Enlarge image

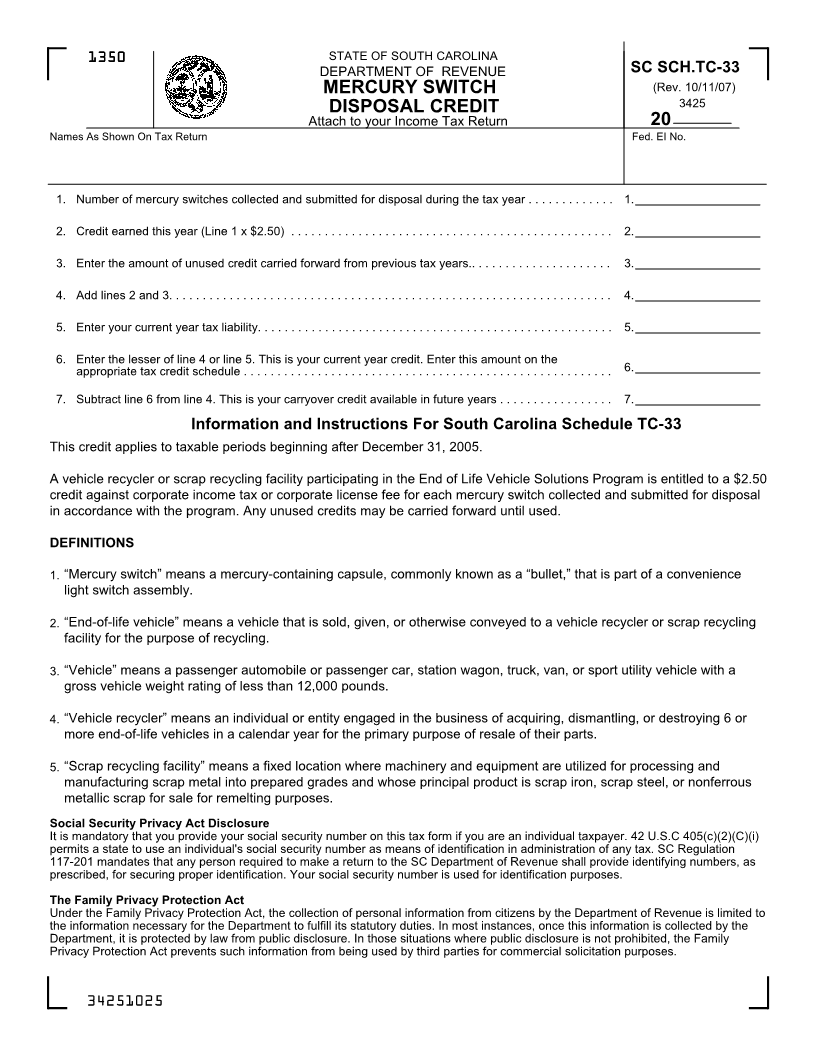

13501350 STATE OF SOUTH CAROLINA DEPARTMENT OF REVENUE SC SCH.TC-33 MERCURY SWITCH (Rev. 10/11/07) DISPOSAL CREDIT 3425 Attach to your Income Tax Return 20 Names As Shown On Tax Return Fed. EI No. DRAFT 1. Number of mercury switches collected and submitted for disposal during the tax year . . . . . . . . . . . . . 1. 8/1/07 2. Credit earned this year (Line 1 x $2.50) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2. 3. Enter the amount of unused credit carried forward from previous tax years.. . . . . . . . . . . . . . . . . . . . . 3. 4. Add lines 2 and 3. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4. 5. Enter your current year tax liability. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5. 6. Enter the lesser of line 4 or line 5. This is your current year credit. Enter this amount on the appropriate tax credit schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6. 7. Subtract line 6 from line 4. This is your carryover credit available in future years . . . . . . . . . . . . . . . . . 7. Information and Instructions For South Carolina Schedule TC-33 This credit applies to taxable periods beginning after December 31, 2005. A vehicle recycler or scrap recycling facility participating in the End of Life Vehicle Solutions Program is entitled to a $2.50 credit against corporate income tax or corporate license fee for each mercury switch collected and submitted for disposal in accordance with the program. Any unused credits may be carried forward until used. DEFINITIONS 1. “Mercury switch” means a mercury-containing capsule, commonly known as a “bullet,” that is part of a convenience light switch assembly. 2. “End-of-life vehicle” means a vehicle that is sold, given, or otherwise conveyed to a vehicle recycler or scrap recycling facility for the purpose of recycling. 3. “Vehicle” means a passenger automobile or passenger car, station wagon, truck, van, or sport utility vehicle with a gross vehicle weight rating of less than 12,000 pounds. 4. “Vehicle recycler” means an individual or entity engaged in the business of acquiring, dismantling, or destroying 6 or more end-of-life vehicles in a calendar year for the primary purpose of resale of their parts. 5. “Scrap recycling facility” means a fixed location where machinery and equipment are utilized for processing and manufacturing scrap metal into prepared grades and whose principal product is scrap iron, scrap steel, or nonferrous metallic scrap for sale for remelting purposes. Social Security Privacy Act Disclosure It is mandatory that you provide your social security number on this tax form if you are an individual taxpayer. 42 U.S.C 405(c)(2)(C)(i) permits a state to use an individual's social security number as means of identification in administration of any tax. SC Regulation 117-201 mandates that any person required to make a return to the SC Department of Revenue shall provide identifying numbers, as prescribed, for securing proper identification. Your social security number is used for identification purposes. The Family Privacy Protection Act Under the Family Privacy Protection Act, the collection of personal information from citizens by the Department of Revenue is limited to the information necessary for the Department to fulfill its statutory duties. In most instances, once this information is collected by the Department, it is protected by law from public disclosure. In those situations where public disclosure is not prohibited, the Family Privacy Protection Act prevents such information from being used by third parties for commercial solicitation purposes. 34251025