Enlarge image

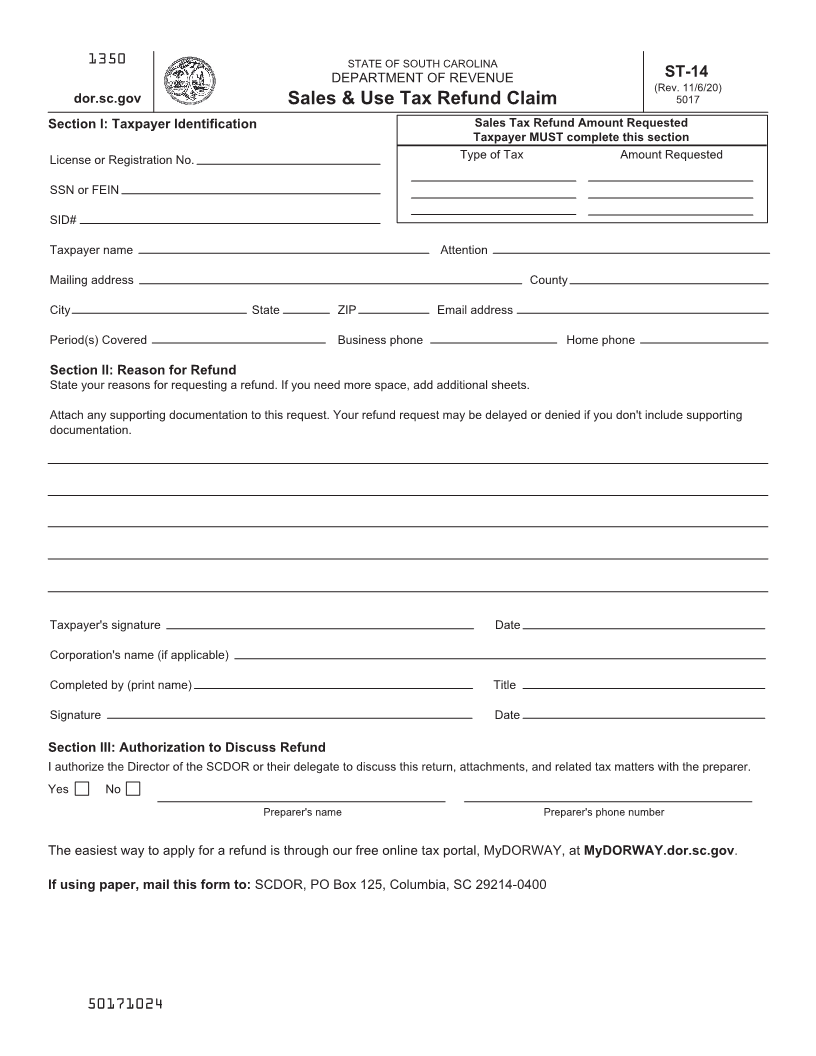

1350 STATE OF SOUTH CAROLINA

DEPARTMENT OF REVENUE ST-14

(Rev. 11/6/20)

dor.sc.gov Sales & Use Tax Refund Claim 5017

Section I: Taxpayer Identification Sales Tax Refund Amount Requested

Taxpayer MUST complete this section

License or Registration No. Type of Tax Amount Requested

SSN or FEIN

SID#

Taxpayer name Attention

Mailing address County

City State ZIP Email address

Period(s) Covered Business phone Home phone

Section II: Reason for Refund

State your reasons for requesting a refund. If you need more space, add additional sheets.

Attach any supporting documentation to this request. Your refund request may be delayed or denied if you don't include supporting

documentation.

Taxpayer's signature Date

Corporation's name (if applicable)

Completed by (print name) Title

Signature Date

Section III: Authorization to Discuss Refund

I authorize the Director of the SCDOR or their delegate to discuss this return, attachments, and related tax matters with the preparer.

Yes No

Preparer's name Preparer's phone number

The easiest way to apply for a refund is through our free online tax portal, MyDORWAY, at MyDORWAY.dor.sc.gov.

If using paper, mail this form to: SCDOR, PO Box 125, Columbia, SC 29214-0400

50171024