Enlarge image

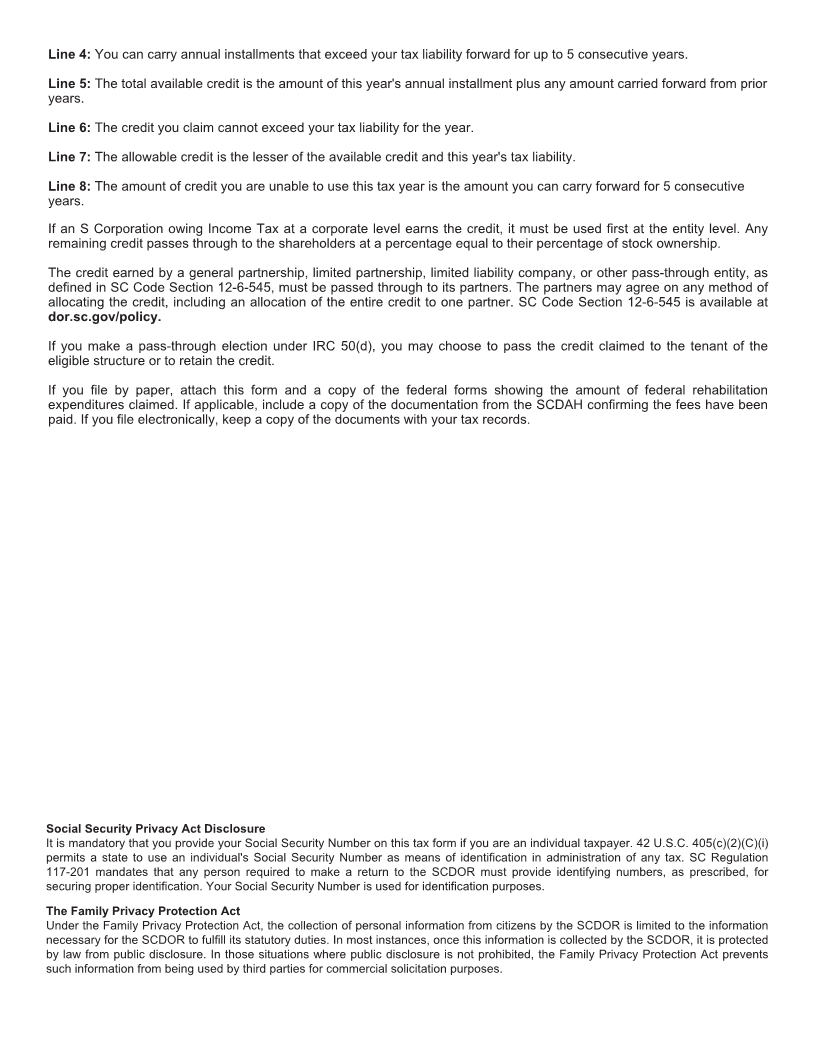

1350 STATE OF SOUTH CAROLINA

DEPARTMENT OF REVENUE SC SCH.TC-21

(Rev. 4/30/24)

CREDIT FOR A CERTIFIED HISTORIC STRUCTURE 3380

dor.sc.gov

20

Name SSN or FEIN

If credit was received from a pass-through entity, name and FEIN of the entity

1. Rehabilitation expenses made to a property located in South Carolina and placed in service

during this tax year ...............................................................................................................1.

If rehabilitation expenses are $500,000 or greater, attach documentation that the preliminary

and final fees were paid to the South Carolina Department of Archives and History (SCDAH).

2. Credit amount earned (10% or 25% of line 1; see instructions) ................................................2.

3. Annual installment amount (divide line 2 by 3 for property placed in service this year, or enter

the previous year's installment amount)..................................................................................3.

4. Amount carried forward from prior tax years ..........................................................................4.

5. Add line 3 and line 4 ............................................................................................................5.

6. Current year tax liability ........................................................................................................6.

7. Current year credit (lesser of line 5 and line 6)........................................................................7.

Individuals: enter the credit on the SC1040TC.

Corporations: enter the credit on the SC1120TC.

8. Credit carryforward (subtract line 7 from line 5).......................................................................8.

Unused credits can be carried forward for five years.

INSTRUCTIONS

Taxpayers can take the Certified Historic Structure Credit against their Income Tax or Corporate License Fee. The credit

is for qualified rehabilitation expenditures to a certified historic structure, as defined in IRC Section 47 and applicable

Internal Revenue Service regulations. To be eligible, a rehabilitation project must meet all requirements for the federal

20% Income Tax credit under IRC Section 47.

Additional work done within five years must be consistent with the Secretary of the Interior's Standards for Rehabilitation.

The State Historic Preservation Officer may review and inspect the additional work. If the State Historic Preservation

Officer determines the additional work is inconsistent with the Standards for Rehabilitation, you will forfeit any unused

credit. If you disagree with the determination, you can request a review by filing an appeal with the State Review Board.

Complete a separate TC-21 for each rehabilitated property. To claim a credit for rehabilitation expenses for a certified

historic residential structure, complete the TC-22.

Line instructions

Line 1: Enter the amount of qualifying rehabilitation expenses made to a certified historic structure located in South

Carolina and placed in service during this tax year.

For projects with rehabilitation expenses of $500,000 or greater, a taxpayer claiming a credit must pay a preliminary fee

and final fee to the SCDAH. The fee schedule is located in SC Code Section 12-6-3535, available at dor.sc.gov/policy.

When filing the TC-21, include a copy of the documentation from the SCDAH confirming that you have paid the fees.

Line 2: The South Carolina credit amount is 10% of the amount qualifying under IRC Section 47. You may elect a 25%

tax credit instead of the 10% credit, not to exceed $1 million for each certified historic structure.

Line 3: The credit is claimed in equal installments over a three-year period beginning with the tax year the property is

placed in service. To calculate the installment amount in the year the property is placed in service, divide line 2 by 3. If the

property was placed in service in a prior year, enter the amount from line 3 of last year's TC-21.

33801028