Enlarge image

04 05 06 07 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82

03 03

04 1350 04

05 05

06 06

07 07

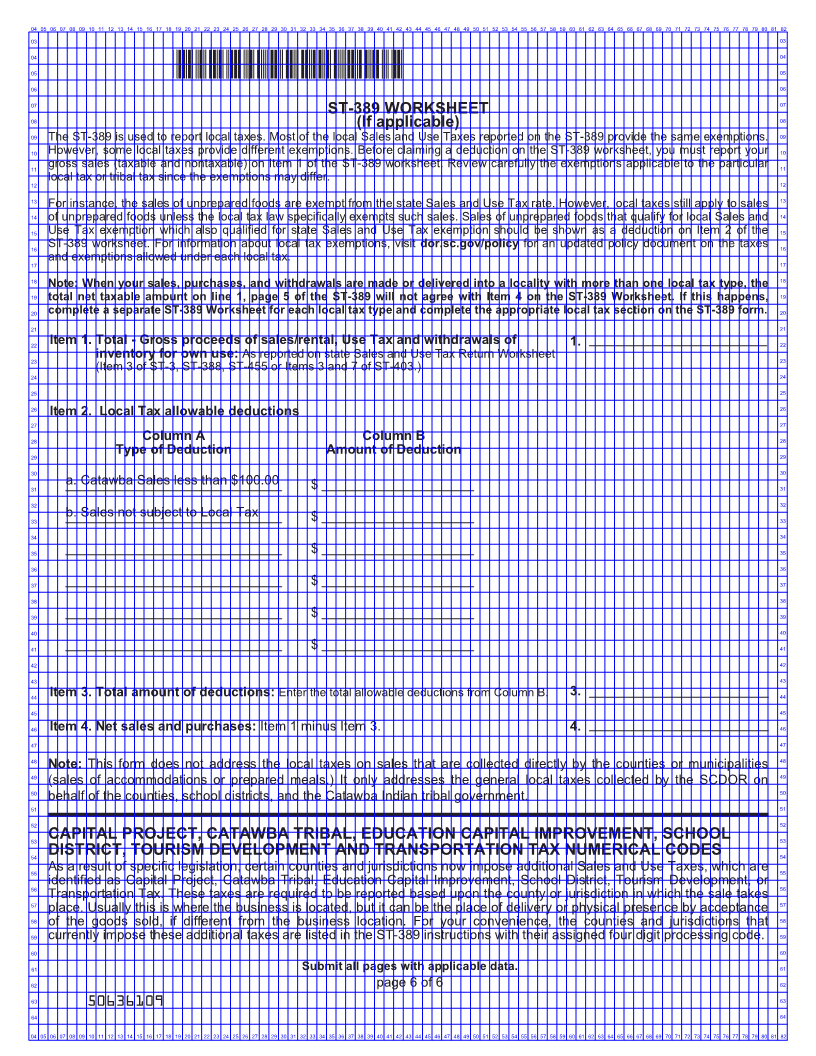

08 STATE OF SOUTH CAROLINA 08

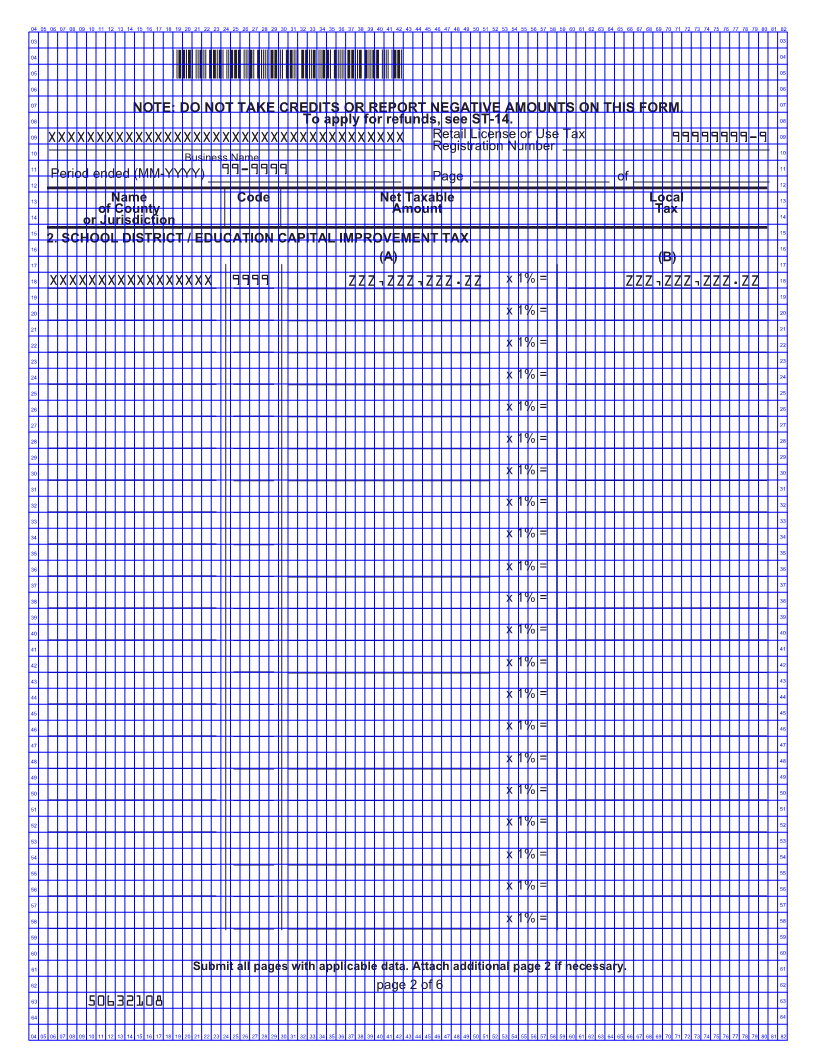

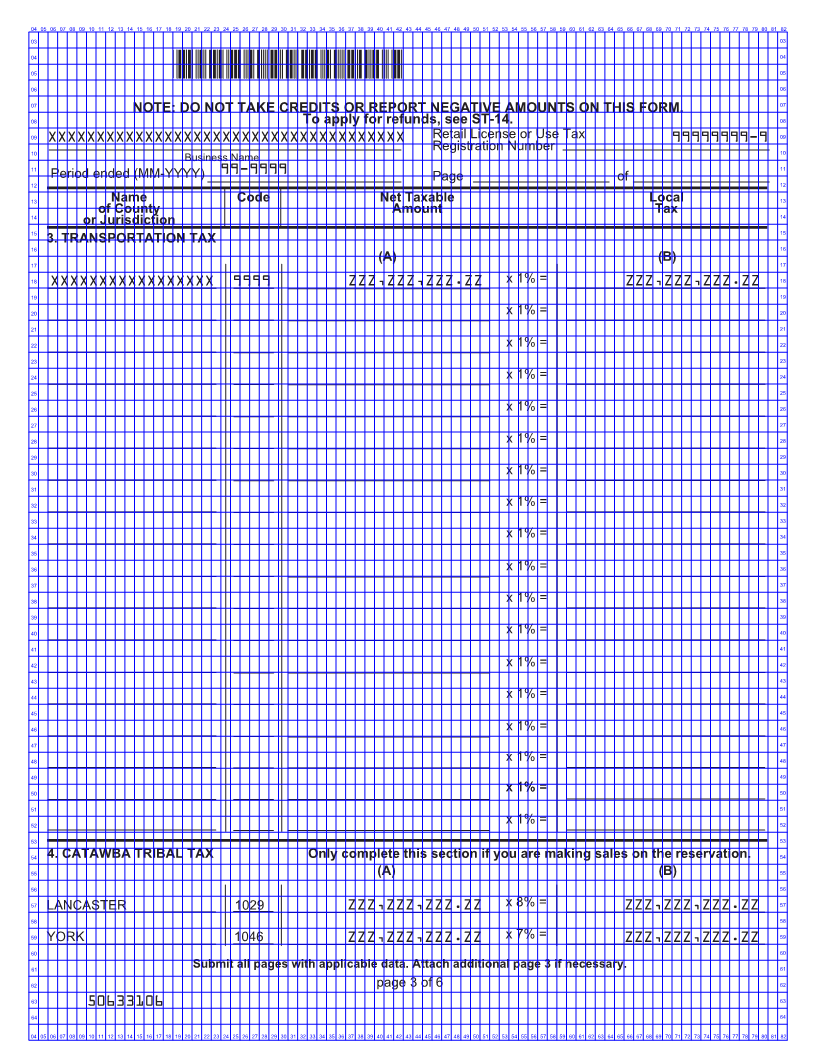

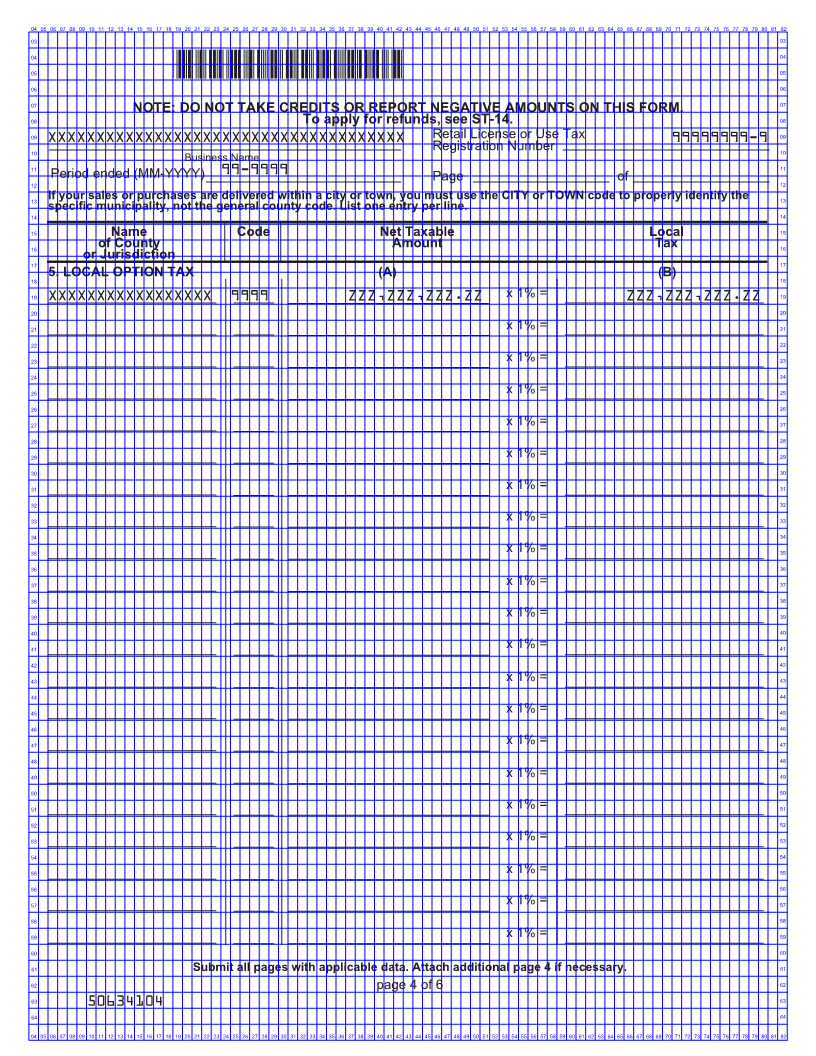

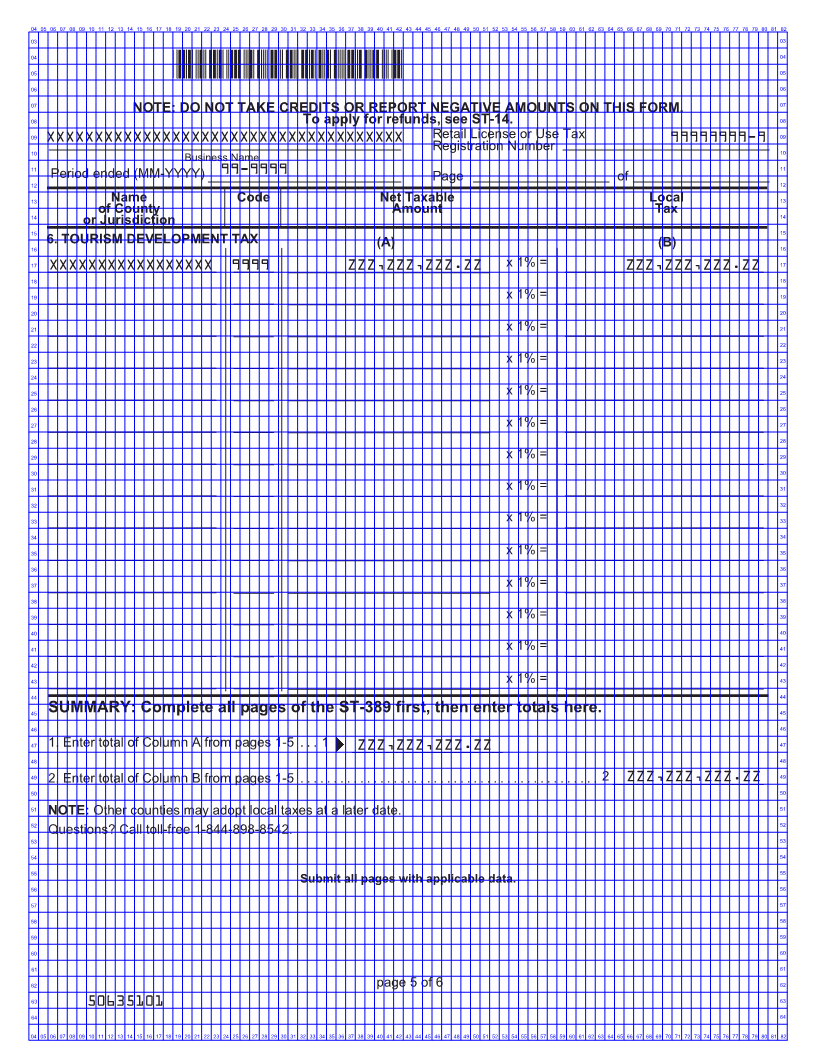

09 DEPARTMENT OF REVENUE ST-389 09

SCHEDULE FOR LOCAL TAXES (Rev. 6/19/19)

10 dor.sc.gov Attach to form ST-3, ST-388, ST-403, and ST-455 when filed. 5063 10

11 11

Retail License or Use Tax 12

12 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX Registration Number 99999999-9

13 Business Name 13

14 Period ended (MM-YYYY) 99-9999 Page of 14

15 NOTE: DO NOT TAKE CREDITS OR REPORT NEGATIVE AMOUNTS ON THIS FORM. 15

16 To apply for refunds, see ST-14. 16

17 Name Code Net Taxable Local 17

18 of County Amount Tax 18

or Jurisdiction

19 19

20 1.CAPITAL PROJECT TAX (A) (B) 20

21 XXXXXXXXXXXXXXX 9999 ZZZ,ZZZ,ZZZ.ZZ x 1% = ZZZ,ZZZ,ZZZ.ZZ 21

22 22

23 x 1% = 23

24 24

25 x 1% = 25

26 26

27 x 1% = 27

28 28

29 x 1% = 29

30 30

31 x 1% = 31

32 32

33 x 1% = 33

34 34

35 x 1% = 35

36 36

37 x 1% = 37

38 38

39 x 1% = 39

40 40

41 x 1% = 41

42 42

43 x 1% = 43

44 44

45 x 1% = 45

46 46

47 x 1% = 47

48 48

49 x 1% = 49

50 50

51 x 1% = 51

52 52

53 x 1% = 53

54 54

55 x 1% = 55

56 56

57 x 1% = 57

58 58

59 x 1% = 59

60 60

61 Submit all pages with applicable data. Attach additional page 1 if necessary. 61

62 page 1 of 6 62

63 50631100 63

64 64

04 05 06 07 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82