Enlarge image

Print Form Reset Form

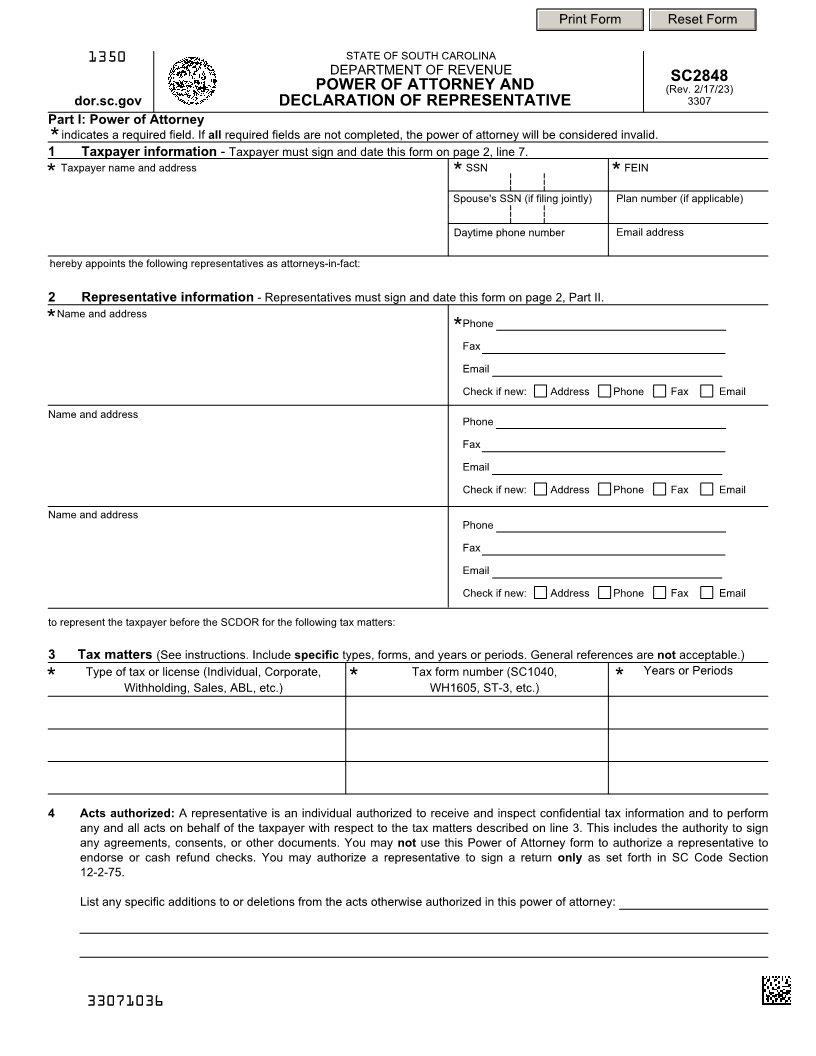

1350 STATE OF SOUTH CAROLINA

DEPARTMENT OF REVENUE

SC2848

POWER OF ATTORNEY AND (Rev. 2/17/23)

dor.sc.gov DECLARATION OF REPRESENTATIVE 3307

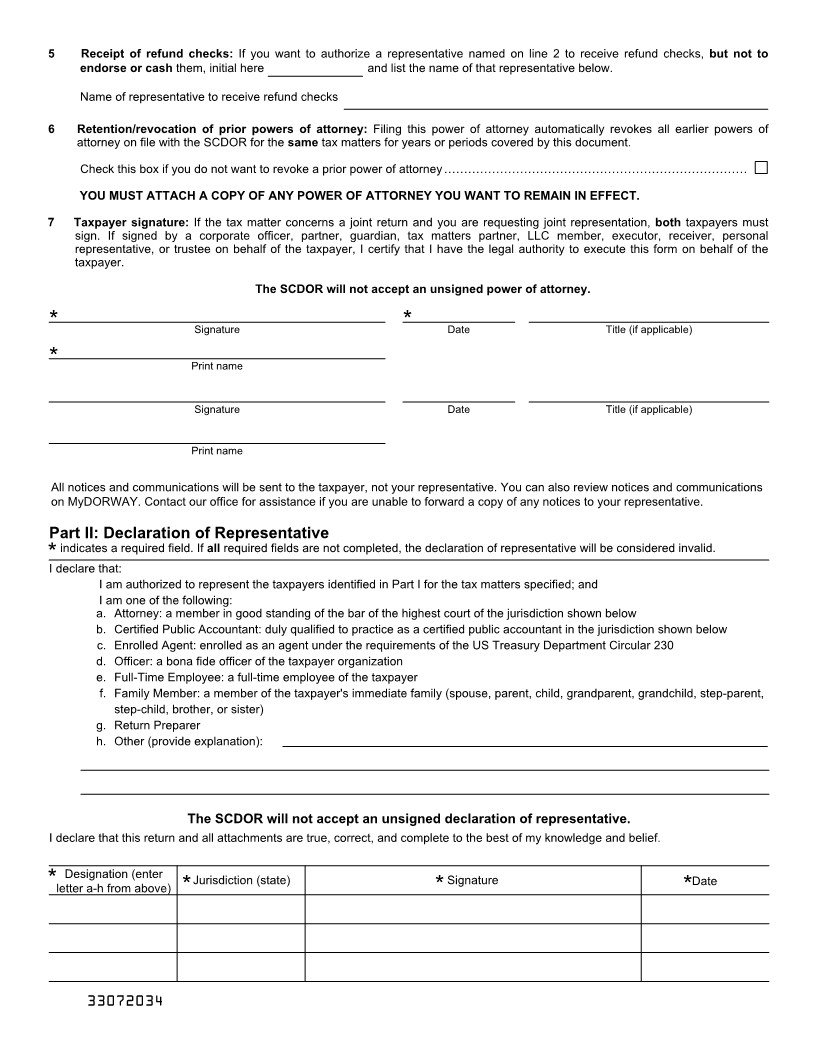

Part I: Power of Attorney

indicates a required field. If all required fields are not completed, the power of attorney will be considered invalid.

*

1 Taxpayer information - Taxpayer must sign and date this form on page 2, line 7.

Taxpayer name and address SSN FEIN

* * *

Spouse's SSN (if filing jointly) Plan number (if applicable)

Daytime phone number Email address

hereby appoints the following representatives as attorneys-in-fact:

2 Representative information - Representatives must sign and date this form on page 2, Part II.

Name and address

* Phone

*

Fax

Email

Check if new: Address Phone Fax Email

Name and address

Phone

Fax

Email

Check if new: Address Phone Fax Email

Name and address

Phone

Fax

Email

Check if new: Address Phone Fax Email

to represent the taxpayer before the SCDOR for the following tax matters:

3 Tax matters (See instructions. Include specific types, forms, and years or periods. General references are not acceptable.)

Type of tax or license (Individual, Corporate, Tax form number (SC1040, Years or Periods

* Withholding, Sales, ABL, etc.) * WH1605, ST-3, etc.) *

4 Acts authorized: A representative is an individual authorized to receive and inspect confidential tax information and to perform

any and all acts on behalf of the taxpayer with respect to the tax matters described on line 3. This includes the authority to sign

any agreements, consents, or other documents. You may not use this Power of Attorney form to authorize a representative to

endorse or cash refund checks. You may authorize a representative to sign a return only as set forth in SC Code Section

12-2-75.

List any specific additions to or deletions from the acts otherwise authorized in this power of attorney:

33071036