Enlarge image

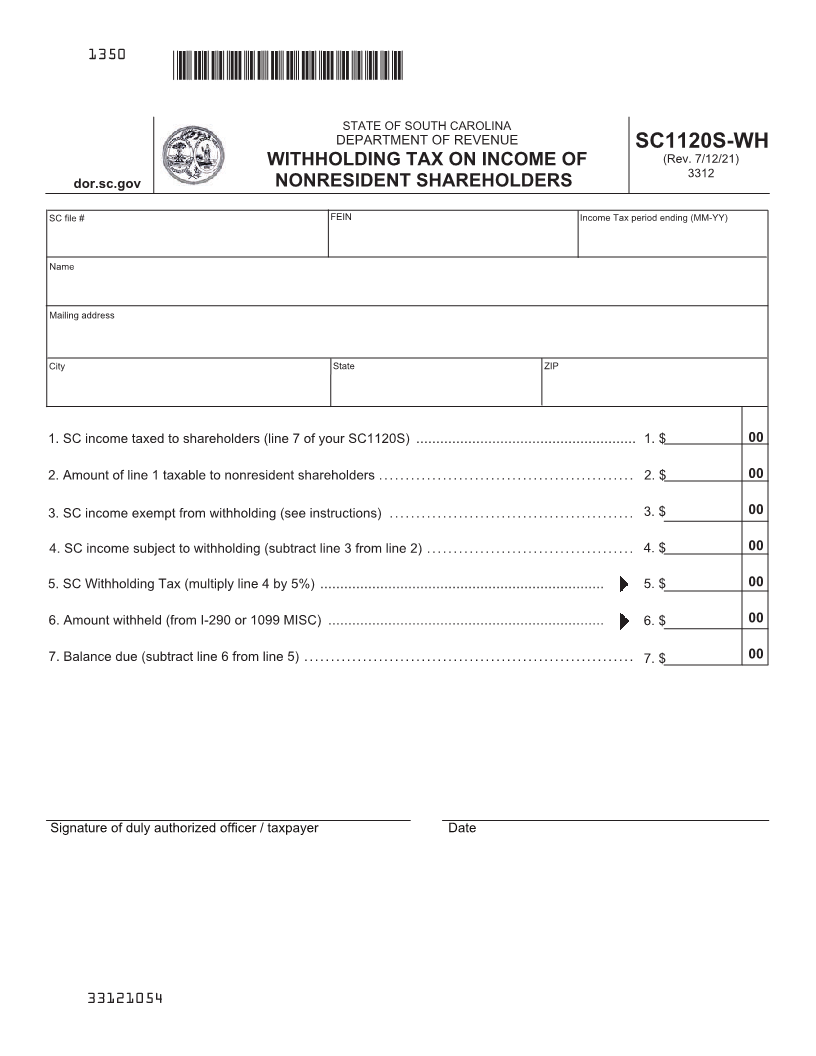

1350

STATE OF SOUTH CAROLINA

DEPARTMENT OF REVENUE SC1120S-WH

WITHHOLDING TAX ON INCOME OF (Rev. 7/12/21)

3312

dor.sc.gov NONRESIDENT SHAREHOLDERS

SC file # FEIN Income Tax period ending (MM-YY)

Name

Mailing address

City State ZIP

1. SC income taxed to shareholders (line 7 of your SC1120S) ....................................................... 1. $ 00

2. Amount of line 1 taxable to nonresident shareholders ................................................ 2. $ 00

3. SC income exempt from withholding (see instructions) .............................................. 3. $ 00

4. SC income subject to withholding (subtract line 3 from line 2) ....................................... 4. $ 00

5. SC Withholding Tax (multiply line 4 by 5%) ....................................................................... 5. $ 00

6. Amount withheld (from I-290 or 1099 MISC) ..................................................................... 6. $ 00

7. Balance due (subtract line 6 from line 5) .............................................................. 7. $ 00

Signature of duly authorized officer / taxpayer Date

33121054