Enlarge image

Software Developer's Guide South Carolina Department of Revenue | dor.sc.gov | October 2023

Enlarge image | Software Developer's Guide South Carolina Department of Revenue | dor.sc.gov | October 2023 |

Enlarge image | Contents Tax Law Changes � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �1 Changes for 2023 Tax Year Returns � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �1 Return Formatting and Line Changes � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �2 Individual Income Tax � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �2 Fiduciary Income Tax � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �2 Partnership Income Tax � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �2 Corporate Income Tax � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �2 New MeF Functionality � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �3 Changes to MeF Business Rules � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �3 Electronic Mandate For Filing and Paying � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � 4 Direct Deposit � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �4 Electronic Payment � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �4 Reminders � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �5 Programming Payment Preferences � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �5 Paper Form Preferences � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �5 Submission Guidelines � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �5 Layout Requirements � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �6 Style Requirements � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �6 Common Errors � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �6 Software Updates � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �7 Common Approval Issues � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �7 SCDOR Mailing Addresses � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �7 Individual Income Tax � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �7 Fiduciary Income Tax � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �8 Corporate Income Tax � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �8 Partnership Income Tax � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �8 Communication Preferences � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �9 Check Digit Calculation � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �11 |

Enlarge image |

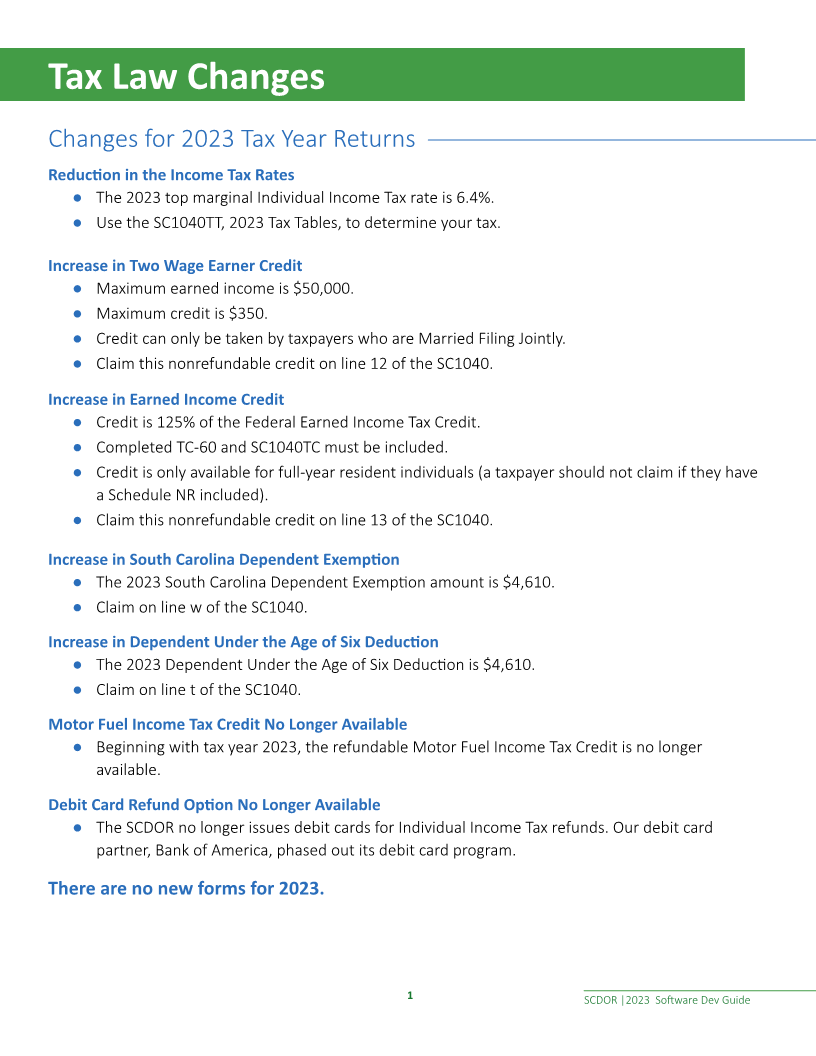

Tax Law Changes

Changes for 2023 Tax Year Returns

Reduction in the Income Tax Rates

● The 2023 top marginal Individual Income Tax rate is 6.4%.

● Use the SC1040TT, 2023 Tax Tables, to determine your tax.

Increase in Two Wage Earner Credit

● Maximum earned income is $50,000.

● Maximum credit is $350.

● Credit can only be taken by taxpayers who are Married Filing Jointly.

● Claim this nonrefundable credit on line 12 of the SC1040.

Increase in Earned Income Credit

● Credit is 125% of the Federal Earned Income Tax Credit.

● Completed TC-60 and SC1040TC must be included.

● Credit is only available for full-year resident individuals (a taxpayer should not claim if they have

a Schedule NR included).

● Claim this nonrefundable credit on line 13 of the SC1040.

Increase in South Carolina Dependent Exemption

● The 2023 South Carolina Dependent Exemption amount is $4,610.

● Claim on line w of the SC1040�

Increase in Dependent Under the Age of Six Deduction

● The 2023 Dependent Under the Age of Six Deduction is $4,610.

● Claim on line t of the SC1040�

Motor Fuel Income Tax Credit No Longer Available

● Beginning with tax year 2023, the refundable Motor Fuel Income Tax Credit is no longer

available�

Debit Card Refund Option No Longer Available

● The SCDOR no longer issues debit cards for Individual Income Tax refunds. Our debit card

partner, Bank of America, phased out its debit card program.

There are no new forms for 2023.

1 SCDOR |2023 Software Dev Guide

|

Enlarge image |

Return Formatting and Line Changes

Individual Income Tax

SC1040

● Filing status - Qualifying widow(er) changed to Qualifying surviving spouse.

● The refundable Motor Fuel Income Tax Credit is no longer available. Line 22e changed to

Reserved for future use�

● The Debit Card refund option is no longer available. Removed from line 35.

TC-21

● Added a new field to report if the credit was received from a pass-through entity and provide

the name and FEIN of the entity.

TC-62

● Within the various tables, changes to the amounts for:

■ rotation credit,

■ maximum credit allowed, and

■ maximum deduction allowed.

I-335

● For tax year 2023, a taxpayer with South Carolina taxable income less than or equal to $16,680

cannot benefit from the 3% rate for active trade or business income.

Fiduciary Income Tax

SC1041

● The refundable Motor Fuel Income Tax Credit is no longer available. Line 15c changed to

Reserved for future use�

Partnership Income Tax

SC1065

● The refundable Motor Fuel Income Tax Credit is no longer available. Line 14 changed to

Reserved for future use�

Corporate Income Tax

SC1120

● The refundable Motor Fuel Income Tax Credit is no longer available. Line 14g changed to

Reserved for future use�

2 SCDOR |2023 Software Dev Guide

|

Enlarge image |

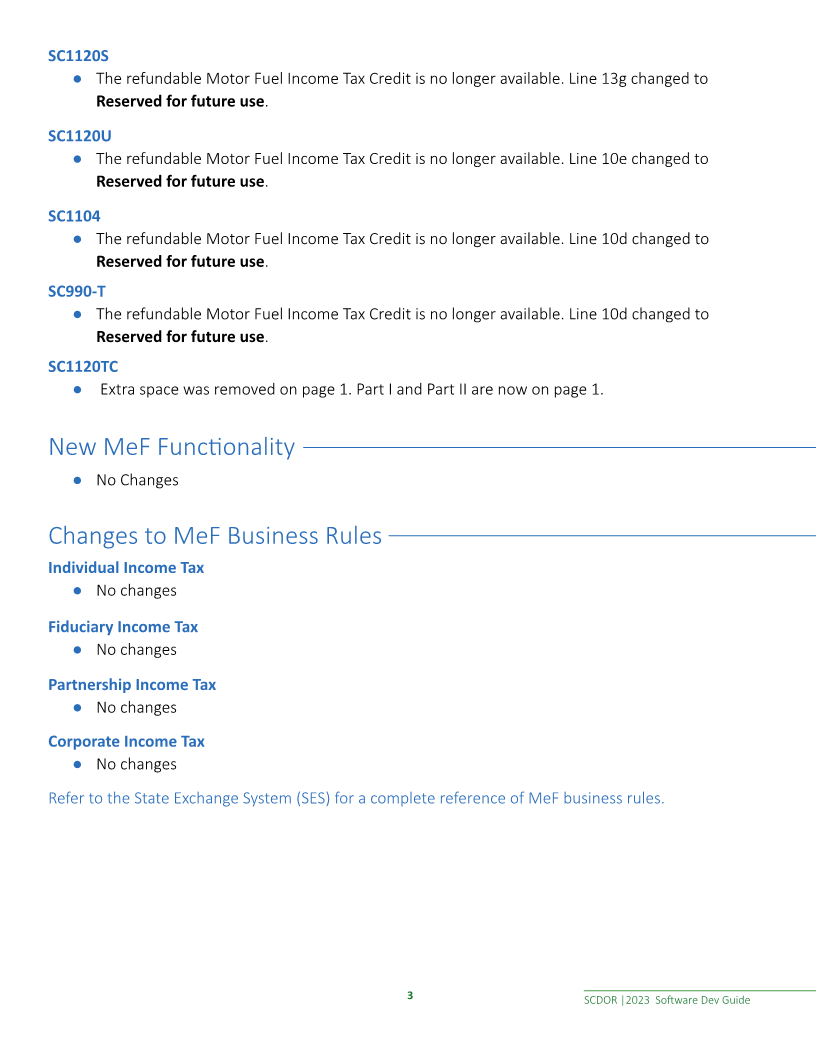

SC1120S

● The refundable Motor Fuel Income Tax Credit is no longer available. Line 13g changed to

Reserved for future use�

SC1120U

● The refundable Motor Fuel Income Tax Credit is no longer available. Line 10e changed to

Reserved for future use�

SC1104

● The refundable Motor Fuel Income Tax Credit is no longer available. Line 10d changed to

Reserved for future use�

SC990-T

● The refundable Motor Fuel Income Tax Credit is no longer available. Line 10d changed to

Reserved for future use�

SC1120TC

● Extra space was removed on page 1. Part I and Part II are now on page 1.

New MeF Functionality

● No Changes

Changes to MeF Business Rules

Individual Income Tax

● No changes

Fiduciary Income Tax

● No changes

Partnership Income Tax

● No changes

Corporate Income Tax

● No changes

Refer to the State Exchange System (SES) for a complete reference of MeF business rules.

3 SCDOR |2023 Software Dev Guide

|

Enlarge image |

Electronic Mandate For Filing and Paying

Any SCDOR return owing $15,000 or more must be filed and paid electronically. Visit the pages below

for a list of electronic filing and paying options.

● Individuals – dor.sc.gov/iit-filing

● Fiduciaries – dor.sc.gov/biz-services

● Corporations – dor.sc.gov/biz-services

● Partnerships – dor.sc.gov/biz-services

Direct Deposit

Use any opportunities to encourage your clients to choose the direct deposit refund option!

Check printing is handled by another state agency. For future tax years:

● The paper refund check option may be limited.

● Taxpayers may experience up to an additional 30 day delay in the printing and mailing of a paper

refund check.

We ask that you use the following highlights in your software to promote direct deposit.

Getting a refund? Direct Deposit is fast, accurate, and secure! With direct deposit, you:

● Get your refund deposited directly into your checking or savings account, giving you the fastest

access to your refund.

● Get your refund sooner.

● Help save tax dollars.

Electronic Payment

Use any opportunities to encourage your clients, both individuals and businesses, to pay their

balance due using an electronic payment option!

We ask that you use the following highlights in your software to promote electronic payment.

Have a balance due? Pay electronically!

● The quickest, easiest way to pay is using the SCDOR’s free online tax portal, MyDORWAY, at

dor.sc.gov/pay�

■ Through MyDORWAY, you can pay by credit card or ACH Debit.

■ For individuals, select Individual Income Tax Payment to get started.

■ For businesses, select Business Income Tax Payment to get started.

● Pay by ACH Debit when you file your return electronically.

■ When you provide your bank account information, the SCDOR will make a request to your

bank for payment of the South Carolina taxes you owe. Your bank will automatically debit

your account for the requested funds. No further action is needed on your part!

4 SCDOR |2023 Software Dev Guide

|

Enlarge image |

Reminders

Individual Income Tax

The SCDOR will not accept Individual Income Tax returns without a valid SSN, ITIN, or FEIN.

Fiduciary Income Tax

The Fiduciary Income Tax returns are processed using the FEIN. Require the customer to enter the FEIN.

Corporate Income Tax

The Corporate Income Tax returns are processed using the FEIN. Require the customer to enter the

FEIN�

Partnership Income Tax

The Partnership Income Tax returns are processed using the FEIN. Require the customer to enter the

FEIN�

Programming Payment Preferences

Payments included with MeF submissions should default the payment withdrawal date to the same day

as the return transmission date unless the taxpayer specifies otherwise.

Paper Form Preferences

Submission Guidelines

1� Name files according to the following format:

■ NACTPCode_FormNumber_MMDDYYYY

• Example: 1012_SC1040ES_06222021

• The form number in the file name must match the form number on the forms page of the

Software Developer site.

• Do not include any dashes or spaces in the form number.

2� For forms with scanlines, submit the five required test cases in a single PDF.

For forms without scanlines, submit one blank copy of your form for approval unless otherwise

noted.

3� Submit your form through the MyDORWAY Software Developer Portal.

5 SCDOR |2023 Software Dev Guide

|

Enlarge image |

■ Log in with the user name you set up after receiving your access notification email.

■ Follow the steps in the SCDOR Software Developer Portal Instructions to submit all forms.

• Email SoftwareDevelopersForms@dor.sc.gov with any questions.

Failure to follow these guidelines will result in rejection upon receipt and you will need to resubmit.

Layout Requirements

● Forms are designed on a 6x10 grid with 0.5 inch margins on all sides.

● Print all forms in black ink on 20lb unlined white paper size 8.5x11.

■ Print voucher forms on the bottom of the page.

■ Clearly outline the cutting line at the top of line 45 and include instructions for the taxpayer

to properly cut the line.

● Place the 4-digit NACTP code on each form in the top left corner as a replacement for “1350” in

line 4, columns 10-13.

■ If applicable, place the secondary vendor NACTP code on line 5, columns 10-13, directly

below the primary vendor code in line 4.

Style Requirements

● The SCDOR standard font for forms is Arial.

● All variable data, including NACTP codes, Form IDs, scan lines, and taxpayer-entered data, must

be in OCR-A Extended 12 pt font.

■ The SCDOR also accepts ANSI-Standard OCR-A Type 1 font at 10 pitch characters per inch, but

the font must be embedded in the document.

■ If OCR-A is not available, the SCDOR will accept test cases printed in Courier New.

■ Check digits must be calculated using the Modulus 10 algorithm. Refer to the Check Digit

Calculation sheet at the end of this guide for more information.

● Delta ( ) placements and sizes must match the official SCDOR form.

Common Errors

Ensure that all tax law changes for 2023 and other updates are incorporated into your software.

This prevents delays in the processing of your clients’ returns, issuance of incorrect letters, incorrect

refunds, and incorrect balance due notices. Some areas of concern include using the following:

● The 2023 Individual Income Tax Tables

● The 2023 limits for the Two-Wage Earner Credit

● The 2023 South Carolina Dependent Exemption Amount

● The 2023 Deduction for Dependents Under the Age of Six

● The 2023 Fiduciary Income Tax rates

6 SCDOR |2023 Software Dev Guide

|

Enlarge image |

Review our MeF business rules on the SES to ensure that your product’s implementation will minimize

rejections. Confirm that the 2D barcode specifications are up to date and that the barcode is easily

machine-readable.

Software Updates

The SCDOR should be made aware of all software updates to products after the initial approval. This

two-way communication is important to make sure we stay informed about bug fixes and features

offered to taxpayers. In turn, we can help communicate these messages to taxpayers when they contact

us, which provides better service for our mutual customers.

Common Approval Issues

● Review all current specification documents, including those posted to the SES and the SCDOR

software developer’s site for our latest requirements and expectations

■ Contact us at the earliest opportunity with any questions related to form design, form

instructions, line changes, tax law changes, or schema changes so we can explain or

correct as needed.

● Review our test cases. Make sure the output from your product has correct calculations,

required supplemental schedules, and correct and readable scanlines or barcodes.

● Submit your paper and electronic returns early. Sending test samples early reserves your place in

the review queue and ensures adequate time for review prior to filing season.

SCDOR Mailing Addresses

If you list SCDOR mailing addresses, confirm the addresses for accuracy.

Individual Income Tax

Estimated Tax (SC1040ES),

Refunds or No Tax Due All balance due returns

Extension (SC4868), or Correspondence

(SC1040) (SC1040)

Voucher (SC1040V)

SC1040 Processing Center SCDOR Taxable Processing Center SCDOR

PO Box 101100 IIT Voucher PO Box 101105 Income Tax

Columbia, SC 29211-0100 PO Box 100123 Columbia, SC 29211-0105 PO Box 125

Columbia, SC 29202 Columbia, SC 29214-0400

7 SCDOR |2023 Software Dev Guide

|

Enlarge image |

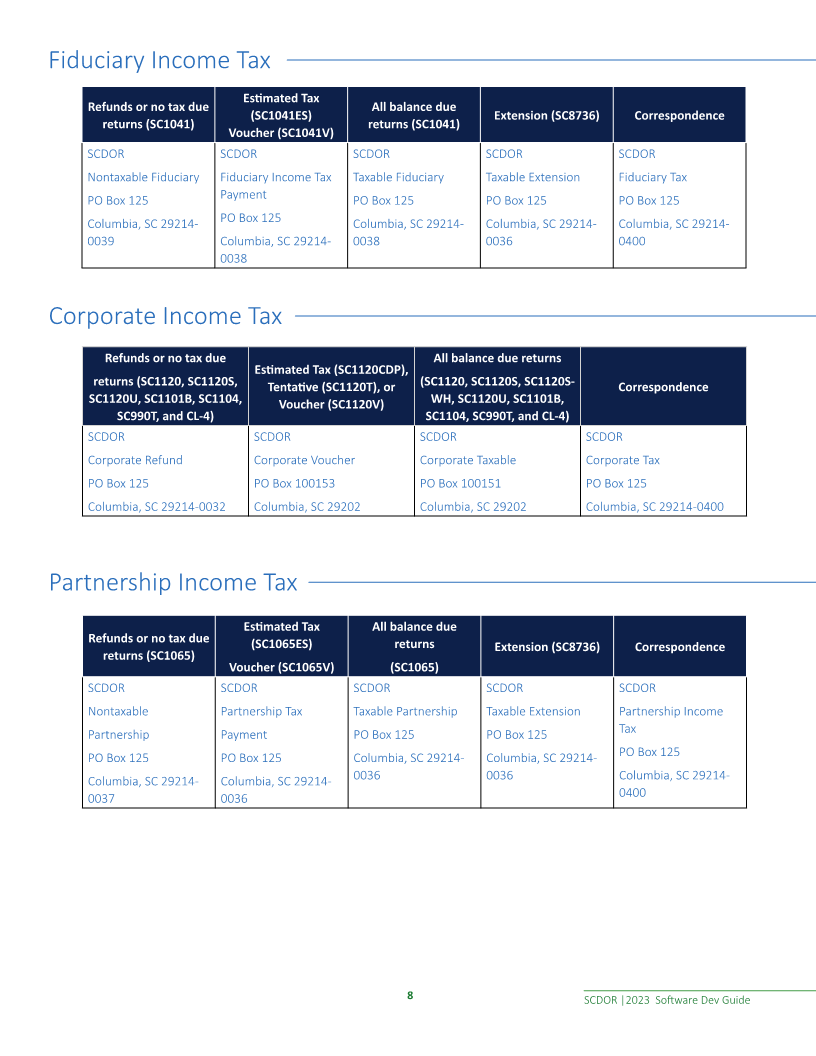

Fiduciary Income Tax

Estimated Tax

Refunds or no tax due All balance due

(SC1041ES) Extension (SC8736) Correspondence

returns (SC1041) returns (SC1041)

Voucher (SC1041V)

SCDOR SCDOR SCDOR SCDOR SCDOR

Nontaxable Fiduciary Fiduciary Income Tax Taxable Fiduciary Taxable Extension Fiduciary Tax

PO Box 125 Payment PO Box 125 PO Box 125 PO Box 125

Columbia, SC 29214- PO Box 125 Columbia, SC 29214- Columbia, SC 29214- Columbia, SC 29214-

0039 Columbia, SC 29214- 0038 0036 0400

0038

Corporate Income Tax

Refunds or no tax due All balance due returns

Estimated Tax (SC1120CDP),

returns (SC1120, SC1120S, Tentative (SC1120T), or (SC1120, SC1120S, SC1120S- Correspondence

SC1120U, SC1101B, SC1104, Voucher (SC1120V) WH, SC1120U, SC1101B,

SC990T, and CL-4) SC1104, SC990T, and CL-4)

SCDOR SCDOR SCDOR SCDOR

Corporate Refund Corporate Voucher Corporate Taxable Corporate Tax

PO Box 125 PO Box 100153 PO Box 100151 PO Box 125

Columbia, SC 29214-0032 Columbia, SC 29202 Columbia, SC 29202 Columbia, SC 29214-0400

Partnership Income Tax

Estimated Tax All balance due

Refunds or no tax due (SC1065ES) returns Extension (SC8736) Correspondence

returns (SC1065)

Voucher (SC1065V) (SC1065)

SCDOR SCDOR SCDOR SCDOR SCDOR

Nontaxable Partnership Tax Taxable Partnership Taxable Extension Partnership Income

Partnership Payment PO Box 125 PO Box 125 Tax

PO Box 125 PO Box 125 Columbia, SC 29214- Columbia, SC 29214- PO Box 125

Columbia, SC 29214- Columbia, SC 29214- 0036 0036 Columbia, SC 29214-

0037 0036 0400

8 SCDOR |2023 Software Dev Guide

|

Enlarge image |

Communication Preferences

We prefer that you direct taxpayers to MyDORWAY for the following:

● Registering a new South Carolina business - dor.sc.gov/register

● Making Payments - dor.sc.gov/pay

● Filing Appeals and Penalty Waivers - MyDORWAY.dor.sc.gov

● Request a Payment Plan - dor.sc.gov/payplan

● Filing a Refund Reissue Request - MyDORWAY.dor.sc.gov

● Accessing their 1099 Online - MyDORWAY.dor.sc.gov

● Checking Account Balances - MyDORWAY.dor.sc.gov

● Checking their Refund Status - dor.sc.gov/refund

● Penalty and Interest Calculator - dor.sc.gov/calculator

We prefer that you direct taxpayers to the following resources for tax information:

● SC TIED guide for tax credit descriptions - https://dor.sc.gov/policy/index/policy-manuals

● I-330 Contribution for Check-Off information - dor.sc.gov/forms/find-a-form?name=I-

330&category=&year=All

● IIT FAQs - dor.sc.gov/tax/individual-income/faq

● Fiduciary FAQs - dor.sc.gov/tax/fiduciary/faq

● Partnership FAQs - dor.sc.gov/tax/partnership/faq

● Corporate FAQs - dor.sc.gov/tax/corporate/faq

We prefer that you do not list our physical locations. Direct taxpayers to dor.sc.gov/contact/in-person

for location information.

We prefer the following use of our brand:

● Only refer to our agency as South Carolina Department of Revenue or SCDOR.

● Our website is dor.sc.gov. Remove references to sctax�org�

● Our free online tax portal is MyDORWAY.dor.sc.gov.

● Contact Communications@dor.sc.gov if you need another logo variation.

● Connect with us on social media at facebook.com/dor.sc.gov and twitter.com/scdor.

9 SCDOR |2023 Software Dev Guide

|

Enlarge image |

• SCDOR Standard Logo

• SCDOR All White Logo

• SCDOR Primary Brand Colors

RGB: 21 | 32 | 73 RGB: 67 | 156 | 70 RGB: 21 | 121 | 47

CMYK: 100 | 92 | 39 | 43 CMYK: 69 | 0 | 92 | 19 CMYK: 75 | 0 | 100 | 41

10 SCDOR |2023 Software Dev Guide

|

Enlarge image |

Check Digit Calculation

Check Digit Calculation - Modulus 10 [2121…]

Modulus 10 [2121...] - Revised 6/17/2021

Revised 6/17/2021 Check Digit Calculation - Modulus 10 [2121…]

The SCDOR uses Modulus 10 weight 2 to calculate the check digit for scan lines on our forms. Each

Revised 6/17/2021

number is assigned a weight in the order of 2121…beginning with 2. These weights are multiplied by

The SCDOR uses Modulus 10 weight 2 to calculate the check digit for scan lines on our forms. Each number is

the corresponding check digit. The result of the multiplication can be a two-digit number where each TheassignedSCDORa weightuses Modulusin the order10 weightof 2121…beginning2 to calculate the check digit for scan lines on our forms. Each number is with 2. These weights are multiplied by the corresponding check

digit is treated as a single digit. Once all of the resulting digits are added together, subtract the last digit digit.assignedThearesultweightofinthethemultiplicationorder of 2121…beginningcan be a two-digit number where each digit is treated as a single digit. Once all with 2. These weights are multiplied by the corresponding check

(right most) of the total from 10 to create the check digit.ofdigit.theTheresultingresultdigitsof thearemultiplicationadded together,can besubtracta two-digitthe lastnumberdigitwhere(right most)each digitof theistotaltreatedfromas10a singleto createdigit.theOncecheckall

digit. of theresulting digits are added together, subtract the last digit (right most) of the total from 10 to create the check

Example: Scan line number (7) x assigned weight (2) = 14. The 14 is then converted to 1 + 4 = 5. 10 – 5 = digit.

Example: Scanline number (7) x assigned weight (2) = 14. The 14 is then converted to 1 + 4 = 5. 10 – 5 = 5. The check

5. The check digit is 5.Example:digit is 5. Scanline number (7) x assigned weight (2) = 14. The 14 is then converted to 1 + 4 = 5. 10 – 5 = 5. The check

digit is 5.

If the sum is a multiple of 10, the check digit value is 0.If the sum is a multiple of 10, the check digit value is 0.

If the sum is a multiple of 10, the check digit value is 0.

Do not use spaces in the calculation.Do not use spaces in the calculation.

Do not use spaces in the calculation.

Example for Scan Line with numeric only:Example for Scan Line with numeric only:

Example for Scan Line with numeric only: Column 1 2 3 4 5 6 7

Column1234567890123456789012345678901234567890123456789012345678901234567890 1 2 3 4 5 6 7

1234567890123456789012345678901234567890123456789012345678901234567890 AAAAAAAAXXBBBBBBBBBXXCCCCCCCCCXXDDEEXXFFFFFFFFFFFXXXXXXXXXXXG

AAAAAAAAXXBBBBBBBBBXXCCCCCCCCCXXDDEEXXFFFFFFFFFFFXXXXXXXXXXXG30801021 123456789 987654321 1208 00000010000 6

30801021 123456789 987654321 1208 00000010000 6

Check Digit calculation for fields B, C, D, E and F using Modulus 10 (21…) starting from the left digit.Check Digit calculation for fields B, C, D, E and F using Modulus 10 (21…) starting from the left digit.

Check Digit calculation for fields B, C, D, E and F using Modulus 10 (21…) starting from the left digit. Number digits: 1 2 3 4 5 6 7 8 9 9 8 7 6 5 4 3 2 1 1 2 0 8 0 0 0 0 0 0 1 0 0 0 0

Number digits: 1 2 3 4 5 6 7 8 9 9 8 7 6 5 4 3 2 1 1 2 0 8 0 0 0 0 0 0 1 0 0 0 0

Multiplier: Number digits:2 1 1 2 2 3 1 4 2 5 1 6 2 7 1 8 9 2 9 1 8 2 7 1 6 2 5 1 4 2 3 1 2 2 1 1 1 2 2 1 0 2 8 1 0 2 0 1 0 2 0 1 0 2 0 1 1 2 0 1 0 2 0 1 0 2

Mutiplier:Multiplie 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2

Results: r: 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 2 2 6 4 10 6 14 8 18 9 16 7 12 5 8 3 4 1 2 2 0 8 0 0 0 0 0 0 2 0 0 0 0

Results:Results: 2 2 2 62 4 6 6 410108 69 14147 81851881693164 17212122 05 88 03 0 04 01 02 0 22 00 08 0 00 0 0 0 0 0 2 0 0 0 0

Sum = 2+2+6+4+1+0+6+1+4+8+1+8+9+1+6+7+1+2+5+8+3+4+1+2+2+0+8+0+0+0+0+0+0+2+0+0+0+0=104

Sum = 2+2+6+4+1+0+6+1+4+8+1+8+9+1+6+7+1+2+5+8+3+4+1+2+2+0+8+0+0+0+0+0+0+2+0+0+0+0=104

CheckSum =Digit2+2+6+4+1+0+6+1+4+8+1+8+9+1+6+7+1+2+5+8+3+4+1+2+2+0+8+0+0+0+0+0+0+2+0+0+0+0=104= 10 –6 4 =

CheckCheckDigitDigit10=–10 4 = –6 6 4 =

Example for Scan Line with alpha (4 letters in name control field):

Example for Scan Line with alpha (4 letters in name control field):Example for Scan Line with alpha (4 letters in name control field): Column 1 2 3 4 5 6 7

Column1234567890123456789012345678901234567890123456789012345678901234567890 1 2 3 4 5 6 7

1234567890123456789012345678901234567890123456789012345678901234567890 AAAAAAAAXXBBBBBBBBBXXCCCCCCCCCXXDDEEXXFFFFXXGGGGGGGGGGGXXXXXH

33321027 123456789 987654321 1207 CLAR 00000010000 7 AAAAAAAAXXBBBBBBBBBXXCCCCCCCCCXXDDEEXXFFFFXXGGGGGGGGGGGXXXXXH

33321027 123456789 987654321 1207 CLAR 00000010000 7

The alpha translation into numeric for check digit calculation is as follows: A=1, B=2, C=3, D=4, E=5, F=6, G=7, H=8,

The alpha translation into numeric for check digit calculation is as follows: A=1, B=2, C=3, D=4, E=5, F=6, G=7, H=8, I=9,

I=9, J=1, K=2, L=3, M=4, N=5, O=6, P=7, Q=8 R=9, S=2, T=3, U=4, V=5, W=6, X=7, Y=8, Z=9. The alpha translation into numeric for check digit calculation is as follows: A=1, B=2, C=3, D=4, E=5, F=6, G=7, H=8,

J=1, K=2, L=3, M=4, N=5, O=6, P=7, Q=8 R=9, S=2, T=3, U=4, V=5, W=6, X=7, Y=8, Z=9.I=9, J=1, K=2, L=3, M=4, N=5, O=6, P=7, Q=8 R=9, S=2, T=3, U=4, V=5, W=6, X=7, Y=8, Z=9.

Check Digit calculation for fields B, C, D, E, F and G using Modulus 10 (21…) starting from the left digit.

Check Digit calculation for fields B, C, D, E, F and G using Modulus 10 (21…) starting from the left NumberCheck Digit calculation for fields B, C, D, E, F and G using Modulus 10 (21…) starting from the left digit.digits: 1 2 3 4 5 6 7 8 9 9 8 7 6 5 4 3 2 1 1 2 0 7 C L A R 0 0 0 0 0 0 1 0 0 0 0

digit.Multiplier: Number digits:2 1 1 2 2 3 1 4 5 2 6 1 7 2 8 1 9 2 9 1 8 2 7 1 6 2 5 1 4 2 3 1 2 2 1 1 1 2 2 1 0 2 7 1 C 2 L 1 A 2 R 1 0 2 0 1 0 2 0 1 0 2 0 1 1 2 0 1 0 2 0 1 0 2

Number digits:Multiplier: 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 Results: 2 2 6 4 10 6 14 8 18 9 16 7 12 5 8 3 4 1 2 2 0 7 6 3 2 9 0 0 0 0 0 0 2 0 0 0 0 1 2 3 4 5 6 7 8 9 9 8 7 6 5 4 3 2 1 1 2 0 7 C L A R 0 0 0 0 0 0 1 0 0 0 0

Mutiplier:Results: 2 2 6 4 10 6 14 8 18 9 16 7 12 5 8 3 4 1 2 2 0 7 6 3 2 9 0 0 0 0 0 0 2 0 0 0 0 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2

Results:Sum = 2+2+6+4+1+0+6+1+4+8+1+8+9+1+6+7+1+2+5+8+3+4+1+2+2+0+7+6+3+2+9+0+0+0+0+0+0+2+0+0+0+0=1232 2 6 4 6 108 9 147 145 8163 4 1 2122 0 7 6 3 2 9 0 0 0 0 0 0 2 0 0 0 0

Sum = 2+2+6+4+1+0+6+1+4+8+1+8+9+1+6+7+1+2+5+8+3+4+1+2+2+0+7+6+3+2+9+0+0+0+0+0+0+2+0+0+0+0=123

Sum = 2+2+6+4+1+0+6+1+4+8+1+8+9+1+6+7+1+2+5+8+3+4+1+2+2+0+7+6+3+2+9+0+0+0+0+0+0+2+0+0+0+0=123

Check Digit = 10 –7 3 =

CheckCheckDigitDigit10=–10 3 = –7 7 3 =

11 SCDOR |2023 Software Dev Guide

|