Enlarge image

SCDOR-111 Instructions Register online at MyDORWAY.dor.sc.gov/register South Carolina Department of Revenue | dor.sc.gov |August 2023

Enlarge image | SCDOR-111 Instructions Register online at MyDORWAY.dor.sc.gov/register South Carolina Department of Revenue | dor.sc.gov |August 2023 |

Enlarge image |

Contents

Entity Registration Information � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �1

Tax Types � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �1

Type of Ownership � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �2

Incorporation Information � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �3

Owner, Officer & Member Information � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �3

Business Addresses � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �3

Account Details � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �4

Account Details - Withholding � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �5

Nonresident Withholding Exemptions � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �7

Banking Information � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �7

Business Contact Information � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �7

Signatures, Titles & Dates � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �7

Additional Resources � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �8

ii SCDOR |SCDOR-111 Instructions Aug 2023

|

Enlarge image |

Entity Registration Information

Tax Types

Select the account types you're applying for. You must pay any applicable license fee before the SCDOR

processes your application and issues your license.

Sales & Use Tax

The Sales & Use Tax category contains several Sales & Use subtypes. Included in this category, for the

purpose of the SCDOR-111 application, are Accommodations, Artist & Craftsman, Aviation, Max Tax,

Retail, and Use Tax. See Section D, Box 9 for more details.

Withholding Tax

Withholding Tax is taken out of employees wages to go towards the employees' total yearly Income

Tax liability. Every employer/withholding agent that has an employee earning wages in South Carolina

(and who is required to file a return or deposit with the IRS) must file a Withholding Tax return with the

SCDOR for any taxes that have been withheld for state purposes. South Carolina requires withholding

from:

● wages

● prizes

● royalties

● winnings

● nonresident contractors (for contracts exceeding $10,000)

● rental payments made to nonresidents who own five or more residential units or one or more

commercial properties in South Carolina

● net proceeds going to nonresident sellers of real estate and associated tangible personal

property located in South Carolina

Wages are taxed in the state in which they are earned unless the employee is working in a state that

does not withhold state Income Tax. If the employee is working in South Carolina, regardless of where

they are a resident, the income earned in South Carolina is taxed by South Carolina. If a South Carolina

resident is earning wages in a state that does not have state Income Tax, the withholding should be for

South Carolina�

Nonresident Withholding Exemption

South Carolina requires employers to withhold Income Tax from certain payments made to

nonresidents. Nonresidents who have activity but no employees in South Carolina can be granted an

exemption from this requirement. Provide a completed I-312, Affidavit of Registration, to the employer

or withholding agent with whom you are contracting. Do not submit the I-312 to the SCDOR. The

SCDOR will forward you a letter of verification upon registration.

1 SCDOR |SCDOR-111 Instructions Aug 2023

|

Enlarge image |

Type of Ownership

Box 1

Select the appropriate option to indicate type of ownership. Corporations that conduct business in

South Carolina as well as LLCs or LLPs, must first register and pay with the Office of the Secretary of

State at least 30 days prior to submitting the SCDOR-111 application.

If your ownership type is LLC, indicate the filing method of Corporation, Partnership, or Single Member

disregarded entity. This filing method must be approved by the IRS. Once IRS election has been granted,

forward that information to the SCDOR. If the LLC is a disregarded entity, indicate Single Member in Box

1 and provide single member information in Section B.

Corporation

A corporation is a business formed and authorized by law to act as a single taxpayer, although

constituted by one or more persons, and is legally endowed with rights and responsibilities. The SCDOR

advises you to consult a lawyer when organizing a corporation to assure full compliance with state and

federal laws.

Limited Liability Company (LLC)

A limited liability company is an unincorporated business association that provides its owners

(members) limited liability and flexible management and financial alternatives. An LLC provides the

limited personal liability of corporations. An LLC can elect to be taxed as a corporation. A multiple-

member LLC not taxed as a corporation is taxed as a partnership.

● Note on Single Member LLCs: A Single Member LLC that does not elect to be taxed as a

corporation for federal Income Tax purposes is said to be "disregarded" for state tax purposes,

in the sense that it is not considered to be an entity separate from its owner. The revenue,

expense, income, assets, liabilities, and equity of the disregarded entity will flow up to the owner

from the corporation as if it were a division of the owner. Therefore, a Single Member who is a

corporation reports income from the Single Member LLC as income from one of its divisions. For

an individual member, income from a Single Member LLC is most likely Schedule C income.

Partnership

A partnership is a legal entity that is jointly owned by two or more entities. As in the sole proprietorship,

the owners are personally responsible for all debts of the business, even those in excess of the amount

invested in the business.

Sole proprietorship

A sole proprietorship is a business owned by an individual who is solely responsible for all aspects of

the business. The owner is personally responsible for all debts of the business, even in the excess of the

amount invested in the business.

2 SCDOR |SCDOR-111 Instructions Aug 2023

|

Enlarge image |

Incorporation Information

Box 2

Enter the FEIN or SSN to be utilized for registration.

● FEIN - Apply for an FEIN using Form SS-4, available at irs.gov.

● SSN - When applying as a Sole Proprietorship, enter your Social Security Number. See the Social

Security Privacy Act on the SCDOR-111 for more information. Sole Proprietors registering for

Withholding are required to obtain an FEIN.

Box 3

Enter your business's legal name and any applicable "Doing Business As" (DBA) name.

Box 4

Indicate the status of your CL-1 (Initial Report of Corporations) fee. This is only applicable to corporation

tax status�

Box 5

Enter the entity's state and date of incorporation.

Owner, Officer & Member Information

Enter the following information

● SSN

● printed name

● title

● phone number

● home address

● percentage of ownership for all owners, partners, officers, and members.

Do not include limited partners.

Business Addresses

Mailing

Enter the complete mailing address for the business.

Location and Physical Address

Enter the complete physical location of the business, including any suite or unit letters or numbers. This

address cannot be a PO Box or any other mail service center address. If your business is located in a

municipality, you're required to enter its municipality.

3 SCDOR |SCDOR-111 Instructions Aug 2023

|

Enlarge image |

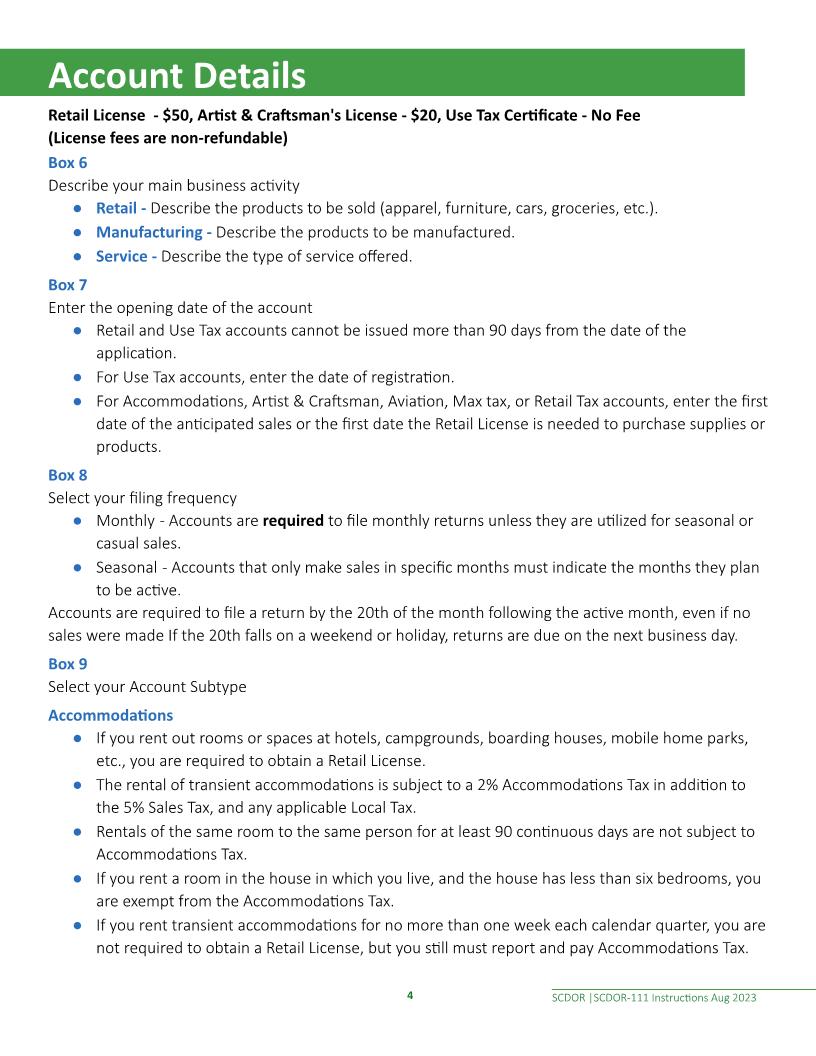

Account Details

Retail License - $50, Artist & Craftsman's License - $20, Use Tax Certificate - No Fee

(License fees are non-refundable)

Box 6

Describe your main business activity

● Retail - Describe the products to be sold (apparel, furniture, cars, groceries, etc.).

● Manufacturing - Describe the products to be manufactured.

● Service - Describe the type of service offered.

Box 7

Enter the opening date of the account

● Retail and Use Tax accounts cannot be issued more than 90 days from the date of the

application.

● For Use Tax accounts, enter the date of registration.

● For Accommodations, Artist & Craftsman, Aviation, Max tax, or Retail Tax accounts, enter the first

date of the anticipated sales or the first date the Retail License is needed to purchase supplies or

products.

Box 8

Select your filing frequency

● Monthly - Accounts are required to file monthly returns unless they are utilized for seasonal or

casual sales.

● Seasonal - Accounts that only make sales in specific months must indicate the months they plan

to be active.

Accounts are required to file a return by the 20th of the month following the active month, even if no

sales were made If the 20th falls on a weekend or holiday, returns are due on the next business day.

Box 9

Select your Account Subtype

Accommodations

● If you rent out rooms or spaces at hotels, campgrounds, boarding houses, mobile home parks,

etc., you are required to obtain a Retail License.

● The rental of transient accommodations is subject to a 2% Accommodations Tax in addition to

the 5% Sales Tax, and any applicable Local Tax.

● Rentals of the same room to the same person for at least 90 continuous days are not subject to

Accommodations Tax.

● If you rent a room in the house in which you live, and the house has less than six bedrooms, you

are exempt from the Accommodations Tax.

● If you rent transient accommodations for no more than one week each calendar quarter, you are

not required to obtain a Retail License, but you still must report and pay Accommodations Tax.

4 SCDOR |SCDOR-111 Instructions Aug 2023

|

Enlarge image |

Artist & Craftsman

● Artist and crafters sell products that they have created or assembled at arts and crafts show and

festivals in South Carolina. They may obtain a permanent Retail License from the SCDOR for $50,

instead of an Artist and Craftsman License.

● Artists and crafters must charge and collect the 6% statewide Sales & Use Tax along with any

applicable Local Tax. Generally, all retail sales are subject to Sales Tax.

Aviation Tax

Sales & Use Tax is imposed on aviation gasoline sold for use in airplanes.

Max Tax

This is due on boats, airplanes, self-propelled light construction equipment with compatible

attachments limited to a maximum of 160 net engine horsepower, and other items not subject to the

Infrastructure Maintenance Fee.

Retail

Sales Tax is imposed on the sales at retail of tangible personal property and certain services.

Use Tax

Use Tax is imposed on the storage, use, or consumption of tangible personal property on which South

Carolina Tax has not been previously paid.

Box 10

Select the appropriate option to indicate if your business sells tobacco products. Visit dor.sc.gov/policy

for additional information regarding tobacco products.

Box 11

Select the appropriate North American Industry Classification System (NAICS) Code to indicate your

type of business. Find more information about NAICS codes on NAICS.com/search

Box 12

Select the appropriate options to indicate which of these items will be sold, or if the entity is providing

a service to wireless users in South Carolina.

Box 13

Select the appropriate option to indicate how and where the sales will be made.

Account Details - Withholding

Box 14

Enter the anticipated date of first payroll. This date will be used as the open date of the Withholding

account. The quarter where this anticipated date falls will be the first quarter that a Withholding Tax

return is due. If payroll occurs in a later quarter, a quarterly Withholding return must still be filed for the

quarter containing the open date.

5 SCDOR |SCDOR-111 Instructions Aug 2023

|

Enlarge image |

A closed Withholding account can only be reopened if done so in the same calendar year it was closed.

To reopen, enter REOPEN and the reopen date. Then enter the closed account's file number in Box 15.

Box 15

Sole Proprietors registering for Withholding Tax are required to obtain an FEIN.

Box 16

Select the residency status of the employer or Withholding agent. Residency status determines when

Withholding payments are remitted to South Carolina.

● Resident Business - The principal place of business is inside South Carolina. Resident employers

or Withholding agents are required to pay Withholding Tax at the same time that federal

payments are due.

● Nonresident Business - The principal place of business is outside South Carolina. Nonresident

employers or Withholding agents are required to pay either quarterly or monthly. If the South

Carolina state tax liability is less than $500 for the quarter, the payment is due by the last day

of the month following the end of the quarter. If the liability reaches $500 or more during the

quarter, the payment is due by the 15th of the following month.

Box 17

Select the appropriate filing frequency for Withholding Tax returns. Employers or Withholding agents

are considered quarterly return filers unless all of their employees are household employees, farmers,

fishermen, ministers, or performed other services listed in SC Code Section 12-8-520 (D).

See Form 105, SC Withholding Tax Information Guide, available at dor.sc.gov/forms, for information

about Withholding payment frequencies. Returns are required for every active period that the

Withholding account is open even when there are no withholding or employees.

● Quarterly - file returns for every quarter.

1st quarter January, February, and March WH-1605 Due April 30

2nd quarter April, May, and June WH-1605 Due July 31

3rd quarter July, August, and September WH-1605 Due October 31

4th quarter October, November, and December WH-1606 Due January 31

● Annual - file return for each calendar year

■ January through December WH-1606 Due January 31

6 SCDOR |SCDOR-111 Instructions Aug 2023

|

Enlarge image |

Nonresident Withholding Exemptions

Provide the nature of your business and select the appropriate option.

Banking Information

Box 18

Provide the name, phone number (including area code), and email address of the financial institution

with whom you are conducting business.

Business Contact Information

You must submit a completed and signed SC2848, Power of Attorney and Declaration of Representative

along with your application.

Box 19

Provide the name, phone number (including area code), and email address of the contact person for

your business.

Signatures, Titles & Dates

The application must be signed by all owners, partners, and corporate officers. The SCDOR will reject

the application if you omit any required information, including signatures.

Additional documentation that may be included with your application

● Articles of Organization

● IRS letter confirming FEIN assignment

The fastest, easiest way to complete this registration is using our free online tax portal, MyDORWAY at

dor.sc.gov/register.

If you register by paper, mail your completed SCDOR-111 along with any applicable license payment

(payable to SCDOR) to: SCDOR, PO Box 125, Columbia, SC 29214-0850.

Reasons your application could be rejected or delayed:

● License fee is not submitted with application.

● Location address, main business type, account commence date, date of first payroll, or signature

omitted.

● The physical address of your business is in South Carolina and the ownership type of the LLC/LLP

or Corporation is not registered with the South Carolina Secretary of State.

7 SCDOR |SCDOR-111 Instructions Aug 2023

|

Enlarge image |

For more information on

● Starting and running a new business in South Carolina, visit MyDORWAY, including tutorials, visit

dor.sc.gov/MyDORWAY

● Filing and paying business taxes, visit dor.sc.gov/biz-services

● Tax seminars & workshops, visit dor.sc.gov/ted

Questions? We're here to help. Contact us at RegistrationForTaxes@dor.sc.gov or 1-844-898-8542�

Additional Resources

● Register your business with the South Carolina Secretary of State's office at sos.sc.gov

● Learn more about federal tax laws on the Internal Revenue website at irs.gov

● Find more business information at South Carolina Business One Stop at scbos.sc.gov

8 SCDOR |SCDOR-111 Instructions Aug 2023

|