Enlarge image

Reset Form Print Form

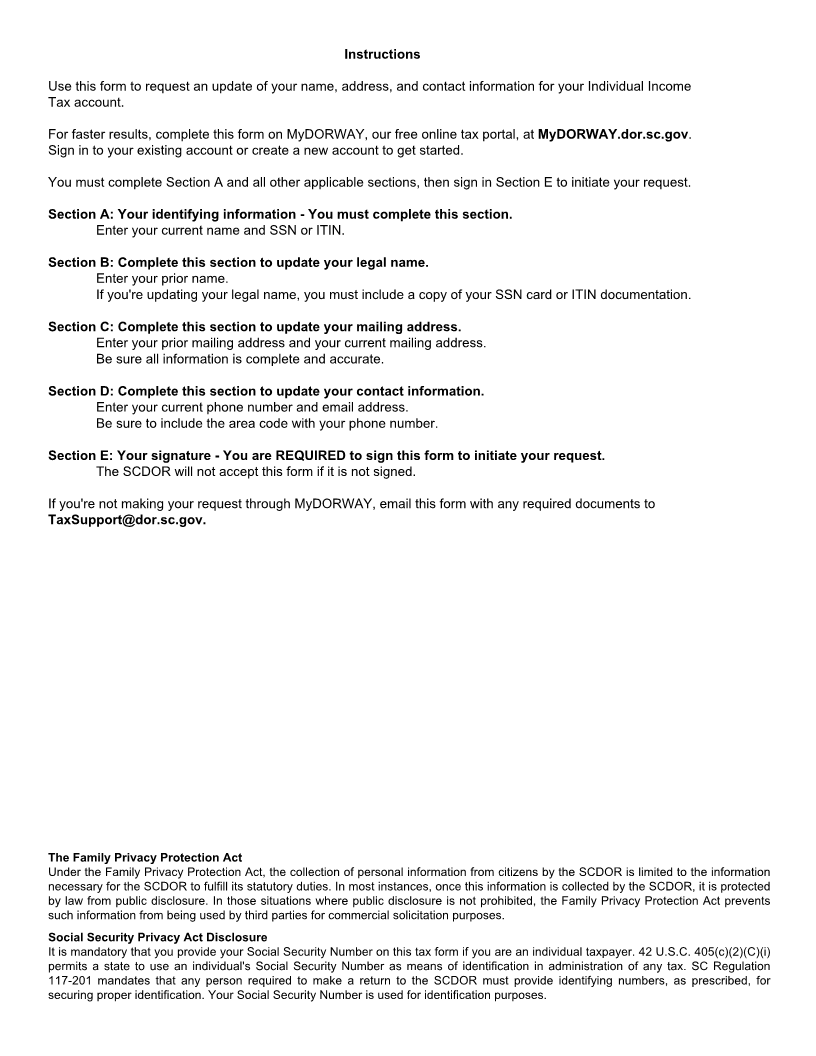

1350 STATE OF SOUTH CAROLINA

DEPARTMENT OF REVENUE

SC8822I

UPDATE NAME / ADDRESS / CONTACT INFORMATION (Rev. 7/27/22)

dor.sc.gov FOR INDIVIDUAL 3314

Save time and paper by completing this form on MyDORWAY, our free online tax portal! Go to MyDORWAY.dor.sc.gov

and sign in to your existing account or create a new account to get started.

Complete this form to notify the SCDOR of a change of name, address, and/or contact information for an Individual

Income Tax account.

The SCDOR will not accept this form unless you complete Section A and all other applicable sections, then sign in

Section E.

Section A: Your identifying information - You must complete this section.

Current name: SSN/ITIN:

Section B:Complete this section to update your legal name.

* If you are updating your legal name, you are REQUIRED to include a copy of your SSN card or ITIN documentation.

Prior name:

Section C:Complete this section to update your mailing address.

Prior mailing address

Street:

County: City: State: ZIP:

Current mailing address

Street:

County: City: State: ZIP:

Section D: Complete this section to update your contact information.

Current phone number (include area code):

Current email:

Section E: Your signature - You are REQUIRED to sign this form to initiate your request.

Signature: Date:

Email this form, with any required documents, to: TaxSupport@dor.sc.gov

33141037