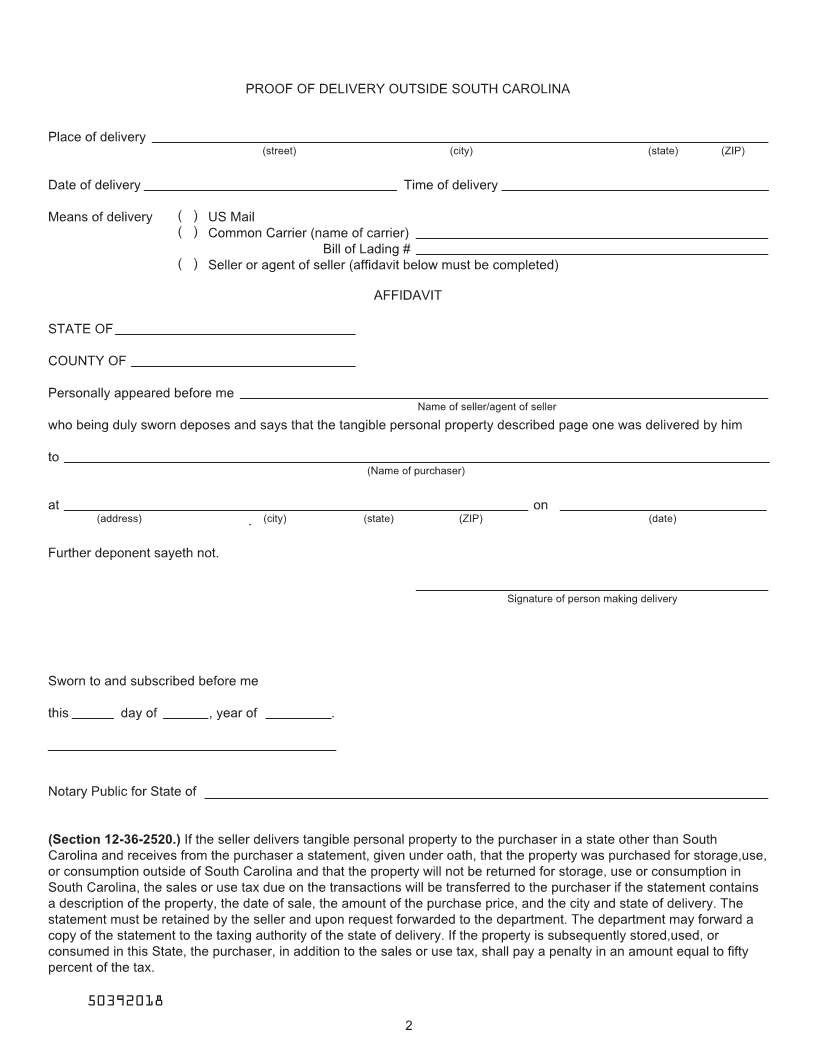

1350 STATE OF SOUTH CAROLINA

DEPARTMENT OF REVENUE

AFFIDAVIT FOR DELIVERY OF TANGIBLE PERSONAL ST-299

(Rev. 7/30/20)

PROPERTY TO THE PURCHASER IN A STATE OTHER 5039

THAN SOUTH CAROLINA

AFFIDAVIT

STATE OF

COUNTY OF

Personally appeared the below named purchaser, who being duly sworn, deposes and says that the property listed below

is purchased for use, storage or other consumption outside of South Carolina, that the property will not be returned for

use, storage or other consumption in South Carolina, and that the purchaser has read and understands the law as printed

on page two of this form.

Name of purchaser

City and state of delivery

State of residence and

address of purchaser

(street) (city) (state) (ZIP)

Name of seller

Address of seller

(street) (city) (state) (ZIP)

Seller's retail license number

Date of sale

(month) (date) (year)

DESCRIPTION OF PROPERTY:

Item:

Model:

Serial number:

Purchase price $ Trade-in allowance $ Net amount paid $

Further deponent sayeth not.

(Purchaser signature)

Sworn to and subscribed before me

this day of , year of .

(Notary Public for )

VALID ONLY WITH PROOF OF DELIVERY OUTSIDE STATE OF SOUTH CAROLINA

SEE PAGE TWO

ORIGINAL Provided for purchaser. Copy Retained by seller.

50391010

1