Enlarge image

of

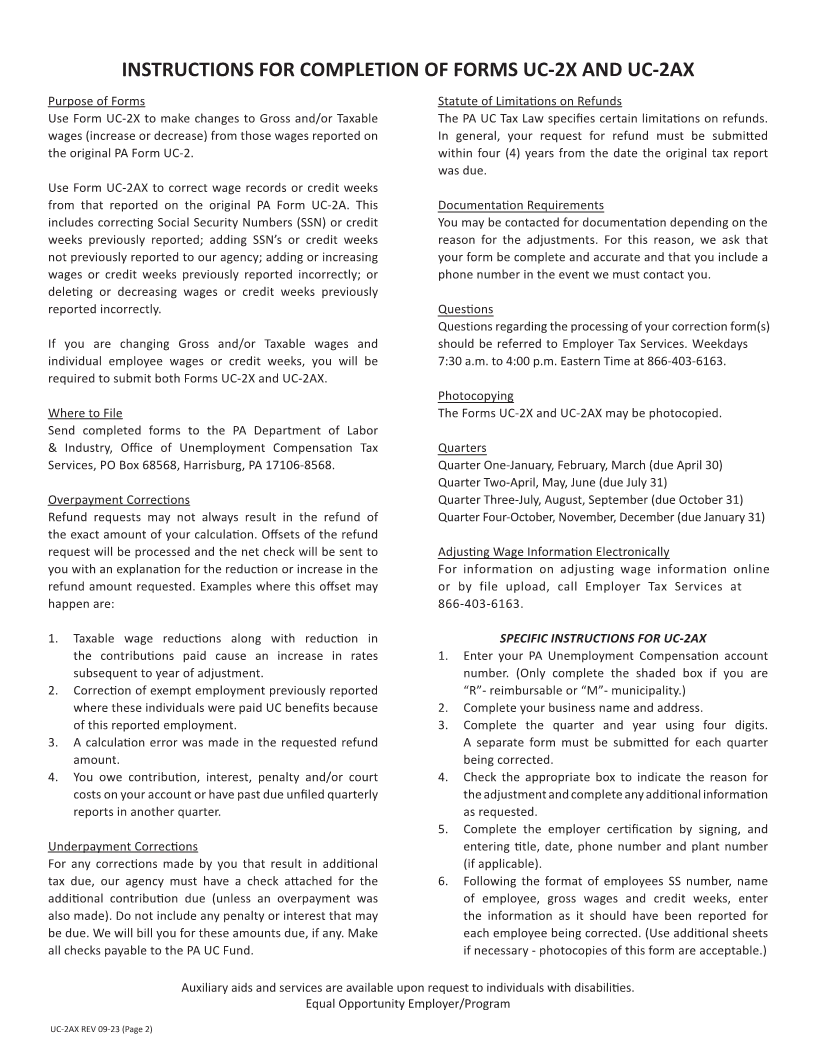

CORRECTED PENNSYLVANIA GROSS WAGES PAID TO EMPLOYEES

1. EMPLOYER ACCOUNT NUMBER 3. QUARTER/YEAR (A separate form must be submitted for each quarter)

- -

R or M CHECK DIGIT 1, 2,

3 or 4

2. Employer Business Name and Address: 4. Reason For Correction (Check all that apply):

Incorrect Employee Social Security Number

Correct Employee Social Security Number

Employee Name

Incorrect Employee Name

Correct Employee Name

Employee Social Security Number

Exempt Wages. Reason:

Employee Wage Adjustment (attach UC-2X, necessary) if

Reason:

Incorrect Credit Weeks

Other (Please explain):

5. I certify that the information on this form is true and correct to the best of my knowledge and belief. No part of the amount of employer contributions reported on taxable

wages was deducted or is to be deducted from the employees’ wages.

SIGNATURE OF OWNER, PARTNER, RESPONSIBLE OFFICER OR AUTHORIZED AGENT TITLE DATE PHONE NUMBER PLANT NUMBER

EMPLOYEE’S

6. NAME OF EMPLOYEE GROSS WAGES CREDIT

SOCIAL SECURITY NO. FIRST NAME INITIAL LAST NAME DOLLARS CENTS WEEKS

COMMONWEALTH OF PENNSYLVANIA DEPARTMENT OF LABOR & INDUSTRY OFFICE OF UNEMPLOYMENT COMPENSATION TAX SERVICES

UC-2AX REV 09-23 (Page 1)