Enlarge image

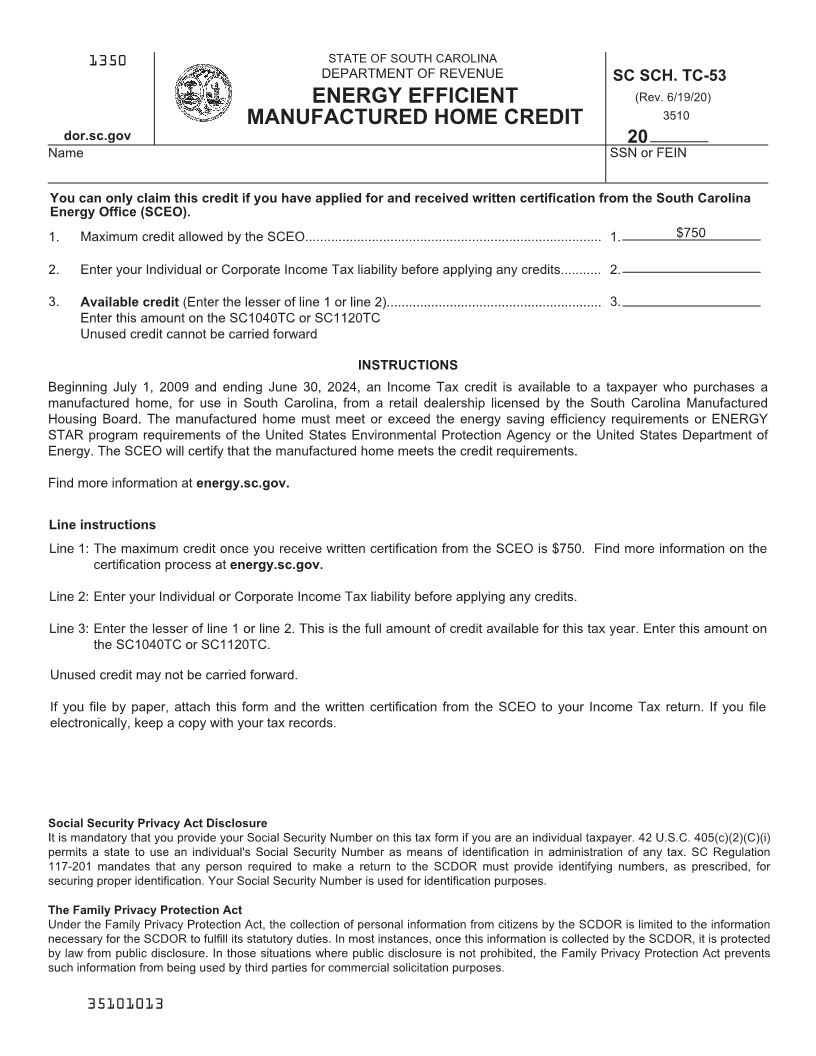

1350 STATE OF SOUTH CAROLINA

DEPARTMENT OF REVENUE SC SCH. TC-53

ENERGY EFFICIENT (Rev. 6/19/20)

MANUFACTURED HOME CREDIT 3510

dor.sc.gov 20

Name SSN or FEIN

You can only claim this credit if you have applied for and received written certification from the South Carolina

Energy Office (SCEO).

1. Maximum credit allowed by the SCEO................................................................................ 1. $750

2. Enter your Individual or Corporate Income Tax liability before applying any credits........... 2.

3. Available credit (Enter the lesser of line 1 or line 2).......................................................... 3.

Enter this amount on the SC1040TC or SC1120TC

Unused credit cannot be carried forward

INSTRUCTIONS

Beginning July 1, 2009 and ending June 30, 2024, an Income Tax credit is available to a taxpayer who purchases a

manufactured home, for use in South Carolina, from a retail dealership licensed by the South Carolina Manufactured

Housing Board. The manufactured home must meet or exceed the energy saving efficiency requirements or ENERGY

STAR program requirements of the United States Environmental Protection Agency or the United States Department of

Energy. The SCEO will certify that the manufactured home meets the credit requirements.

Find more information at energy.sc.gov.

Line instructions

Line 1: The maximum credit once you receive written certification from the SCEO is $750. Find more information on the

certification process at energy.sc.gov.

Line 2: Enter your Individual or Corporate Income Tax liability before applying any credits.

Line 3: Enter the lesser of line 1 or line 2. This is the full amount of credit available for this tax year. Enter this amount on

the SC1040TC or SC1120TC.

Unused credit may not be carried forward.

If you file by paper, attach this form and the written certification from the SCEO to your Income Tax return. If you file

electronically, keep a copy with your tax records.

Social Security Privacy Act Disclosure

It is mandatory that you provide your Social Security Number on this tax form if you are an individual taxpayer. 42 U.S.C. 405(c)(2)(C)(i)

permits a state to use an individual's Social Security Number as means of identification in administration of any tax. SC Regulation

117-201 mandates that any person required to make a return to the SCDOR must provide identifying numbers, as prescribed, for

securing proper identification. Your Social Security Number is used for identification purposes.

The Family Privacy Protection Act

Under the Family Privacy Protection Act, the collection of personal information from citizens by the SCDOR is limited to the information

necessary for the SCDOR to fulfill its statutory duties. In most instances, once this information is collected by the SCDOR, it is protected

by law from public disclosure. In those situations where public disclosure is not prohibited, the Family Privacy Protection Act prevents

such information from being used by third parties for commercial solicitation purposes.

35101013