Enlarge image

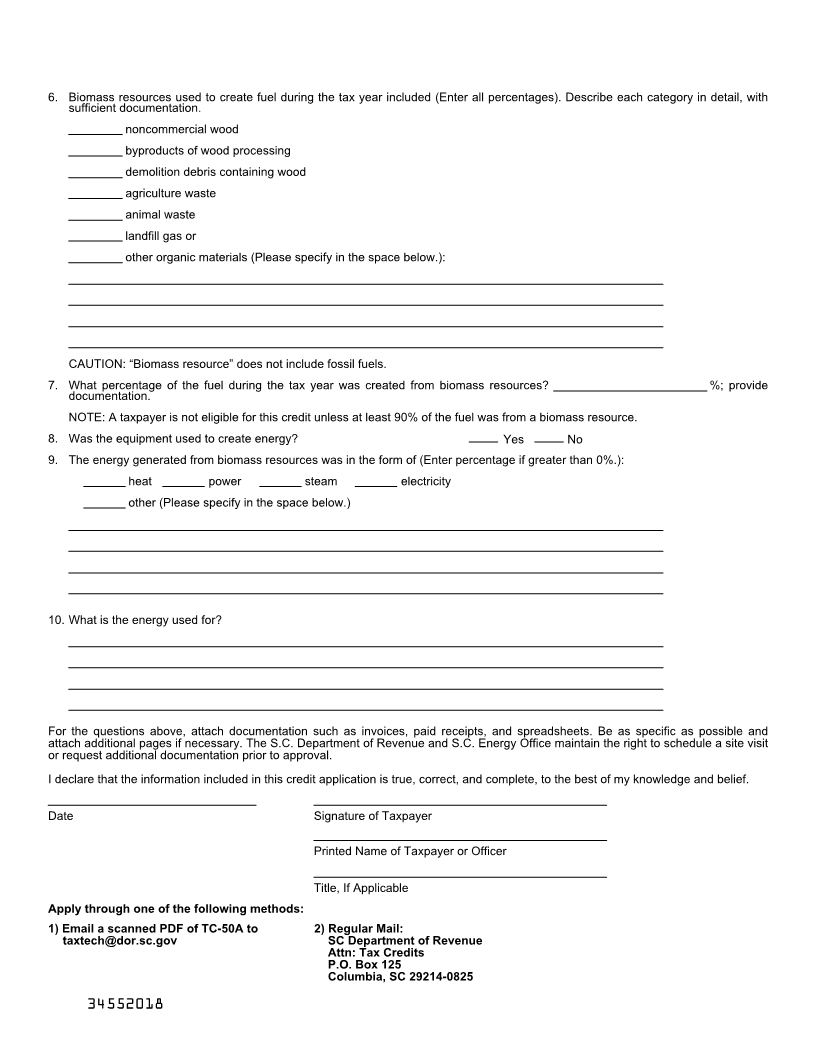

1350 STATE OF SOUTH CAROLINA

DEPARTMENT OF REVENUE SC SCH.TC-50A

(Rev. 2/28/18)

APPLICATION FOR 3455

dor.sc.gov BIOMASS RESOURCE CREDIT

20

Name(s) As Shown On Tax Return SSN or FEIN

Mailing Address Contact Person

Street

Contact Person's Title

City County State Zip

Telephone Number

Physical Address

Alternate Telephone Number

Street

City County State Zip Email

1. What is the date of completion for installation of equipment used to create energy from a fuel from one or more biomass

resources? Provide documentation.

2. Name of facility where equipment has been installed (Apply separately for each facility.)

Location of facility

City, if applicable County ZIP

3. Name of equipment manufacturer

Address of manufacturer

Expected life of equipment (in years)

Warranty period

Name and type of equipment

Cost of equipment $

Cost of shipping $

4. Other relevant costs $

TOTAL COSTS $

Name of company installing the equipment

Address of installer

Cost of labor and installation $

5. For electricity production, what is the capacity of the system (MW)?

How many kWh will be produced per year on average?

For thermal energy, what is the capacity of the system (therms)? How many therms will the system produce?

How many decatherms will the system produce per year on average?

For any equipment displacing conventionally generated electricity or thermal energy, how many units of energy is it displacing?

34551010