Enlarge image

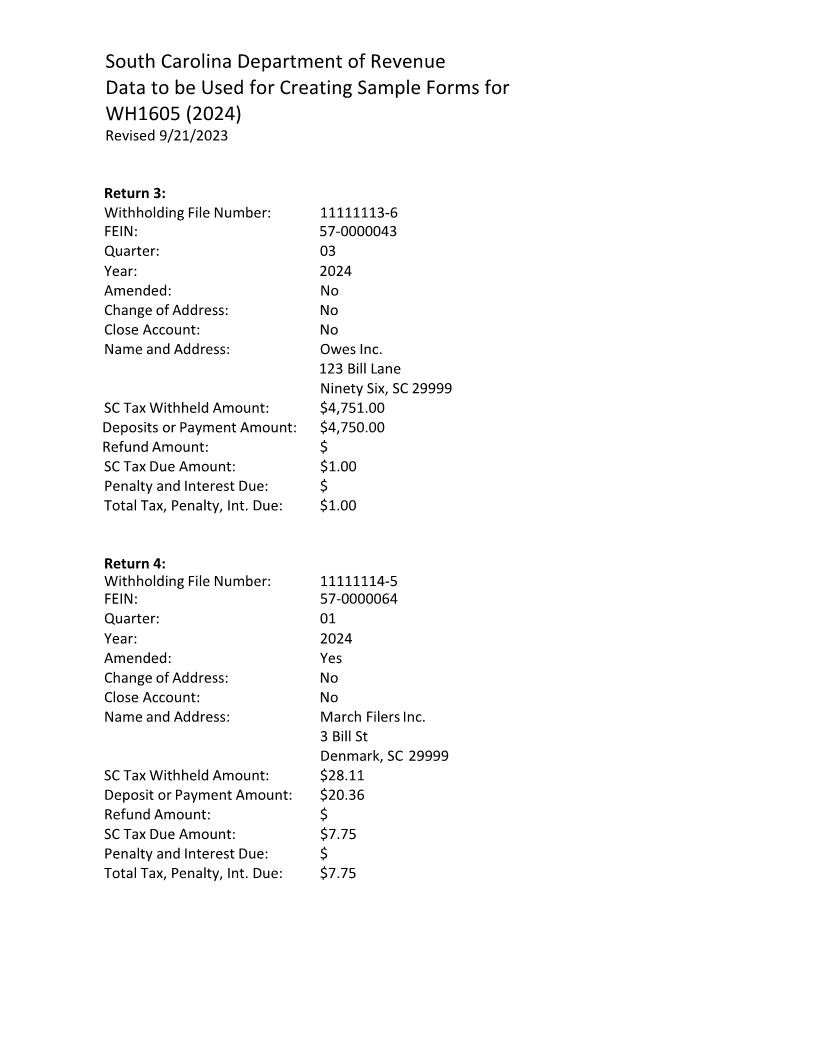

South Carolina Department of Revenue Data to be Used for Creating Sample Forms for WH1605 (2024) Revised 9/21/2023 You must submit 1 form for each example, for a total of five test cases. Submissions will not be approved if the correct number of test cases is not provided and/or if South Carolina test cases are not used. Return 1: Withholding File Number: 11531111-8 FEIN: 57-0000057 Quarter: 01 Year: 2024 Amended: No Change of Address: No Close Account: No Name and Address: Withholding Returns Inc. 123 Time to File Barnwell, SC 29999 SC Tax Withheld Amount: $46,418.97 Deposits or Payment Amount: $42,896.59 Refund Amount: $ SC Tax Due Amount: $3,522.38 Penalty and Interest Due: $53.00 Total Tax, Penalty, Int. Due: $3,575.38 Return 2: Withholding File Number: 11241112-7 FEIN: 57-0000042 Quarter: 02 Year: 2024 Amended: No Change of Address: No Close Account: Yes Name and Address: Bill It Now, Inc John and Sally Withholds 1234 Time to Pay Pelzer, SC 29999 SC Tax Withheld Amount: $8,726.49 Deposits or Payment Amount: $8,700.00 Refund Amount: $ SC Tax Due Amount: $26.49 Penalty and Interest Due: $ Total Tax, Penalty, Int. Due: $26.49