Enlarge image

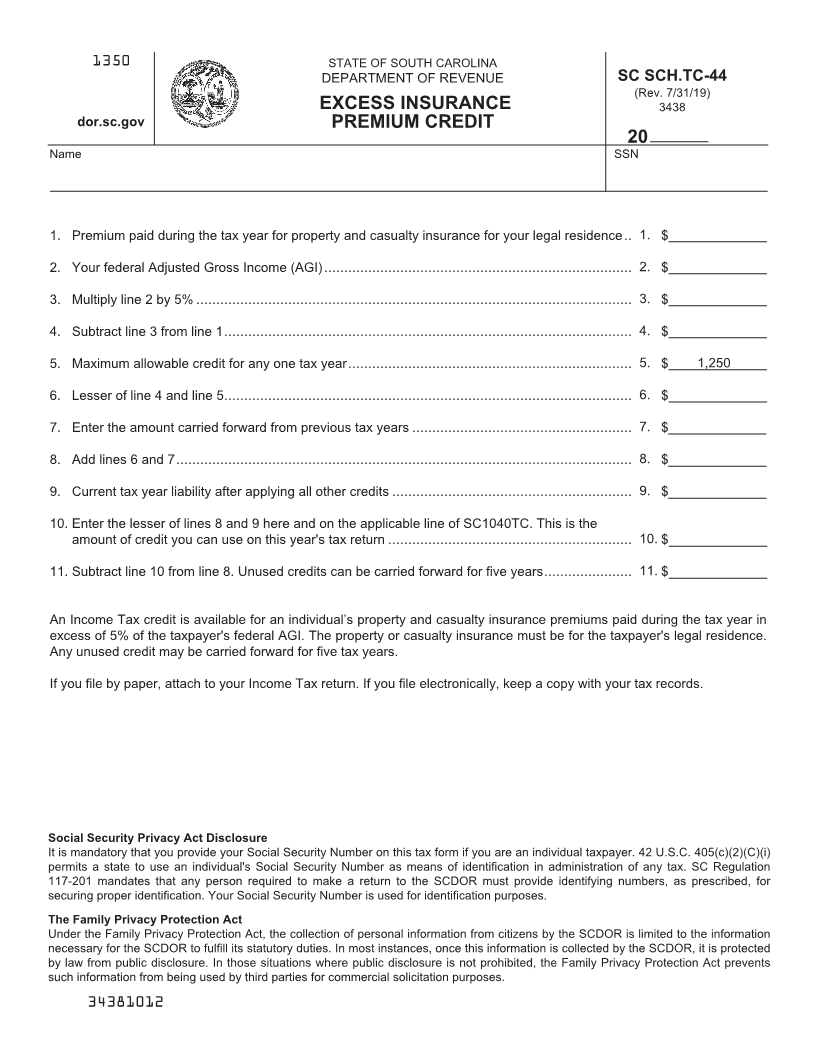

1350 STATE OF SOUTH CAROLINA

DEPARTMENT OF REVENUE SC SCH.TC-44

(Rev. 7/31/19)

EXCESS INSURANCE 3438

dor.sc.gov PREMIUM CREDIT

20

Name SSN

1. Premium paid during the tax year for property and casualty insurance for your legal residence.. 1. $

2. Your federal Adjusted Gross Income (AGI)............................................................................. 2. $

3. Multiply line 2 by 5% ............................................................................................................. 3. $

4. Subtract line 3 from line 1...................................................................................................... 4. $

5. Maximum allowable credit for any one tax year....................................................................... $5. 1,250

6. Lesser of line 4 and line 5...................................................................................................... 6. $

7. Enter the amount carried forward from previous tax years ....................................................... 7. $

8. Add lines 6 and 7.................................................................................................................. 8. $

9. Current tax year liability after applying all other credits ............................................................ 9. $

10. Enter the lesser of lines 8 and 9 here and on the applicable line of SC1040TC. This is the

amount of credit you can use on this year's tax return ............................................................. 10. $

11. Subtract line 10 from line 8. Unused credits can be carried forward for five years...................... 11. $

An Income Tax credit is available for an individual’s property and casualty insurance premiums paid during the tax year in

excess of 5% of the taxpayer's federal AGI. The property or casualty insurance must be for the taxpayer's legal residence.

Any unused credit may be carried forward for five tax years.

If you file by paper, attach to your Income Tax return. If you file electronically, keep a copy with your tax records.

Social Security Privacy Act Disclosure

It is mandatory that you provide your Social Security Number on this tax form if you are an individual taxpayer. 42 U.S.C. 405(c)(2)(C)(i)

permits a state to use an individual's Social Security Number as means of identification in administration of any tax. SC Regulation

117-201 mandates that any person required to make a return to the SCDOR must provide identifying numbers, as prescribed, for

securing proper identification. Your Social Security Number is used for identification purposes.

The Family Privacy Protection Act

Under the Family Privacy Protection Act, the collection of personal information from citizens by the SCDOR is limited to the information

necessary for the SCDOR to fulfill its statutory duties. In most instances, once this information is collected by the SCDOR, it is protected

by law from public disclosure. In those situations where public disclosure is not prohibited, the Family Privacy Protection Act prevents

such information from being used by third parties for commercial solicitation purposes.

34381012