Enlarge image

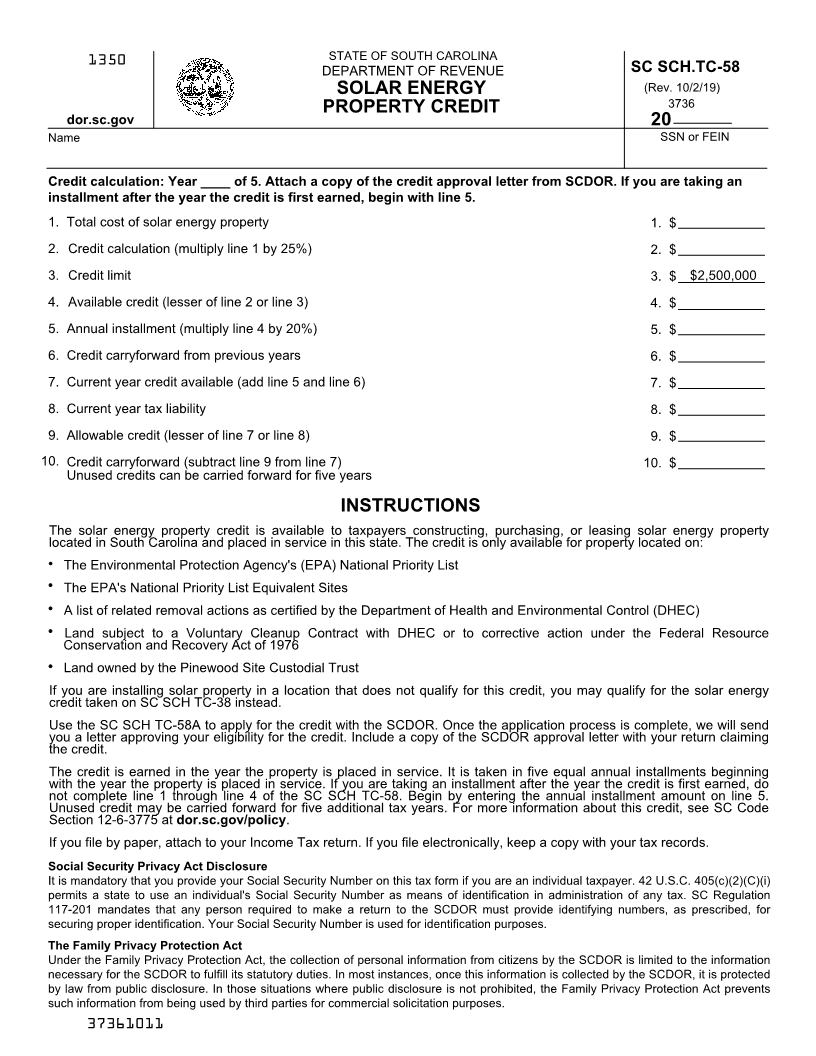

1350 STATE OF SOUTH CAROLINA

DEPARTMENT OF REVENUE SC SCH.TC-58

SOLAR ENERGY (Rev. 10/2/19)

3736

PROPERTY CREDIT

dor.sc.gov 20

Name SSN or FEIN

Credit calculation: Year ____ of 5. Attach a copy of the credit approval letter from SCDOR. If you are taking an

installment after the year the credit is first earned, begin with line 5.

1. Total cost of solar energy property 1. $

2. Credit calculation (multiply line 1 by 25%) 2. $

3. Credit limit 3. $ $2,500,000

4. Available credit (lesser of line 2 or line 3) 4. $

5. Annual installment (multiply line 4 by 20%) 5. $

6. Credit carryforward from previous years 6. $

7. Current year credit available (add line 5 and line 6) 7. $

8. Current year tax liability 8. $

9. Allowable credit (lesser of line 7 or line 8) 9. $

10. Credit carryforward (subtract line 9 from line 7) 10. $

Unused credits can be carried forward for five years

INSTRUCTIONS

The solar energy property credit is available to taxpayers constructing, purchasing, or leasing solar energy property

located in South Carolina and placed in service in this state. The credit is only available for property located on:

The Environmental Protection Agency's (EPA) National Priority List

The EPA's National Priority List Equivalent Sites

A list of related removal actions as certified by the Department of Health and Environmental Control (DHEC)

Land subject to a Voluntary Cleanup Contract with DHEC or to corrective action under the Federal Resource

Conservation and Recovery Act of 1976

Land owned by the Pinewood Site Custodial Trust

If you are installing solar property in a location that does not qualify for this credit, you may qualify for the solar energy

credit taken on SC SCH TC-38 instead.

Use the SC SCH TC-58A to apply for the credit with the SCDOR. Once the application process is complete, we will send

you a letter approving your eligibility for the credit. Include a copy of the SCDOR approval letter with your return claiming

the credit.

The credit is earned in the year the property is placed in service. It is taken in five equal annual installments beginning

with the year the property is placed in service. If you are taking an installment after the year the credit is first earned, do

not complete line 1 through line 4 of the SC SCH TC-58. Begin by entering the annual installment amount on line 5.

Unused credit may be carried forward for five additional tax years. For more information about this credit, see SC Code

Section 12-6-3775 at dor.sc.gov/policy.

If you file by paper, attach to your Income Tax return. If you file electronically, keep a copy with your tax records.

Social Security Privacy Act Disclosure

It is mandatory that you provide your Social Security Number on this tax form if you are an individual taxpayer. 42 U.S.C. 405(c)(2)(C)(i)

permits a state to use an individual's Social Security Number as means of identification in administration of any tax. SC Regulation

117-201 mandates that any person required to make a return to the SCDOR must provide identifying numbers, as prescribed, for

securing proper identification. Your Social Security Number is used for identification purposes.

The Family Privacy Protection Act

Under the Family Privacy Protection Act, the collection of personal information from citizens by the SCDOR is limited to the information

necessary for the SCDOR to fulfill its statutory duties. In most instances, once this information is collected by the SCDOR, it is protected

by law from public disclosure. In those situations where public disclosure is not prohibited, the Family Privacy Protection Act prevents

such information from being used by third parties for commercial solicitation purposes.

37361011