Enlarge image

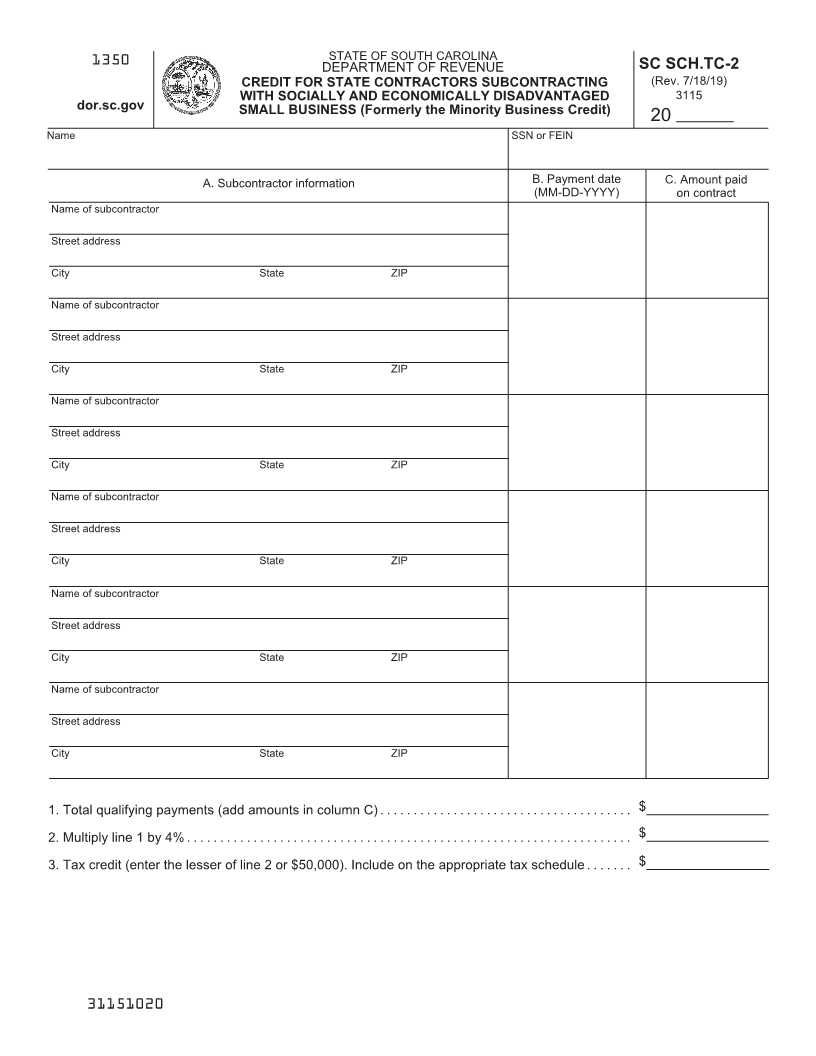

1350 STATE OF SOUTH CAROLINA SC SCH.TC-2

DEPARTMENT OF REVENUE

CREDIT FOR STATE CONTRACTORS SUBCONTRACTING (Rev. 7/18/19)

WITH SOCIALLY AND ECONOMICALLY DISADVANTAGED 3115

dor.sc.gov SMALL BUSINESS (Formerly the Minority Business Credit)

20

Name SSN or FEIN

A. Subcontractor information B. Payment date C. Amount paid

(MM-DD-YYYY) on contract

Name of subcontractor

Street address

City State ZIP

Name of subcontractor

Street address

City State ZIP

Name of subcontractor

Street address

City State ZIP

Name of subcontractor

Street address

City State ZIP

Name of subcontractor

Street address

City State ZIP

Name of subcontractor

Street address

City State ZIP

1. Total qualifying payments (add amounts in column C) ...................................... $

2. Multiply line 1 by 4% ............................................................... .... $

3. Tax credit (enter the lesser of line 2 or $50,000). Include on the appropriate tax schedule ....... $

31151020