- 7 -

Enlarge image

|

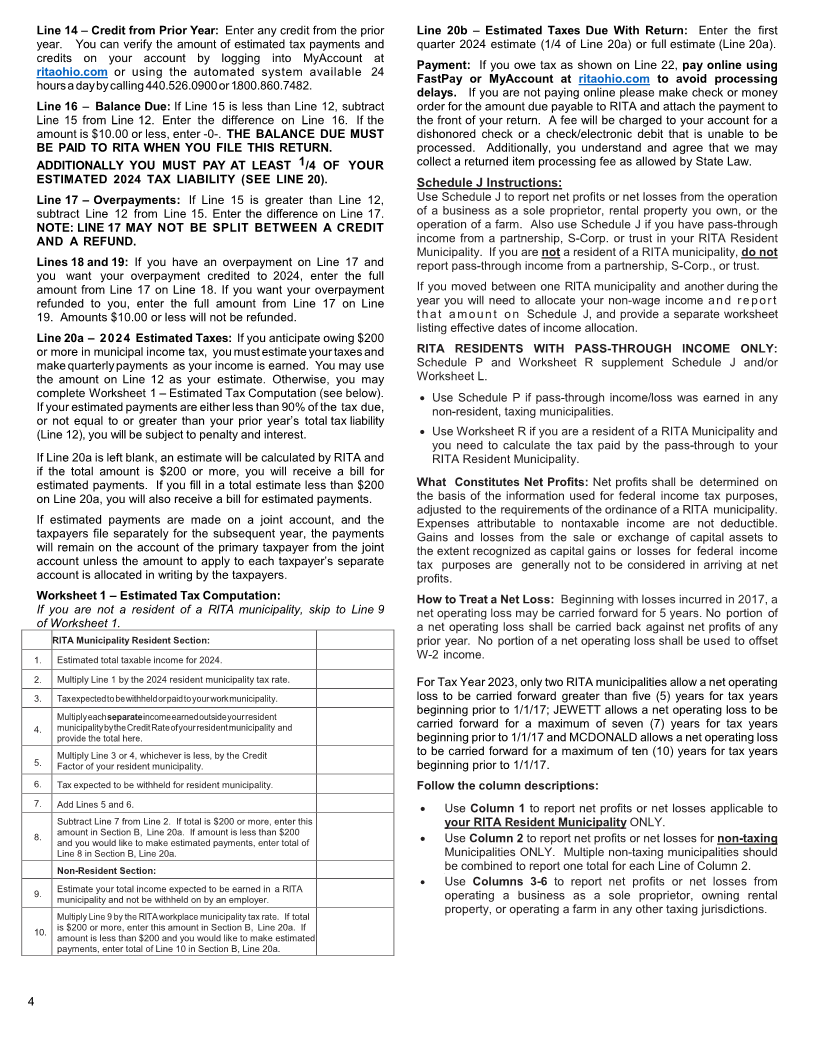

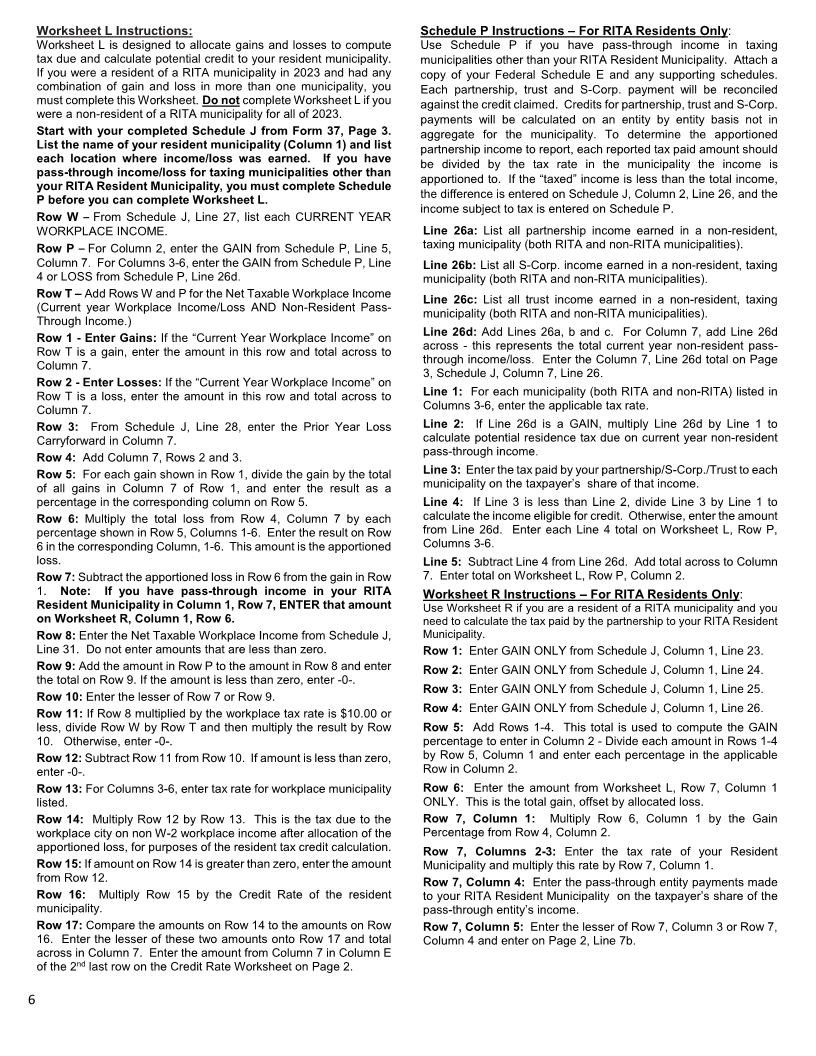

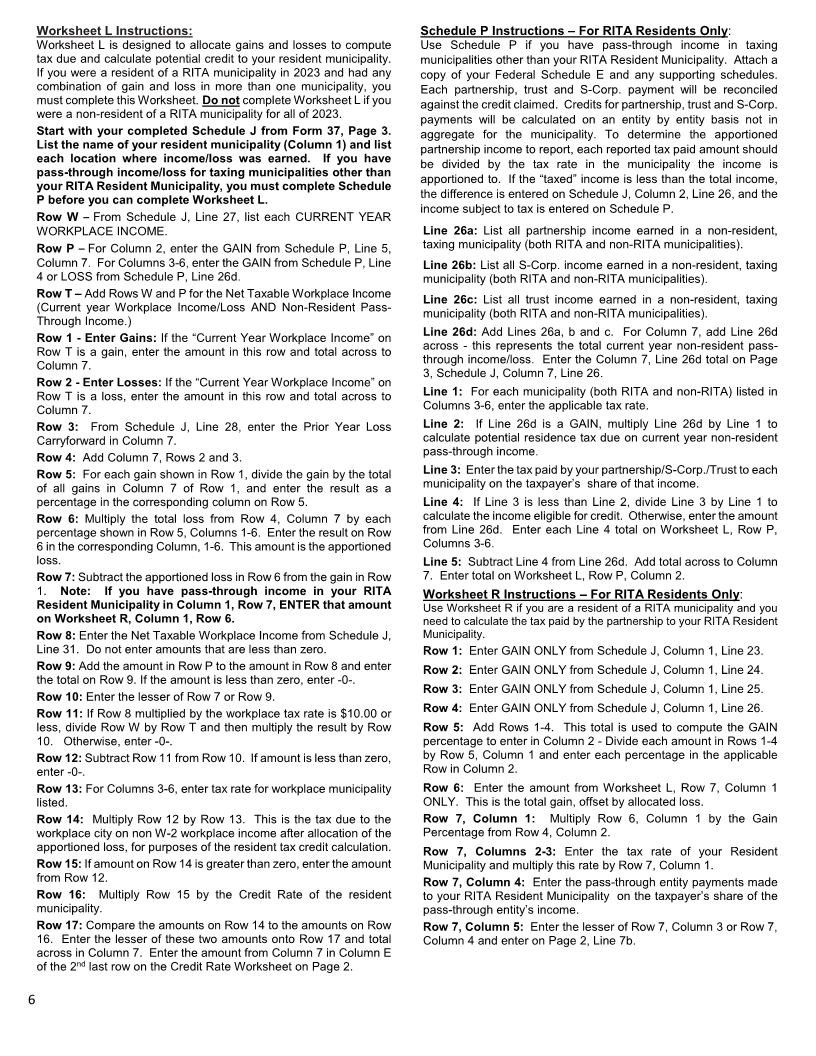

Worksheet L Instructions: Schedule P Instructions – For RITA Residents Only:

Worksheet L is designed to allocate gains and losses to compute Use Schedule P if you have pass-through income in taxing

tax due and calculate potential credit to your resident municipality. municipalities other than your RITA Resident Municipality. Attach a

If you were a resident of a RITA municipality in 2023 and had any copy of your Federal Schedule E and any supporting schedules.

combination of gain and loss in more than one municipality, you Each partnership, trust and S-Corp. payment will be reconciled

must complete this Worksheet. Do not complete Worksheet L if you against the credit claimed. Credits for partnership, trust and S-Corp.

were a non-resident of a RITA municipality for all of 2023. payments will be calculated on an entity by entity basis not in

Start with your completed Schedule J from Form 37, Page 3. aggregate for the municipality. To determine the apportioned

List the name of your resident municipality (Column 1) and list partnership income to report, each reported tax paid amount should

each location where income/loss was earned. If you have be divided by the tax rate in the municipality the income is

pass-through income/loss for taxing municipalities other than apportioned to. If the “taxed” income is less than the total income,

your RITA Resident Municipality, you must complete Schedule

the difference is entered on Schedule J, Column 2, Line 26, and the

P before you can complete Worksheet L.

income subject to tax is entered on Schedule P.

Row W – From Schedule J, Line 27, list each CURRENT YEAR

WORKPLACE INCOME. Line 26a: List all partnership income earned in a non-resident,

Row P – For Column 2, enter the GAIN from Schedule P, Line 5, taxing municipality (both RITA and non-RITA municipalities).

Column 7. For Columns 3-6, enter the GAIN from Schedule P, Line Line 26b: List all S-Corp. income earned in a non-resident, taxing

4 or LOSS from Schedule P, Line 26d. municipality (both RITA and non-RITA municipalities).

Row T – Add Rows W and P for the Net Taxable Workplace Income Line 26c: List all trust income earned in a non-resident, taxing

(Current year Workplace Income/Loss AND Non-Resident Pass- municipality (both RITA and non-RITA municipalities).

Through Income.)

Row 1 - Enter Gains: If the “Current Year Workplace Income” on Line 26d: Add Lines 26a, b and c. For Column 7, add Line 26d

Row T is a gain, enter the amount in this row and total across to across - this represents the total current year non-resident pass-

through income/loss. Enter the Column 7, Line 26d total on Page

Column 7. 3, Schedule J, Column 7, Line 26.

Row 2 - Enter Losses: If the “Current Year Workplace Income” on

Row T is a loss, enter the amount in this row and total across to Line 1: For each municipality (both RITA and non-RITA) listed in

Columns 3-6, enter the applicable tax rate.

Column 7.

Row 3: From Schedule J, Line 28, enter the Prior Year Loss Line 2: If Line 26d is a GAIN, multiply Line 26d by Line 1 to

Carryforward in Column 7. calculate potential residence tax due on current year non-resident

pass-through income.

Row 4: Add Column 7, Rows 2 and 3.

Row 5: For each gain shown in Row 1, divide the gain by the total Line 3: Enter the tax paid by your partnership/S-Corp./Trust to each

of all gains in Column 7 of Row 1, and enter the result as a municipality on the taxpayer’s share of that income.

percentage in the corresponding column on Row 5. Line 4: If Line 3 is less than Line 2, divide Line 3 by Line 1 to

Row 6: Multiply the total loss from Row 4, Column 7 by each calculate the income eligible for credit. Otherwise, enter the amount

percentage shown in Row 5, Columns 1-6. Enter the result on Row from Line 26d. Enter each Line 4 total on Worksheet L, Row P,

6 in the corresponding Column, 1-6. This amount is the apportioned Columns 3-6.

loss. Line 5: Subtract Line 4 from Line 26d. Add total across to Column

Row 7:Subtract the apportioned loss in Row 6 from the gain in Row 7. Enter total on Worksheet L, Row P, Column 2.

1. Note: If you have pass-through income in your RITA Worksheet R Instructions – For RITA Residents Only:

Resident Municipality in Column 1, Row 7, ENTER that amount Use Worksheet R if you are a resident of a RITA municipality and you

on Worksheet R, Column 1, Row 6. need to calculate the tax paid by the partnership to your RITA Resident

Row 8:Enter the Net Taxable Workplace Income from Schedule J, Municipality.

Line 31. Do not enter amounts that are less than zero. Row 1: Enter GAIN ONLY from Schedule J, Column 1, Line 23.

Row 9:Add the amount in Row P to the amount in Row 8 and enter Row 2: Enter GAIN ONLY from Schedule J, Column 1, Line 24.

the total on Row 9. If the amount is less than zero, enter -0-.

Row 3: Enter GAIN ONLY from Schedule J, Column 1, Line 25.

Row 10: Enter the lesser of Row 7 or Row 9.

Row 11: If Row 8 multiplied by the workplace tax rate is $10.00 or Row 4: Enter GAIN ONLY from Schedule J, Column 1, Line 26.

less, divide Row W by Row T and then multiply the result by Row Row 5: Add Rows 1-4. This total is used to compute the GAIN

10. Otherwise, enter -0-. percentage to enter in Column 2 - Divide each amount in Rows 1-4

Row 12: Subtract Row 11 from Row 10. If amount is less than zero, by Row 5, Column 1 and enter each percentage in the applicable

enter -0-. Row in Column 2.

Row 13: For Columns 3-6, enter tax rate for workplace municipality Row 6: Enter the amount from Worksheet L, Row 7, Column 1

listed. ONLY. This is the total gain, offset by allocated loss.

Row 14: Multiply Row 12 by Row 13. This is the tax due to the Row 7, Column 1: Multiply Row 6, Column 1 by the Gain

workplace city on non W-2 workplace income after allocation of the Percentage from Row 4, Column 2.

apportioned loss, for purposes of the resident tax credit calculation. Row 7, Columns 2-3: Enter the tax rate of your Resident

Row 15:If amount on Row 14 is greater than zero, enter the amount Municipality and multiply this rate by Row 7, Column 1.

from Row 12. Row 7, Column 4: Enter the pass-through entity payments made

Row 16: Multiply Row 15 by the Credit Rate of the resident to your RITA Resident Municipality on the taxpayer’s share of the

municipality. pass-through entity’s income.

Row 17: Compare the amounts on Row 14 to the amounts on Row Row 7, Column 5: Enter the lesser of Row 7, Column 3 or Row 7,

16. Enter the lesser of these two amounts onto Row 17 and total Column 4 and enter on Page 2, Line 7b.

across in Column 7. Enter the amount from Column 7 in Column E

of the 2 ndlast row on the Credit Rate Worksheet on Page 2.

6

|