Enlarge image

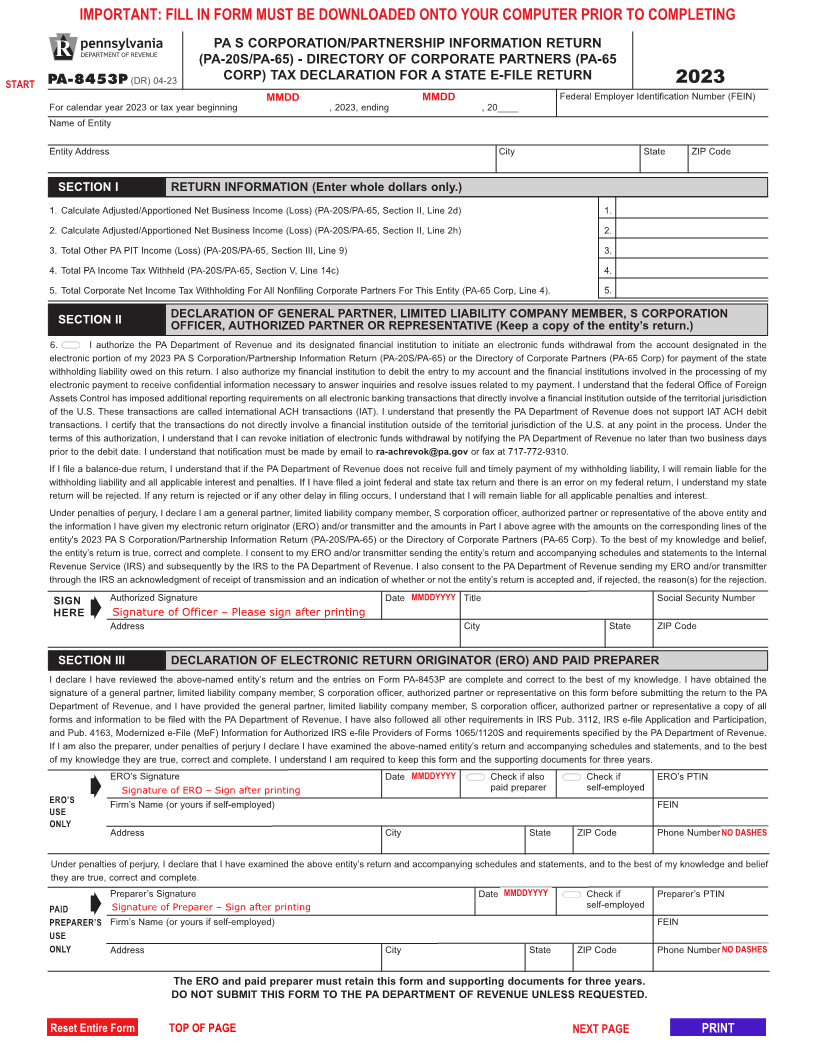

IMPORTANT: FILL IN FORM MUST BE DOWNLOADED ONTO YOUR COMPUTER PRIOR TO COMPLETING

PA S CORPORATION/PARTNERSHIP INFORMATION RETURN

(PA-20S/PA-65) - DIRECTORY OF CORPORATE PARTNERS (PA-65

START PA-8453P (DR) 04-23 CORP) TAX DECLARATION FOR A STATE E-FILE RETURN 2023

Federal Employer Identification Number (FEIN)

Ü For calendar year 2023 or tax year beginning MMDD , 2023, ending MMDD , 20_ ___

Name of Entity

Entity Address City State ZIP Code

SECTION I RETURN INFORMATION (Enter whole dollars only.)

1. Calculate Adjusted/Apportioned Net Business Income (Loss) (PA-20S/PA-65, Section II, Line 2d) 1.

2. Calculate Adjusted/Apportioned Net Business Income (Loss) (PA-20S/PA-65, Section II, Line 2h) 2.

3. Total Other PA PIT Income (Loss) (PA-20S/PA-65, Section III, Line 9) 3.

4. Total PA Income Tax Withheld (PA-20S/PA-65, Section V, Line 14c) 4.

5. Total Corporate Net Income Tax Withholding For All Nonfiling Corporate Partners For This Entity (PA-65 Corp, Line 4). 5.

SECTION II DECLARATION OF GENERAL PARTNER, LIMITED LIABILITY COMPANY MEMBER, S CORPORATION

OFFICER, AUTHORIZED PARTNER OR REPRESENTATIVE (Keep a copy of the entity’s return.)

6. I authorize the PA Department of Revenue and its designated financial institution to initiate an electronic funds withdrawal from the account designated in the

electronic portion of my 2023 PA S Corporation/Partnership Information Return (PA-20S/PA-65) or the Directory of Corporate Partners (PA-65 Corp) for payment of the state

withholding liability owed on this return. I also authorize my financial institution to debit the entry to my account and the financial institutions involved in the processing of my

electronic payment to receive confidential information necessary to answer inquiries and resolve issues related to my payment. I understand that the federal Office of Foreign

Assets Control has imposed additional reporting requirements on all electronic banking transactions that directly involve a financial institution outside of the territorial jurisdiction

of the U.S. These transactions are called international ACH transactions (IAT). I understand that presently the PA Department of Revenue does not support IAT ACH debit

transactions. I certify that the transactions do not directly involve a financial institution outside of the territorial jurisdiction of the U.S. at any point in the process. Under the

terms of this authorization, I understand that I can revoke initiation of electronic funds withdrawal by notifying the PA Department of Revenue no later than two business days

prior to the debit date. I understand that notification must be made by email to ra-achrevok@pa.gov or fax at 717-772-9310.

If I file a balance-due return, I understand that if the PA Department of Revenue does not receive full and timely payment of my withholding liability, I will remain liable for the

withholding liability and all applicable interest and penalties. If I have filed a joint federal and state tax return and there is an error on my federal return, I understand my state

return will be rejected. If any return is rejected or if any other delay in filing occurs, I understand that I will remain liable for all applicable penalties and interest.

Under penalties of perjury, I declare I am a general partner, limited liability company member, S corporation officer, authorized partner or representative of the above entity and

the information I have given my electronic return originator (ERO) and/or transmitter and the amounts in Part I above agree with the amounts on the corresponding lines of the

entity's 2023 PA S Corporation/Partnership Information Return (PA-20S/PA-65) or the Directory of Corporate Partners (PA-65 Corp). To the best of my knowledge and belief,

the entity’s return is true, correct and complete. I consent to my ERO and/or transmitter sending the entity’s return and accompanying schedules and statements to the Internal

Revenue Service (IRS) and subsequently by the IRS to the PA Department of Revenue. I also consent to the PA Department of Revenue sending my ERO and/or transmitter

through the IRS an acknowledgment of receipt of transmission and an indication of whether or not the entity’s return is accepted and, if rejected, the reason(s) for the rejection.

SIGN Authorized Signature Date MMDDYYYY Title Social Security Number

HERE Á Signature of Officer – Please sign after printing

Address City State ZIP Code

SECTION III DECLARATION OF ELECTRONIC RETURN ORIGINATOR (ERO) AND PAID PREPARER

I declare I have reviewed the above-named entity’s return and the entries on Form PA-8453P are complete and correct to the best of my knowledge. I have obtained the

signature of a general partner, limited liability company member, S corporation officer, authorized partner or representative on this form before submitting the return to the PA

Department of Revenue, and I have provided the general partner, limited liability company member, S corporation officer, authorized partner or representative a copy of all

forms and information to be filed with the PA Department of Revenue. I have also followed all other requirements in IRS Pub. 3112, IRS e-file Application and Participation,

and Pub. 4163, Modernized e-File (MeF) Information for Authorized IRS e-file Providers of Forms 1065/1120S and requirements specified by the PA Department of Revenue.

If I am also the preparer, under penalties of perjury I declare I have examined the above-named entity’s return and accompanying schedules and statements, and to the best

of my knowledge they are true, correct and complete. I understand I am required to keep this form and the supporting documents for three years.

ERO’s Signature Date MMDDYYYY Check if also Check if ERO’s PTIN

paid preparer self-employed

ERO’S Á Signature of ERO – Sign after printing

Firm’s Name (or yours if self-employed) FEIN

USE

ONLY

Address City State ZIP Code Phone Number NO DASHES

Under penalties of perjury, I declare that I have examined the above entity’s return and accompanying schedules and statements, and to the best of my knowledge and belief

they are true, correct and complete.

Preparer’s Signature Date MMDDYYYY Check if Preparer’s PTIN

self-employed

PAID Á Signature of Preparer – Sign after printing

PREPARER’S Firm’s Name (or yours if self-employed) FEIN

USE

ONLY Address City State ZIP Code Phone Number NO DASHES

The ERO and paid preparer must retain this form and supporting documents for three years.

DO NOT SUBMIT THIS FORM TO THE PA DEPARTMENT OF REVENUE UNLESS REQUESTED.

Reset Entire Form TOP OF PAGE NEXT PAGE PRINT