Enlarge image

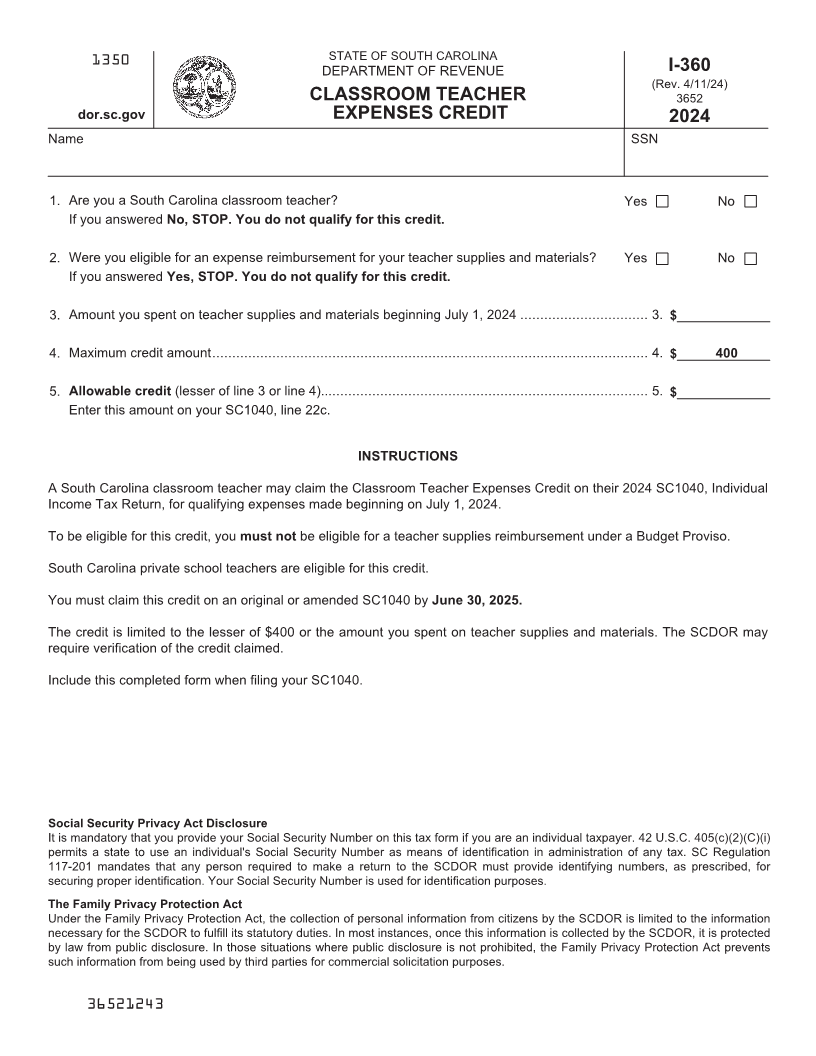

1350 STATE OF SOUTH CAROLINA

DEPARTMENT OF REVENUE I-360

(Rev. 4/11/24)

CLASSROOM TEACHER 3652

dor.sc.gov EXPENSES CREDIT 2024

Name SSN

1. Are you a South Carolina classroom teacher? Yes No

If you answered No, STOP. You do not qualify for this credit.

2. Were you eligible for an expense reimbursement for your teacher supplies and materials? Yes No

If you answered Yes, STOP. You do not qualify for this credit.

3. Amount you spent on teacher supplies and materials beginning July 1, 2024 ................................ 3. $

4. Maximum credit amount............................................................................................................. 4. $ 400

5. Allowable credit (lesser of line 3 or line 4).................................................................................. 5. $

Enter this amount on your SC1040, line 22c.

INSTRUCTIONS

A South Carolina classroom teacher may claim the Classroom Teacher Expenses Credit on their 2024 SC1040, Individual

Income Tax Return, for qualifying expenses made beginning on July 1, 2024.

To be eligible for this credit, you must not be eligible for a teacher supplies reimbursement under a Budget Proviso.

South Carolina private school teachers are eligible for this credit.

You must claim this credit on an original or amended SC1040 by June 30, 2025.

The credit is limited to the lesser of $400 or the amount you spent on teacher supplies and materials. The SCDOR may

require verification of the credit claimed.

Include this completed form when filing your SC1040.

Social Security Privacy Act Disclosure

It is mandatory that you provide your Social Security Number on this tax form if you are an individual taxpayer. 42 U.S.C. 405(c)(2)(C)(i)

permits a state to use an individual's Social Security Number as means of identification in administration of any tax. SC Regulation

117-201 mandates that any person required to make a return to the SCDOR must provide identifying numbers, as prescribed, for

securing proper identification. Your Social Security Number is used for identification purposes.

The Family Privacy Protection Act

Under the Family Privacy Protection Act, the collection of personal information from citizens by the SCDOR is limited to the information

necessary for the SCDOR to fulfill its statutory duties. In most instances, once this information is collected by the SCDOR, it is protected

by law from public disclosure. In those situations where public disclosure is not prohibited, the Family Privacy Protection Act prevents

such information from being used by third parties for commercial solicitation purposes.

36521243