Enlarge image

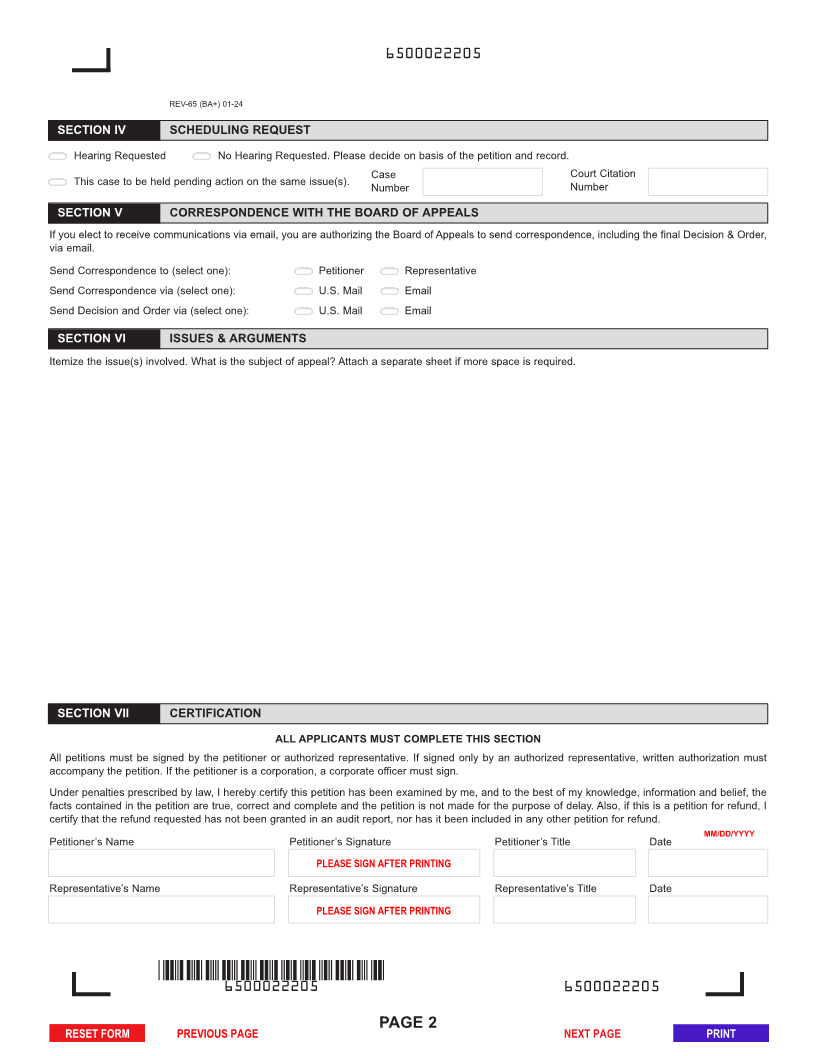

IMPORTANT: FILL IN FORM MUST BE DOWNLOADED ONTO YOUR COMPUTER PRIOR TO COMPLETING

6500022105

(BA+) 01-24

OFFICIAL USE ONLY

REV-65

BOARD OF APPEALS BOARD OF APPEALS

PO BOX 281021

HARRISBURG PA 17128-1021 PETITION FORM

START SECTION I TAX INFORMATION

MM/DD/YYYY

Ü Tax Type Appealed (select one): Tax Period Begin Date

Personal Income Tax Corporation Tax Sales/Use Tax

Employer Withholding Inheritance Tax PTRR Other Tax Period End Date

Type of Petition: Refund Reassessment/Review

FOR REFUND PETITION ONLY:

If petition is in regard to sales tax, please list amount(s) below:

Cash Total Refund Requested PA Tax Refund Philadelphia Tax Refund Allegheny County Tax Refund

Credit

FOR REASSESSMENT/REVIEW PETITION ONLY: MM/DD/YYYY

Assessment Letter ID Assessment Letter Mail Date Tax Assessment Amount Penalty/Fees Assessment Amount

MM/DD/YYYY

Paid: Yes No If paid, date paid

Are there any current Yes Audit Number Are there any current Yes Docket Number

audits for this taxpayer appeals for this taxpayer

or tax period? No or tax period? No

SECTION II PETITIONER INFORMATION

Individual Corporation Partnership (attach list of partners & addresses) Other

MM/DD/YYYY

Estate Date of Death (required for estates &

personal income tax fiduciary appeals)

Legal Name (for individual applicants give your full legal name) SSN/FEIN Account ID

Trade Name or DBA (if different from Legal Name) Secondary ID (see instructions) Telephone Number

Contact Last Name Contact First Name Email Address

Address City State ZIP Code Country Code

SECTION III REPRESENTATIVE INFORMATION

Company Name Telephone Number

Contact Last Name Contact First Name Email Address

Address City State ZIP Code Country Code

6500022105 6500022105

PAGE 1

RESET FORM TOP OF PAGE NEXT PAGE PRINT