Enlarge image

1350 STATE OF SOUTH CAROLINA

DEPARTMENT OF REVENUE SC SCH.TC-1

(Rev. 7/17/19)

DRIP/TRICKLE IRRIGATION 3114

dor.sc.gov

SYSTEMS CREDIT 20

Name SSN or FEIN

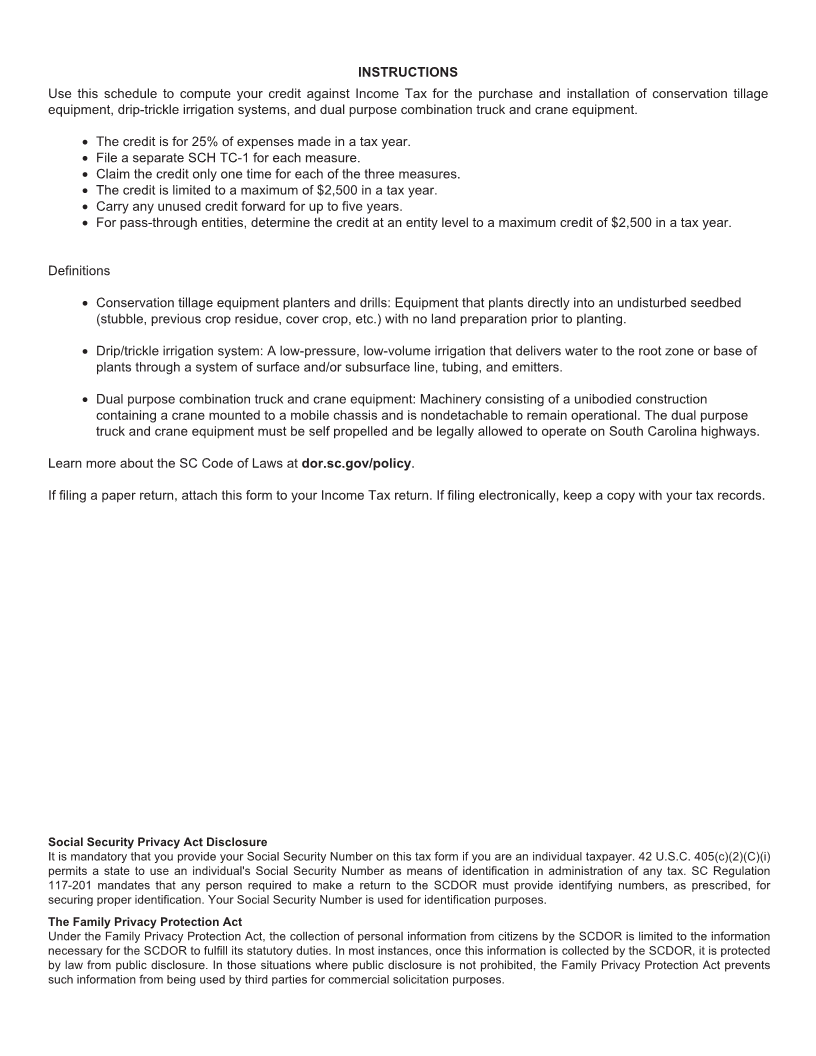

List the items, purchase prices, and installation costs of your conservation tillage equipment, drip/trickle irrigation systems,

and dual purpose combination truck and crane equipment.

1 Conservation tillage equipment *

2 Drip/trickle irrigation systems (including but not limited to) *

a Dams .......................................................................

b Pipe.........................................................................

c Pumps ......................................................................

d Wells ........................................................................

e Other items (list here)

3 Dual purpose combination truck and crane equipment *

4 Enter amount from lines 1, 2, or 3. File a separate TC-1 for each measure ...............

5 Enter 25% of line 4 ...............................................................

6 Maximum credit allowed ........................................................... $2,500

7 Lesser of lines 5 or 6 ..............................................................

8 Enter the amount carried forward from previous years .................................

9 Add lines 7 and 8 .................................................................

10 Enter your current tax year liability ..................................................

11 Enter the smaller of lines 9 or 10. This is the amount of credit you can use this year .......

12 Subtract line 11 from line 9. Unused credit can be carried forward for five years ..........

* This credit may be claimed only one time for each of the three measures.

31141021