Enlarge image

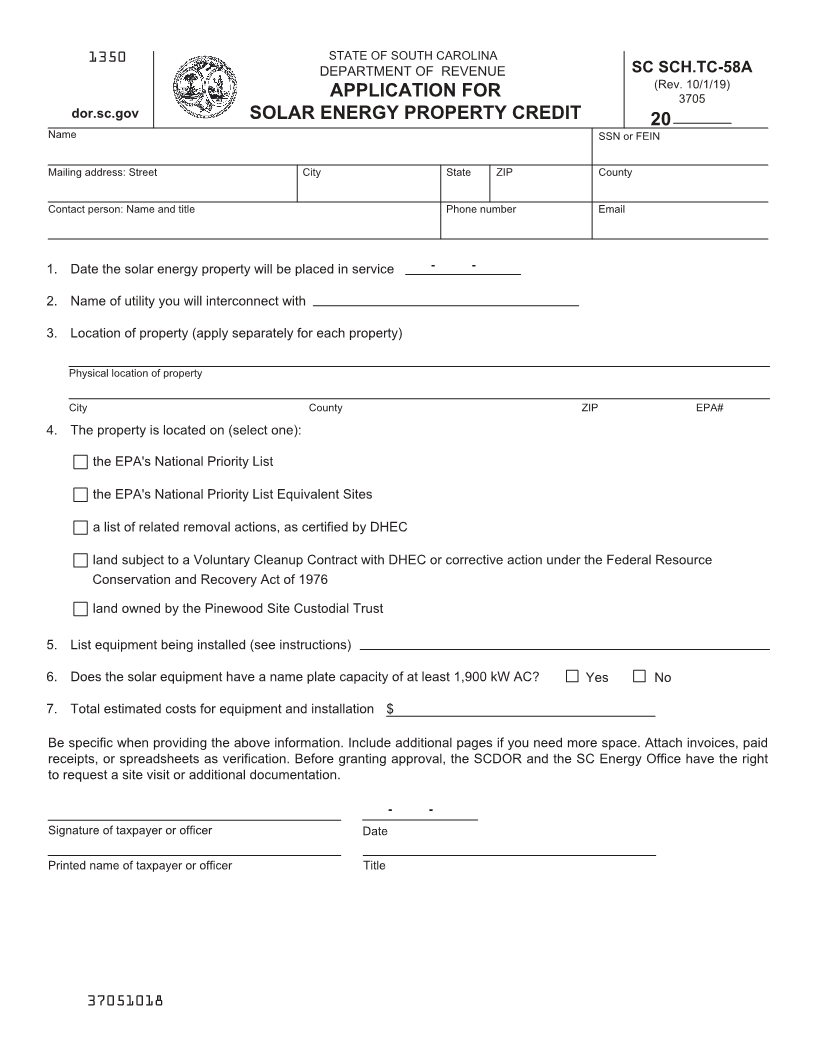

1350 STATE OF SOUTH CAROLINA

DEPARTMENT OF REVENUE SC SCH.TC-58A

(Rev. 10/1/19)

APPLICATION FOR 3705

dor.sc.gov SOLAR ENERGY PROPERTY CREDIT 20

Name SSN or FEIN

Mailing address: Street City State ZIP County

Contact person: Name and title Phone number Email

1. Date the solar energy property will be placed in service - -

2. Name of utility you will interconnect with

3. Location of property (apply separately for each property)

Physical location of property

City County ZIP EPA#

4. The property is located on (select one):

the EPA's National Priority List

the EPA's National Priority List Equivalent Sites

a list of related removal actions, as certified by DHEC

land subject to a Voluntary Cleanup Contract with DHEC or corrective action under the Federal Resource

Conservation and Recovery Act of 1976

land owned by the Pinewood Site Custodial Trust

5. List equipment being installed (see instructions)

6. Does the solar equipment have a name plate capacity of at least 1,900 kW AC? Yes No

7. Total estimated costs for equipment and installation $

Be specific when providing the above information. Include additional pages if you need more space. Attach invoices, paid

receipts, or spreadsheets as verification. Before granting approval, the SCDOR and the SC Energy Office have the right

to request a site visit or additional documentation.

- -

Signature of taxpayer or officer Date

Printed name of taxpayer or officer Title

37051018