Enlarge image

Reset Form Print Form

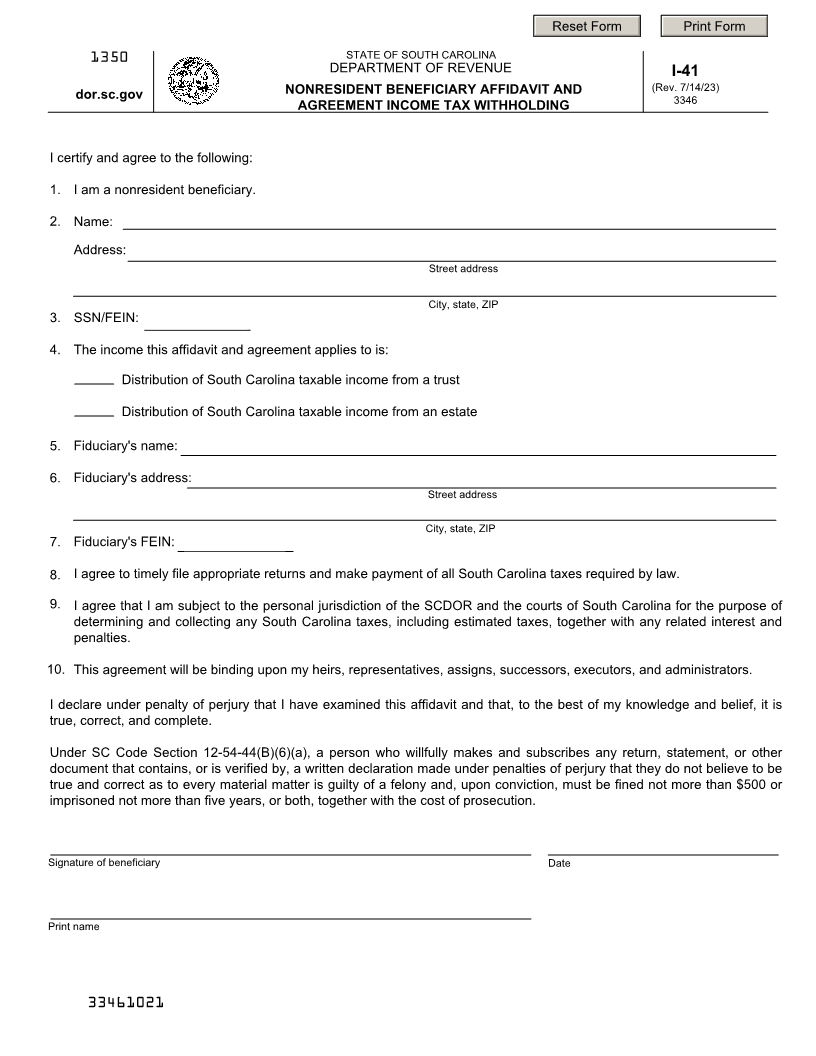

1350 STATE OF SOUTH CAROLINA

DEPARTMENT OF REVENUE I-41

NONRESIDENT BENEFICIARY AFFIDAVIT AND (Rev. 7/14/23)

dor.sc.gov 3346

AGREEMENT INCOME TAX WITHHOLDING

I certify and agree to the following:

1. I am a nonresident beneficiary.

2. Name:

Address:

Street address

City, state, ZIP

3. SSN/FEIN:

4. The income this affidavit and agreement applies to is:

Distribution of South Carolina taxable income from a trust

Distribution of South Carolina taxable income from an estate

5. Fiduciary's name:

6. Fiduciary's address:

Street address

City, state, ZIP

7. Fiduciary's FEIN:

8. I agree to timely file appropriate returns and make payment of all South Carolina taxes required by law.

9. I agree that I am subject to the personal jurisdiction of the SCDOR and the courts of South Carolina for the purpose of

determining and collecting any South Carolina taxes, including estimated taxes, together with any related interest and

penalties.

10. This agreement will be binding upon my heirs, representatives, assigns, successors, executors, and administrators.

I declare under penalty of perjury that I have examined this affidavit and that, to the best of my knowledge and belief, it is

true, correct, and complete.

Under SC Code Section 12-54-44(B)(6)(a), a person who willfully makes and subscribes any return, statement, or other

document that contains, or is verified by, a written declaration made under penalties of perjury that they do not believe to be

true and correct as to every material matter is guilty of a felony and, upon conviction, must be fined not more than $500 or

imprisoned not more than five years, or both, together with the cost of prosecution.

Signature of beneficiary Date

Print name

33461021