Enlarge image

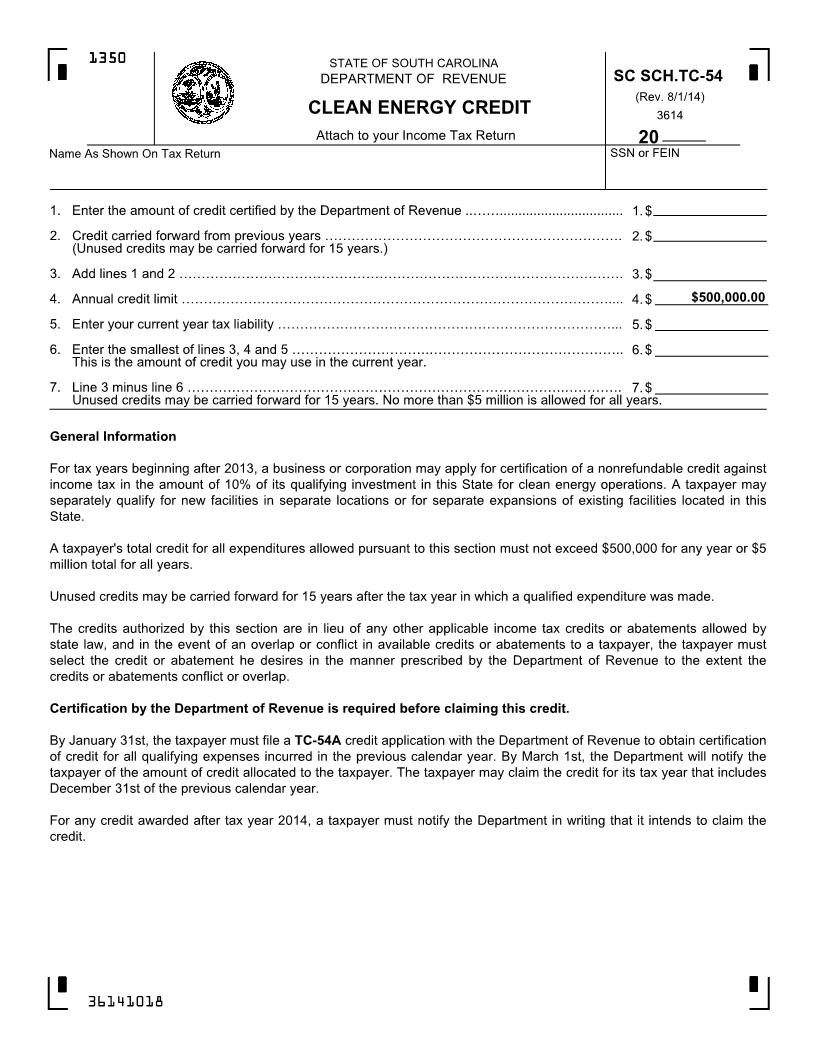

13501350 STATE OF SOUTH CAROLINA

DEPARTMENT OF REVENUE SC SCH.TC-54

(Rev. 8/1/14)

CLEAN ENERGY CREDIT 3614

Attach to your Income Tax Return 20

Name As Shown On Tax Return SSN or FEIN

1. Enter the amount of credit certified by the Department of Revenue ..……................................. 1.$

2. Credit carried forward from previous years …………………………………………………………. 2.$

(Unused credits may be carried forward for 15 years.)

3. Add lines 1 and 2 ………………………………………………………………………………………. 3.$

4. Annual credit limit …………………………………………………………………………………….... 4.$ $500,000.00

5. Enter your current year tax liability …………………………………………………………………... 5.$

6. Enter the smallest of lines 3, 4 and 5 ………………………….…………………………………….. 6.$

This is the amount of credit you may use in the current year.

7. Line 3 minus line 6 ………………………………………………………………………….…………. 7.$

Unused credits may be carried forward for 15 years. No more than $5 million is allowed for all years.

General Information

For tax years beginning after 2013, a business or corporation may apply for certification of a nonrefundable credit against

income tax in the amount of 10% of its qualifying investment in this State for clean energy operations. A taxpayer may

separately qualify for new facilities in separate locations or for separate expansions of existing facilities located in this

State.

A taxpayer's total credit for all expenditures allowed pursuant to this section must not exceed $500,000 for any year or $5

million total for all years.

Unused credits may be carried forward for 15 years after the tax year in which a qualified expenditure was made.

The credits authorized by this section are in lieu of any other applicable income tax credits or abatements allowed by

state law, and in the event of an overlap or conflict in available credits or abatements to a taxpayer, the taxpayer must

select the credit or abatement he desires in the manner prescribed by the Department of Revenue to the extent the

credits or abatements conflict or overlap.

Certification by the Department of Revenue is required before claiming this credit.

By January 31st, the taxpayer must file a TC-54A credit application with the Department of Revenue to obtain certification

of credit for all qualifying expenses incurred in the previous calendar year. By March 1st, the Department will notify the

taxpayer of the amount of credit allocated to the taxpayer. The taxpayer may claim the credit for its tax year that includes

December 31st of the previous calendar year.

For any credit awarded after tax year 2014, a taxpayer must notify the Department in writing that it intends to claim the

credit.

36141018