Enlarge image

(EX) 10-23 2024 INDIVIDUALS

REV-414 (I) WORKSHEET FOR OFFICIAL USE ONLY

PO BOX 281210 ESTIMATED TAX

HARRISBURG PA 17128-1210 Keep for Your Records

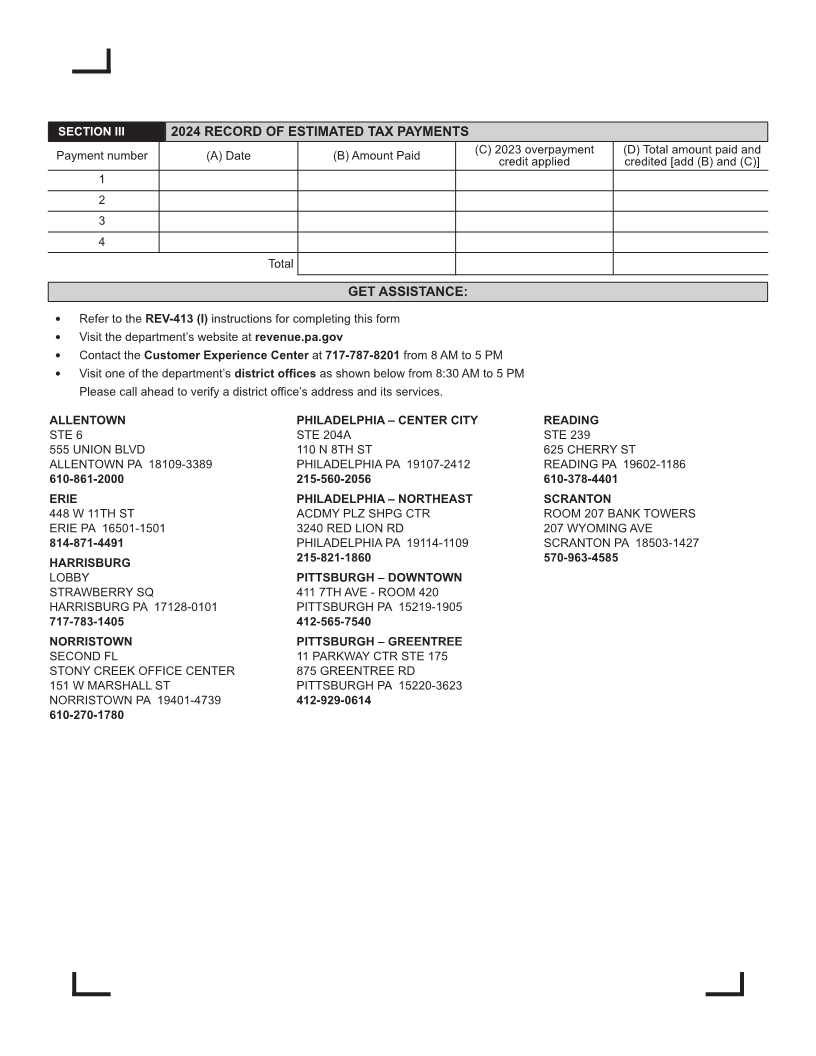

SECTION I 2024 PA ESTIMATED TAX PAYMENT WORKSHEET

1. 2024 Estimated Income. See the instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .1.

2. 2024 Estimated Tax. Multiply the amount on Line 1 by 3.07% (0.0307). . . . . . . . . . . . . . . . . . . . . . . . . . . . .2.

3. Estimated 2024 resident credit for income tax to be paid to other states. . . . . . . . .3.

4. Estimated 2024 PA Schedule OC Credits. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .4.

5. Estimated 2024 Special Tax Forgiveness Credit. . . . . . . . . . . . . . . . . . . . . . . . . . . .5.

6. Estimated 2024 PA Schedule DC Credits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .6.

7. Total Estimated Credits. Add Lines 3 through 6. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .7.

8. 2024 Estimated Tax Net of Estimated Credits. Subtract Line 7 from Line 2. . . . . . . . . . . . . . . . . . . . . . .8.

9. Enter 90% of Line 8. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .9.

10. Safe Harbor Method Income. See the instructions.

Enter 100% of your PA taxable income for 2023. . . . . . . . . . . . . . . . . . . . . . . . . . .10.

NOTE: If a part-year resident for 2023 or no return filed for 2023, skip Lines 10 through 14 and enter the amount from Line 9 on Line 15.

11. Safe Harbor Method Tax Liability. Multiply Line 10 by 3.07% (0.0307). . . . . . . . . . .11.

12. Expected 2024 Withholdings. See the instructions. . . . . . . . . . . . . . . . . . . . . . . . .12.

13. Total Withholdings and Credits. Add Lines 7 and 12. . . . . . . . . . . . . . . . . . . . . . . .13.

14. Safe Harbor Method Net Estimated Tax Liability. See the instructions. . . . . . . . . . .14.

15. Total 2024 Estimated Tax Liability. Enter the smaller of Line 9 or 14. . . . . . . . . . . .15.

16. Nonresident Withholding Adjustment. If you are a non-PA resident,

include income tax to be withheld by your PA S corporation or partnership,

by an estate or trust, or to be included on federal Form 1099-MISC, or 1099-NEC. . .16.

17. TOTAL 2024 REQUIRED ESTIMATED TAX. See the instructions. . . . . . . . . . . . .17.

NOTE. The department will apply your credit from your 2023 PA PIT return on the due date of your 2023 PA return. If your 2023 credit is

greater than your first 2024 installment payment, it is not necessary that you file your first estimated form. The department does not

require a 2024 PA PIT estimated form until you must make a payment to your estimated account.

SECTION II 2024 AMENDED PA ESTIMATED TAX SCHEDULE

1. Amended estimated tax. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .1.

2. Amount of 2023 overpayment applied to 2024 estimated tax and payments to date. . . . . . . . . . . . . . . . . . .2.

3. Estimated tax payments to date. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .3.

4. Total (add Lines 2 and 3). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .4.

5. Unpaid balance (subtract Line 4 from Line 1). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .5.