Enlarge image

Software Developer's Guide South Carolina Department of Revenue | dor.sc.gov | August 2024

Enlarge image | Software Developer's Guide South Carolina Department of Revenue | dor.sc.gov | August 2024 |

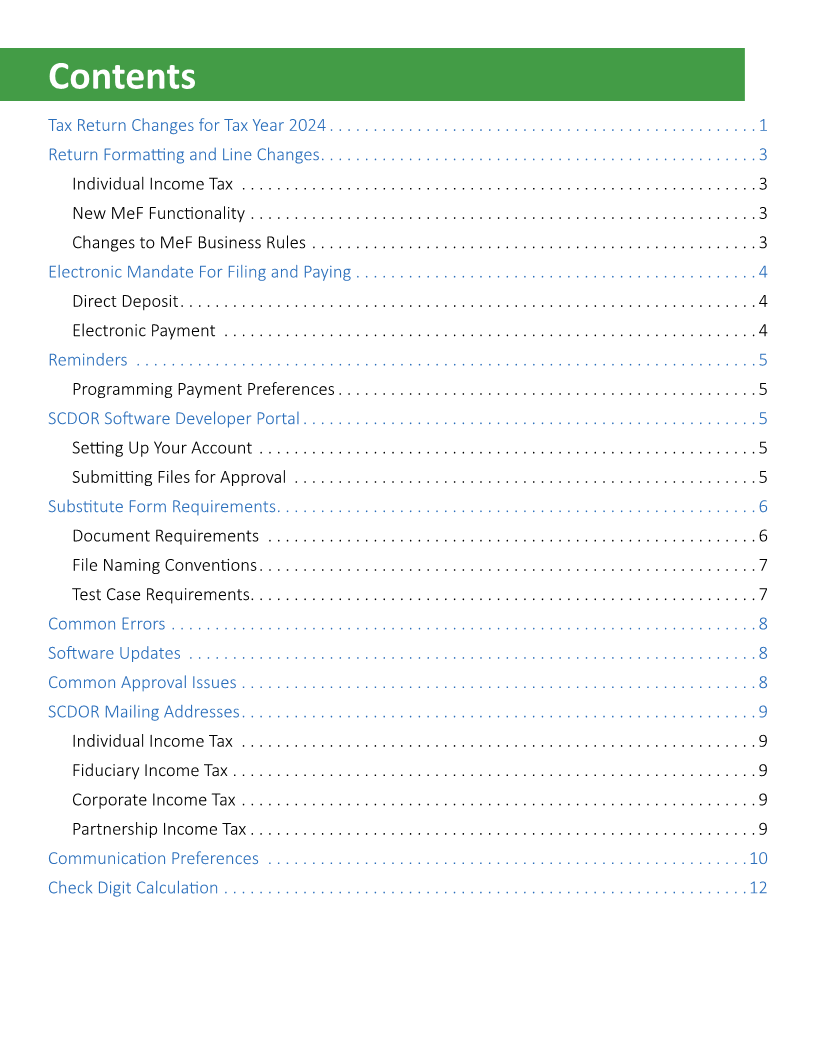

Enlarge image | Contents Tax Return Changes for Tax Year 2024 � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �1 Return Formatting and Line Changes � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �3 Individual Income Tax � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �3 New MeF Functionality � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �3 Changes to MeF Business Rules � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �3 Electronic Mandate For Filing and Paying � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � 4 Direct Deposit � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �4 Electronic Payment � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �4 Reminders � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �5 Programming Payment Preferences � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �5 SCDOR Software Developer Portal � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �5 Setting Up Your Account � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �5 Submitting Files for Approval � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �5 Substitute Form Requirements � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �6 Document Requirements � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �6 File Naming Conventions � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �7 Test Case Requirements � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �7 Common Errors � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �8 Software Updates � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �8 Common Approval Issues � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �8 SCDOR Mailing Addresses � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �9 Individual Income Tax � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �9 Fiduciary Income Tax � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �9 Corporate Income Tax � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �9 Partnership Income Tax � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �9 Communication Preferences � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �10 Check Digit Calculation � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �12 |

Enlarge image |

Tax Return Changes for Tax Year 2024

Reduction in the Income Tax Rates

● The 2024 top marginal Individual Income Tax rate is 6.2%.

● Use the SC1040TT, 2024 Tax Tables, to determine your tax.

Increase in Volunteer Deduction for Certain Public Servants

● Increases to $6,000 per tax year.

● Claim this deduction on line j of the SC1040.

Increase in the Subsistence Allowance for Certain Public Servants

● Increases to $16 per each regular workday in a tax year.

● Claim on line s of the SC1040�

Increase in South Carolina Dependent Exemption

● The 2024 South Carolina Dependent Exemption amount is $4,790.

● Claim on line w of the SC1040�

Increase in Dependent Under the Age of Six Deduction

● The 2024 Dependent Under the Age of Six Deduction is $4,790.

● Claim on line t of the SC1040�

Increase in Classroom Teacher Expenses Credit

● For 2024, the maximum allowable credit is $400.

● Completed I-360 must be included.

● Credit is only available if the South Carolina classroom teacher was not eligible for an expense

reimbursement for their teacher supplies and materials.

● Claim this refundable credit on line 22c of the SC1040.

Maximum Credit for the Industry Partnership Fund Credit

● For tax years beginning after 2022, the maximum credit for a single taxpayer is $500,000. The

total amount that can be claimed for all taxpayers is $12 million. If the $12 million limit is not

met within 60 days of the opening date for the credit application, the maximum credit for a

single taxpayer increases to $1 million until the $12 million maximum total is met.

● Use the TC-36 to claim the credit.

Maximum Credit, Per Site, for the Abandoned Buildings Revitalization Credit

● The maximum credit earned in a tax year for each abandoned building site cannot exceed

$700,000.

● Use the TC-55 to claim the credit.

Apprenticeship Credit for tax years ending May 21, 2024 and after

● The credit is equal to the cost of the apprenticeship or $1,000, whichever is greater, for each

employed apprentice.

1 SCDOR |2024 Software Dev Guide

|

Enlarge image |

● For a tax year, the credit cannot exceed:

■ $4,000 for an apprentice, or

■ $6,000 for the youth apprenticeship program.

● For a taxpayer to claim the credit for more than four years, the apprentice must:

■ complete the apprenticeship, and

■ remain an employee of the taxpayer.

● If the apprentice meets those qualifications, the taxpayer is eligible to claim a $1,000 credit for

up to three additional tax years.

● Use the TC-45 to claim the credit.

● The maximum aggregate credit amount for all taxpayers may not exceed $5 million in a tax year.

Headquarters Credit

● Formerly the Corporate Headquarters Credit

● The credit can be taken against Corporate Income Tax, Corporate License Fee, Bank Tax,

Individual Income Tax, and Fiduciary Income Tax.

● Use the TC-8 to claim the credit

Minimum Level of Investment for the Qualifying Recycling Facility Credit

● The minimum level of investment for a qualified recycling facility must be $150 million incurred

by the end of the fifth calendar year after the year the taxpayer begins construction or operation

of the facility.

● Use the TC-17 to claim the credit.

Energy Efficient Manufactured Home Credit

● This credit has expired and is only available for taxpayers who qualified before July 2, 2024.

● Use the TC-53 to claim the credit, if the taxpayer qualified by July 1, 2024.

Railroad Expenditures Credit

● This is a nonrefundable tax credit available for tax years beginning after December 31, 2023, and

will be repealed on December 31, 2028.

● The credit is available to eligible taxpayers with qualified railroad reconstruction or replacement

expenditures.

● The credit can be taken against Corporate or Individual Income Tax, Bank Tax, Savings and Loan

Tax, or Insurance Premium Tax.

● The guidelines for the Railroad Expenditures Credit are administered by the SC Department of

Commerce.

● A copy of the Credit Certificate issued by the SC Department of Commerce must be attached to

the tax return�

● Use the TC-66 to claim the credit.

Recreational Trail Easement Credit

● This is a nonrefundable tax credit available for tax years beginning after December 31, 2023, and

will be repealed on January 1, 2029.

2 SCDOR |2024 Software Dev Guide

|

Enlarge image |

● Available to an eligible taxpayer who encumbers property with a perpetual recreational trail

easement and right of way.

● The maximum amount of tax credits allowed for a calendar year cannot exceed $1 million.

● Use the TC-67 to claim the credit.

New Forms

● TC-66 – Railroad Expenditures Credit

● TC-67 – Recreational Trail Easement Credit

Return Formatting and Line Changes

Individual Income Tax

SC1040

● No changes

TC-62

● Within the various tables, changes to the amounts for:

■ rotation credit,

■ maximum credit allowed, and

■ maximum deduction allowed.

I-335

● For tax year 2024, a taxpayer with South Carolina taxable income less than or equal to $17,330

cannot benefit from the 3% rate for active trade or business income.

There are no changes to Fiduciary, Partnership, or Corporate Income Tax returns for

2024.

New MeF Functionality

There are no changes to MeF functionality for 2024.

Changes to MeF Business Rules

Individual Income Tax

The TC-62 requirement for MeF submission if electronically filing the SC1040 has been removed. If

claiming the TC-62, a PDF may be attached as a supplemental schedule.

Refer to the State Exchange System (SES) for a complete reference of MeF business rules.

3 SCDOR |2024 Software Dev Guide

|

Enlarge image |

Electronic Mandate For Filing and Paying

Any SCDOR return owing $15,000 or more must be filed and paid electronically. Visit the pages below

for a list of electronic filing and paying options.

● Individuals – dor.sc.gov/iit-filing

● Fiduciaries – dor.sc.gov/biz-services

● Corporations – dor.sc.gov/biz-services

● Partnerships – dor.sc.gov/biz-services

Direct Deposit

Use any opportunities to encourage your clients to choose the direct deposit refund option!

Check printing is handled by another state agency. For future tax years:

● The paper refund check option may be limited.

● Taxpayers may experience up to an additional 30 day delay in the printing and mailing of a paper

refund check.

We ask that you use the following highlights in your software to promote direct deposit.

Getting a refund? Direct Deposit is fast, accurate, and secure! With direct deposit, you:

● Get your refund deposited directly into your checking or savings account, giving you the fastest

access to your refund.

● Get your refund sooner.

● Help save tax dollars.

Electronic Payment

Use any opportunities to encourage your clients, both individuals and businesses, to pay their

balance due using an electronic payment option!

We ask that you use the following highlights in your software to promote electronic payment.

Have a balance due? Pay electronically!

● The quickest, easiest way to pay is using the SCDOR’s free online tax portal, MyDORWAY, at

dor.sc.gov/pay�

■ Through MyDORWAY, you can pay by credit card or ACH Debit.

■ For individuals, select Individual Income Tax Payment to get started.

■ For businesses, select Business Income Tax Payment to get started.

● Pay by ACH Debit when you file your return electronically.

■ When you provide your bank account information, the SCDOR will make a request to your

bank for payment of the South Carolina taxes you owe. Your bank will automatically debit

your account for the requested funds. No further action is needed on your part!

■ The ACH Debit amount entered on the SC1040 cannot be greater than the balance due on

Line 34.

4 SCDOR |2024 Software Dev Guide

|

Enlarge image |

Reminders

Individual Income Tax

The SCDOR will not accept Individual Income Tax returns without a valid SSN, ITIN, or FEIN.

Fiduciary Income Tax

Fiduciary Income Tax returns are processed using the FEIN. Require the customer to enter the FEIN.

Corporate Income Tax

Corporate Income Tax returns are processed using the FEIN. Require the customer to enter the FEIN.

Partnership Income Tax

Partnership Income Tax returns are processed using the FEIN. Require the customer to enter the FEIN.

Programming Payment Preferences

Payments included with MeF submissions should default the payment withdrawal date to the same day

as the return transmission date unless the taxpayer specifies otherwise.

SCDOR Software Developer Portal

Setting Up Your Account

If you have not used our portal in the past, we will set you up in our system first. You will get an email

when this is done.

Creating Your Login

Follow the steps below to create a login for a new or existing company.

● Go to https://mef.mydorway.dor.sc.gov/ and click on Sign Up�

● Enter your company's Vendor Code (Production ETIN or NACTP) and Legal Name (as written on

the LOI).

■ These details will also be included in the email sent to the Authorized Representative when

your LOI is approved.

● After verification, enter all requested information for your vendor username and password.

■ Remember your login information and security question! We can unlock your account or

send you a password reset email, but we can't give you any of your login information.

Submitting Files for Approval

MeF Submission Instructions

● Once your account is set up and you log in, you should see a link for “2024” under Year. After

clicking on the link, you should see the five form types we support through MeF with “0 out of 5

certifications passed”

5 SCDOR |2024 Software Dev Guide

|

Enlarge image |

● Click into the link under Form Type. On this screen, you should see test cases 1-5. Click into the

link for test case #1.

● On this screen, enter in the Submission ID associated with the matching test case.

● We will be notified internally that a test case was submitted.

● After review, we will mark the test case as passed or not passed. This status will be pushed back

out to the portal�

● You can check each submission’s approval status at your convenience and can send messages

through the portal�

Paper Forms Submission Instructions

● Once you have logged in, click Send a Message under the I Want To tab�

● Select Paper Form Submission under Select Message Type�

● Enter the submission you want reviewed in the message subject line, using the format NACTP_

FormName_Date (example: 1234_SC1040_09012022).

● Add your attachment, which should be named the same as above. The description should also

follow the same format�

● Enter any additional information we might need in the email text box.

● Click Submit to send your message.

● Allow 10 business days for review.

● You will receive a reply email with your pass or fail results after review.

Substitute Form Requirements

Our Software Developer site will keep you informed about recent updates, procedures, as well as

contain all updated forms, specifications, and test cases.

You must submit all forms indicated on your LOI that have changed or been updated since their last

approval. We do not require that you submit forms that have not changed unless there has been a

change in your software that may impact the final version of that form.

Document Requirements

File Layout Specifications

● Forms are designed on a 6x10 grid with 0.5 inch margins on all sides.

● Print all forms in black ink on 20lb unlined white paper size 8.5x11.

■ Print voucher forms on the bottom of the page.

■ Clearly outline the cutting line at the top of line 45 and include instructions for the taxpayer

to properly cut the line.

● Place the 4-digit NACTP code on each form in the top left corner as a replacement for “1350” in

line 4, columns 10-13.

■ If applicable, place the secondary vendor NACTP code on line 5, columns 10-13, directly

below the primary vendor code in line 4.

6 SCDOR |2024 Software Dev Guide

|

Enlarge image |

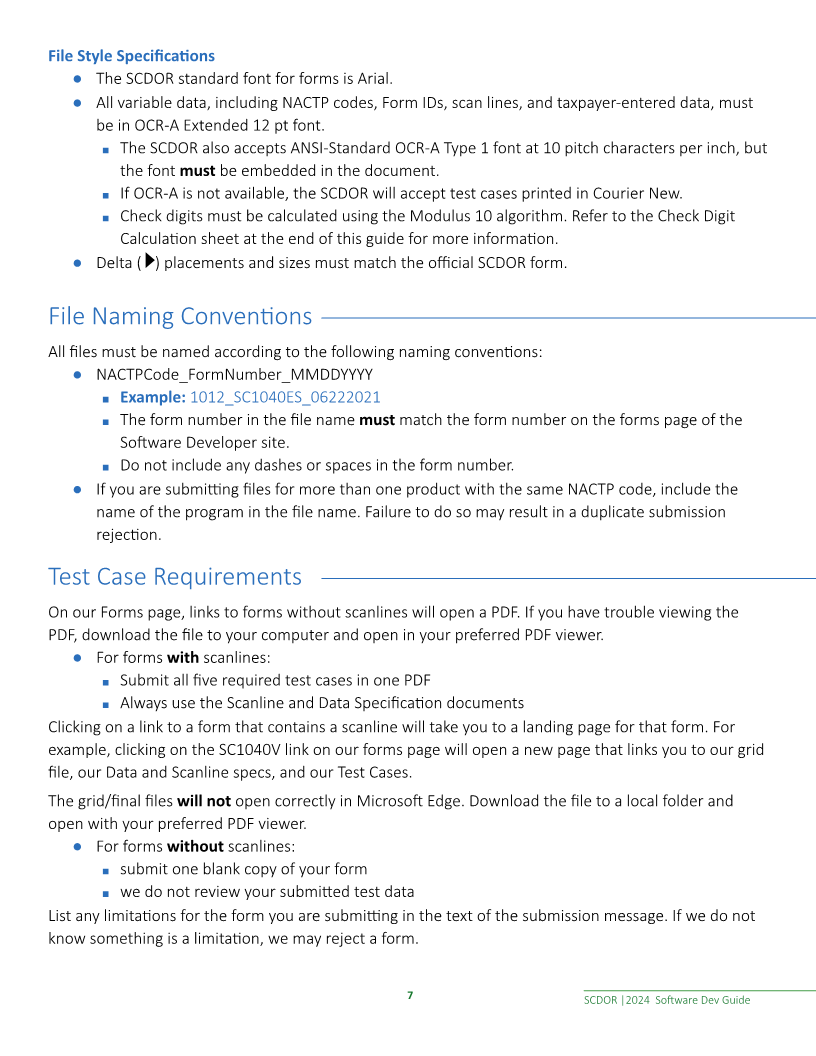

File Style Specifications

● The SCDOR standard font for forms is Arial.

● All variable data, including NACTP codes, Form IDs, scan lines, and taxpayer-entered data, must

be in OCR-A Extended 12 pt font.

■ The SCDOR also accepts ANSI-Standard OCR-A Type 1 font at 10 pitch characters per inch, but

the font must be embedded in the document.

■ If OCR-A is not available, the SCDOR will accept test cases printed in Courier New.

■ Check digits must be calculated using the Modulus 10 algorithm. Refer to the Check Digit

Calculation sheet at the end of this guide for more information.

● Delta ( ) placements and sizes must match the official SCDOR form.

File Naming Conventions

All files must be named according to the following naming conventions:

● NACTPCode_FormNumber_MMDDYYYY

■ Example: 1012_SC1040ES_06222021

■ The form number in the file name must match the form number on the forms page of the

Software Developer site.

■ Do not include any dashes or spaces in the form number.

● If you are submitting files for more than one product with the same NACTP code, include the

name of the program in the file name. Failure to do so may result in a duplicate submission

rejection.

Test Case Requirements

On our Forms page, links to forms without scanlines will open a PDF. If you have trouble viewing the

PDF, download the file to your computer and open in your preferred PDF viewer.

● For forms with scanlines:

■ Submit all five required test cases in one PDF

■ Always use the Scanline and Data Specification documents

Clicking on a link to a form that contains a scanline will take you to a landing page for that form. For

example, clicking on the SC1040V link on our forms page will open a new page that links you to our grid

file, our Data and Scanline specs, and our Test Cases.

The grid/final files will not open correctly in Microsoft Edge. Download the file to a local folder and

open with your preferred PDF viewer.

● For forms without scanlines:

■ submit one blank copy of your form

■ we do not review your submitted test data

List any limitations for the form you are submitting in the text of the submission message. If we do not

know something is a limitation, we may reject a form.

7 SCDOR |2024 Software Dev Guide

|

Enlarge image |

Common Errors

Ensure that all tax law changes for 2024 and other updates are incorporated into your software.

This prevents delays in the processing of your clients’ returns, issuance of incorrect letters, incorrect

refunds, and incorrect balance due notices. Some areas of concern include using the following:

● The 2024 Individual Income Tax Tables

● The 2024 South Carolina Dependent Exemption Amount

● The 2024 Deduction for Dependents Under the Age of Six

● The 2024 Fiduciary Income Tax rates

Review our MeF business rules on the SES to ensure that your product’s implementation will minimize

rejections. Confirm that the 2D barcode specifications are up to date and that the barcode is easily

machine-readable.

Software Updates

Notify the SCDOR of all software updates to products after the initial approval. This two-way

communication is important to make sure we stay informed about bug fixes and features offered to

taxpayers. In turn, we can help communicate these messages to taxpayers when they contact us, which

provides better service for our mutual customers.

Common Approval Issues

● Review all current specification documents, including those posted to the SES and the SCDOR

software developer’s site for our latest requirements and expectations.

■ Contact us at the earliest opportunity with any questions related to form design, form

instructions, line changes, tax law changes, or schema changes so we can explain or

correct as needed.

● Review our test cases. Make sure the output from your product has correct calculations,

required supplemental schedules, and correct and readable scanlines or barcodes.

● Submit your paper and electronic returns early. Sending test samples early reserves your place in

the review queue and ensures adequate time for review prior to filing season.

8 SCDOR |2024 Software Dev Guide

|

Enlarge image |

SCDOR Mailing Addresses

If you list SCDOR mailing addresses, confirm the addresses for accuracy.

Individual Income Tax

Estimated Tax (SC1040ES),

Refunds or No Tax Due All balance due returns

Extension (SC4868), or Correspondence

(SC1040) (SC1040)

Voucher (SC1040V)

SC1040 Processing Center SCDOR Taxable Processing Center SCDOR

PO Box 101100 IIT Voucher PO Box 101105 Income Tax

Columbia, SC 29211-0100 PO Box 100123 Columbia, SC 29211-0105 PO Box 125

Columbia, SC 29202 Columbia, SC 29214-0400

Fiduciary Income Tax

Refunds or no tax due Estimated Tax (SC1041ES) All balance due

Extension (SC8736) Correspondence

returns (SC1041) Voucher (SC1041V) returns (SC1041)

SCDOR SCDOR SCDOR SCDOR SCDOR

Nontaxable Fiduciary Fiduciary Income Tax Taxable Fiduciary Taxable Extension Fiduciary Tax

PO Box 125 Payment PO Box 125 PO Box 125 PO Box 125

Columbia, SC 29214- PO Box 125 Columbia, SC 29214- Columbia, SC 29214- Columbia, SC 29214-

0039 Columbia, SC 29214-0038 0038 0036 0400

Corporate Income Tax

Refunds or no tax due All balance due returns

Estimated Tax (SC1120CDP),

returns (SC1120, SC1120S, (SC1120, SC1120S, SC1120S-

Tentative (SC1120T), or Correspondence

SC1120U, SC1101B, SC1104, WH, SC1120U, SC1101B,

Voucher (SC1120V)

SC990T, and CL-4) SC1104, SC990T, and CL-4)

SCDOR SCDOR SCDOR SCDOR

Corporate Refund Corporate Voucher Corporate Taxable Corporate Tax

PO Box 125 PO Box 100153 PO Box 100151 PO Box 125

Columbia, SC 29214-0032 Columbia, SC 29202 Columbia, SC 29202 Columbia, SC 29214-0400

Partnership Income Tax

Estimated Tax

Refunds or no tax due All balance due

(SC1065ES) Extension (SC8736) Correspondence

returns (SC1065) returns (SC1065)

Voucher (SC1065V)

SCDOR SCDOR SCDOR SCDOR SCDOR

Nontaxable Partnership Tax Taxable Partnership Taxable Extension Partnership Income Tax

Partnership Payment PO Box 125 PO Box 125 PO Box 125

PO Box 125 PO Box 125 Columbia, SC 29214- Columbia, SC 29214- Columbia, SC 29214-

Columbia, SC 29214- Columbia, SC 29214- 0036 0036 0400

0037 0036

9 SCDOR |2024 Software Dev Guide

|

Enlarge image |

Communication Preferences

We prefer that you direct taxpayers to MyDORWAY for the following:

● Registering a new South Carolina business - dor.sc.gov/register

● Making Payments - dor.sc.gov/pay

● Filing Appeals and Penalty Waivers - MyDORWAY.dor.sc.gov

● Request a Payment Plan - dor.sc.gov/payplan

● Filing a Refund Reissue Request - MyDORWAY.dor.sc.gov

● Accessing their 1099 Online - MyDORWAY.dor.sc.gov

● Checking Account Balances - MyDORWAY.dor.sc.gov

● Checking their Refund Status - dor.sc.gov/refund

● Penalty and Interest Calculator - dor.sc.gov/calculator

● Copies of Individual Income Tax return Transcripts for 2021 and newer - MyDORWAY.dor.sc.gov

We prefer that you direct taxpayers to the following resources for tax information:

● SC TIED guide for tax credit descriptions - https://dor.sc.gov/policy/index/policy-manuals

● I-330 Contribution for Check-Off information - dor.sc.gov/forms/find-a-form?name=I-

330&category=&year=All

● IIT FAQs - dor.sc.gov/tax/individual-income/faq

● Fiduciary FAQs - dor.sc.gov/tax/fiduciary/faq

● Partnership FAQs - dor.sc.gov/tax/partnership/faq

● Corporate FAQs - dor.sc.gov/tax/corporate/faq

We prefer that you do not list our physical locations. Direct taxpayers to dor.sc.gov/contact/in-person

for location information.

We prefer the following use of our brand:

● Only refer to our agency as South Carolina Department of Revenue or SCDOR.

● Our website is dor.sc.gov. Remove references to sctax.org.

● Our free online tax portal is MyDORWAY.dor.sc.gov.

● Contact Communications@dor.sc.gov if you need another logo variation.

● Connect with us on Facebook (facebook.com/dor.sc.gov), Instagram (instagram.com/thescdor),

and X, formerly known as Twitter (x.com/scdor).

10 SCDOR |2024 Software Dev Guide

|

Enlarge image |

• SCDOR Standard Logo

• SCDOR All White Logo

• SCDOR Primary Brand Colors

RGB: 21 | 32 | 73 RGB: 67 | 156 | 70 RGB: 21 | 121 | 47

CMYK: 100 | 92 | 39 | 43 CMYK: 69 | 0 | 92 | 19 CMYK: 75 | 0 | 100 | 41

11 SCDOR |2024 Software Dev Guide

|

Enlarge image |

Check Digit Calculation

Check Digit Calculation - Modulus 10 [2121…]

Modulus 10 [2121...] - Revised 6/17/2021

Revised 6/17/2021 Check Digit Calculation - Modulus 10 [2121…]

The SCDOR uses Modulus 10 weight 2 to calculate the check digit for scan lines on our forms. Each

Revised 6/17/2021

number is assigned a weight in the order of 2121…beginning with 2. These weights are multiplied by

The SCDOR uses Modulus 10 weight 2 to calculate the check digit for scan lines on our forms. Each number is

theTheassignedcheckcorresponding digit.SCDOR usesThe resultatheof Modulusweightmultiplication10incanweightthebe aordertwo-digit2 tonumbercalculateofwhere2121…beginningeach the check digitwithfor2. Thesescan linesweightson ourareforms.multipliedEach numberby the correspondingis check

digit treatedis assigneddigit.asTheaasingle digit.resultweightallOnce theof ofinresultingthedigitsthearemultiplicationaddedordertogether,ofsubtract2121…beginningcanthebelastadigittwo-digitwithnumber2. Thesewhereweightseacharedigitmultipliedis treatedby theas acorrespondingsingle digit. Oncecheckall

(rightdigit.ofmost)theof theThetotalresultingresultto10 from createdigitsofthethecheckaredigit.multiplicationadded together,can besubtracta two-digitthe lastnumberdigitwhere(right most)eachofdigittheistotaltreatedfromas10atosinglecreatedigit.the checkOnce all

digit. of the resulting digits are added together, subtract the last digit (right most) of the total from 10 to create the check

Example:digit. Scan numberline assignedx (7) weight 14.= (2) The thenis 14 converted to = 5.4 1 + 5– 10 =

Example: Scanline number (7) x assigned weight (2) = 14. The 14 is then converted to 1 + 4 = 5. 10 – 5 = 5. The check

5.Example:digitThe checkisdigit is 5.5. Scanline number (7) x assigned weight (2) = 14. The 14 is then converted to 1 + 4 = 5. 10 – 5 = 5. The check

digit is 5.

If theIf theis asum summultiple the10, of ischeckadigitmultiplevalue 0.is of 10, the check digit value is 0.

If the sum is a multiple of 10, the check digit value is 0.

Do notDospacesuse notin theusecalculation.spaces in the calculation.

Do not use spaces in the calculation.

ExampleExampleScanfor Scanfor Line withonly: Line with numeric only:numeric

ExampleColumnScanfor with only: numeric Line 1 2 3 4 5 6 7

Column1234567890123456789012345678901234567890123456789012345678901234567890 1 2 3 4 5 6 7

1234567890123456789012345678901234567890123456789012345678901234567890 AAAAAAAAXXBBBBBBBBBXXCCCCCCCCCXXDDEEXXFFFFFFFFFFFXXXXXXXXXXXG

AAAAAAAAXXBBBBBBBBBXXCCCCCCCCCXXDDEEXXFFFFFFFFFFFXXXXXXXXXXXG30801021 123456789 987654321 1208 00000010000 6

30801021 123456789 987654321 1208 00000010000 6

CheckCheck DigitDigitcalculationcalculationC,for fields B, D, andE B, C,for fields Modulus using F starting(21…) 10 D,the from digit.left E and 10 (21…) startingModulus F using from the left digit.

CheckNumberDigit calculation B, fields for C,digits:D, andE using F 10 Modulus starting(21…) 1 left digit.from the 2 3 4 5 6 7 8 9 9 8 7 6 5 4 3 2 1 1 2 0 8 0 0 0 0 0 0 1 0 0 0 0

Number digits: 1 2 3 4 5 6 7 8 9 9 8 7 6 5 4 3 2 1 1 2 0 8 0 0 0 0 0 0 1 0 0 0 0

Multiplier: Number digits:2 1 1 2 2 3 4 1 5 6 2 7 8 1 9 9 2 8 7 1 6 5 4 2 3 2 1 1 2 1 1 2 2 0 1 8 0 2 0 0 1 0 0 2 0 1 1 0 0 2 0 0 1 2 1 2 1 2 1 2 1 2 1 2 1 2

Mutiplier:Multiplie 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2

Results: r: 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 2 2 6 4 10 6 14 8 18 9 16 7 12 5 8 3 4 1 2 2 0 8 0 0 0 0 0 0 2 0 0 0 0

Results:Results: 2 2 2 62 4 6 4 106 106 148 8 189 149 16 77 121855 8 8163 34 1 4 12 2122 20 08 80 0 00 0 00 00 2 0 00 0 00 0 2 0 0 0 0

Sum = 2+2+6+4+1+0+6+1+4+8+1+8+9+1+6+7+1+2+5+8+3+4+1+2+2+0+8+0+0+0+0+0+0+2+0+0+0+0=104

Sum = 2+2+6+4+1+0+6+1+4+8+1+8+9+1+6+7+1+2+5+8+3+4+1+2+2+0+8+0+0+0+0+0+0+2+0+0+0+0=104

SumCheck= 2+2+6+4+1+0+6+1+4+8+1+8+9+1+6+7+1+2+5+8+3+4+1+2+2+0+8+0+0+0+0+0+0+2+0+0+0+0=104Digit = 10 – 4 = 6

CheckCheckDigit = 4 10 Digit = 10 ––4 = 6 6

Example for Scan Line with alpha (4 letters in name control field):

ExampleExampleColumnfor Scanfor ScanLine withalphawith Line letters name(4 in alpha field): control 1 (4 letters in name control field): 2 3 4 5 6 7

Column1234567890123456789012345678901234567890123456789012345678901234567890 1 2 3 4 5 6 7

1234567890123456789012345678901234567890123456789012345678901234567890 AAAAAAAAXXBBBBBBBBBXXCCCCCCCCCXXDDEEXXFFFFXXGGGGGGGGGGGXXXXXH

33321027 123456789 987654321 1207 CLAR 00000010000 7 AAAAAAAAXXBBBBBBBBBXXCCCCCCCCCXXDDEEXXFFFFXXGGGGGGGGGGGXXXXXH

33321027 123456789 987654321 1207 CLAR 00000010000 7

The alpha translation into numeric for check digit calculation is as follows: A=1, B=2, C=3, D=4, E=5, F=6, G=7, H=8,

The alpha translation into numeric for check digit calculation is as follows: A=1, B=2, C=3, D=4, E=5, F=6, G=7, H=8, I=9,

I=9, J=1, K=2, L=3, M=4, N=5, O=6, P=7, Q=8 R=9, S=2, T=3, U=4, V=5, W=6, X=7, Y=8, Z=9. The alpha translation into numeric for check digit calculation is as follows: A=1, B=2, C=3, D=4, E=5, F=6, G=7, H=8,

J=1, K=2, L=3, M=4, N=5, O=6, P=7, Q=8 R=9, S=2, T=3, U=4, V=5, W=6, X=7, Y=8, Z=9.I=9, J=1, K=2, L=3, M=4, N=5, O=6, P=7, Q=8 R=9, S=2, T=3, U=4, V=5, W=6, X=7, Y=8, Z=9.

Check Digit calculation for fields B, C, D, E, F and G using Modulus 10 (21…) starting from the left digit.

CheckCheckNumberDigitDigitcalculationcalculationC,for fields B, digits:D, F andE, B, fields for C,Modulus using G starting(21…) 10 D,1 left from the digit.F E, and2 (21…) 10 using startingG Modulus 3 4 5 6 7 thefrom 8 9 9 left8 7 6 5 4 3 2 1 1 2 0 7 C L A R 0 0 0 0 0 0 1 0 0 0 0

digit.Multiplier: Number digits:2 1 1 2 2 3 4 1 5 6 2 7 8 9 1 9 8 2 7 6 1 5 4 2 3 2 1 1 2 1 1 2 2 0 1 7 C 2 L A 1 R 2 0 0 0 1 0 0 2 0 1 1 0 2 0 0 1 0 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2

Number digits:Multiplier: 4 53 1 2 8 96 7 9 6 58 7 3 4 0 7 C2 2 1 1 L 0 0 1 0 0 0 R A 0 0 0 00 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2

Results: 2 2 6 4 10 6 14 8 18 9 16 7 12 5 8 3 4 1 2 2 0 7 6 3 2 9 0 0 0 0 0 0 2 0 0 0 0

Mutiplier:Results: 2 2 6 4 10 6 14 8 18 9 16 7 12 5 8 3 4 1 2 2 0 7 6 3 2 9 0 0 0 0 0 0 2 0 0 0 0 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2 1 2

Results:Sum = 2+2+6+4+1+0+6+1+4+8+1+8+9+1+6+7+1+2+5+8+3+4+1+2+2+0+7+6+3+2+9+0+0+0+0+0+0+2+0+0+0+0=1232 2 6 4 6 108 9 147 185 8163 4 1 2122 0 7 6 3 2 9 0 0 0 0 0 0 2 0 0 0 0

Sum = 2+2+6+4+1+0+6+1+4+8+1+8+9+1+6+7+1+2+5+8+3+4+1+2+2+0+7+6+3+2+9+0+0+0+0+0+0+2+0+0+0+0=123

Sum = 2+2+6+4+1+0+6+1+4+8+1+8+9+1+6+7+1+2+5+8+3+4+1+2+2+0+7+6+3+2+9+0+0+0+0+0+0+2+0+0+0+0=123

Check Digit = 10 – 3 = 7

CheckCheckDigit = 3 10 Digit = 10 ––3 = 7 7

12 SCDOR |2024 Software Dev Guide

|