Enlarge image

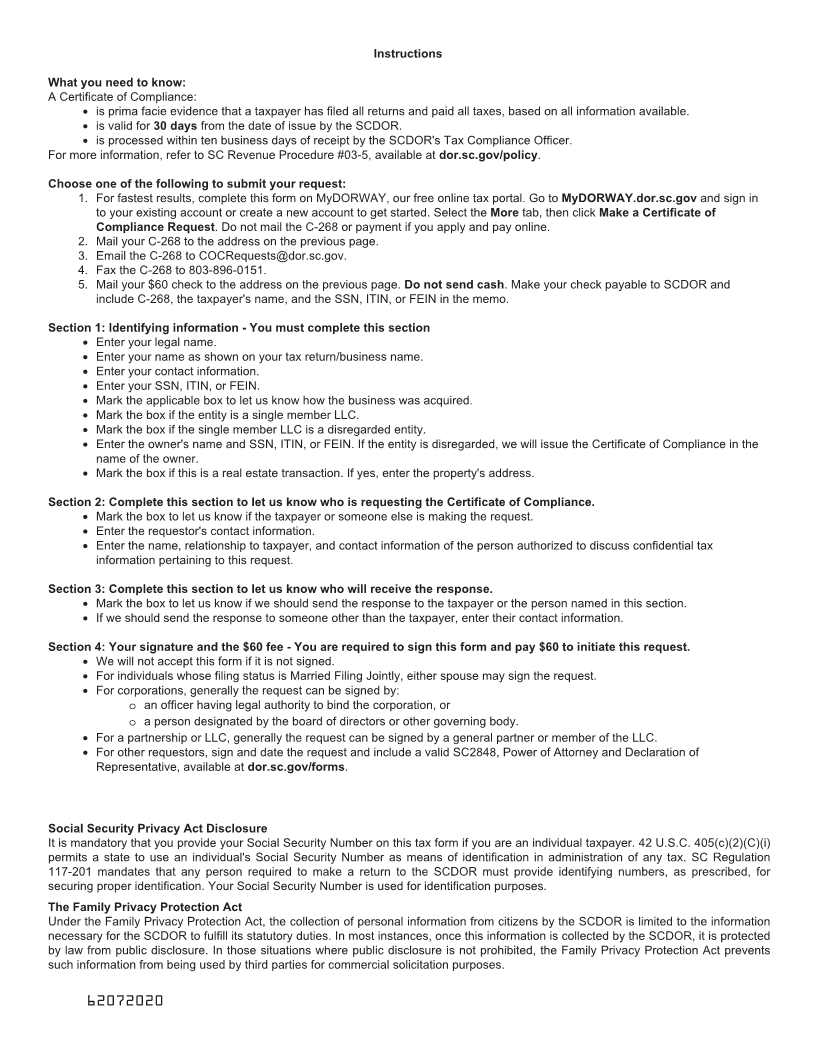

1350 STATE OF SOUTH CAROLINA

DEPARTMENT OF REVENUE

C-268

CERTIFICATE OF TAX COMPLIANCE (Rev. 7/7/22)

dor.sc.gov REQUEST FORM 6207

For fastest results, complete this form on MyDORWAY, our free online tax portal. Go to MyDORWAY.dor.sc.gov and sign in to your

existing account or create a new account to get started. Select the More tab, then click Make a Certificate of Compliance Request.

Section 1: Required identifying information

Legal name:

Name as shown on return/business name:

Mailing address:

City: State: ZIP: Phone:

SSN/ITIN/FEIN: State of incorporation:

How was business acquired? Purchase Started (Start Date): Merger (Date of Merger):

Is this entity a single member LLC? Yes No If yes, is it a disregarded entity? Yes No

Owner's name: SSN/ITIN/FEIN:

(To avoid processing delays, include the SSN, ITIN, or FEIN of the single member LLC.)

Is this a real estate transaction? Yes No If yes, list the property address:

Section 2: Requestor information

This request is made by: Taxpayer Other (explain):

Attach an SC2848, Power of Attorney and Declaration of Representative, if the taxpayer is not submitting this request.

Requestor's name:

Mailing address:

City: State: ZIP:

Phone: Fax:

Enter the contact information of the person authorized to discuss confidential tax information pertaining to this request.

Name: Relationship to the taxpayer:

Phone: Fax:

Section 3: Response destination

Send response to:

The taxpayer

The person named below, even if the taxpayer is not in compliance.

If we are sending the response to someone other than the taxpayer, enter their contact information below.

Name:

Mailing address:

City: State: ZIP:

Phone: Fax:

Section 4: Signature and nonrefundable $60.00 fee

Signature of taxpayer/power of attorney Title (if applicable)

Print name Date

Email

If requesting by paper, mail this form and a check for $60 to the address below. Do not send cash. Make your check payable to

SCDOR and include C-268 and the taxpayer's name and SSN, ITIN, or FEIN in the memo.

South Carolina Department of Revenue

Tax Compliance Office

300A Outlet Pointe Blvd.

Columbia, SC 29210

62071022