Enlarge image

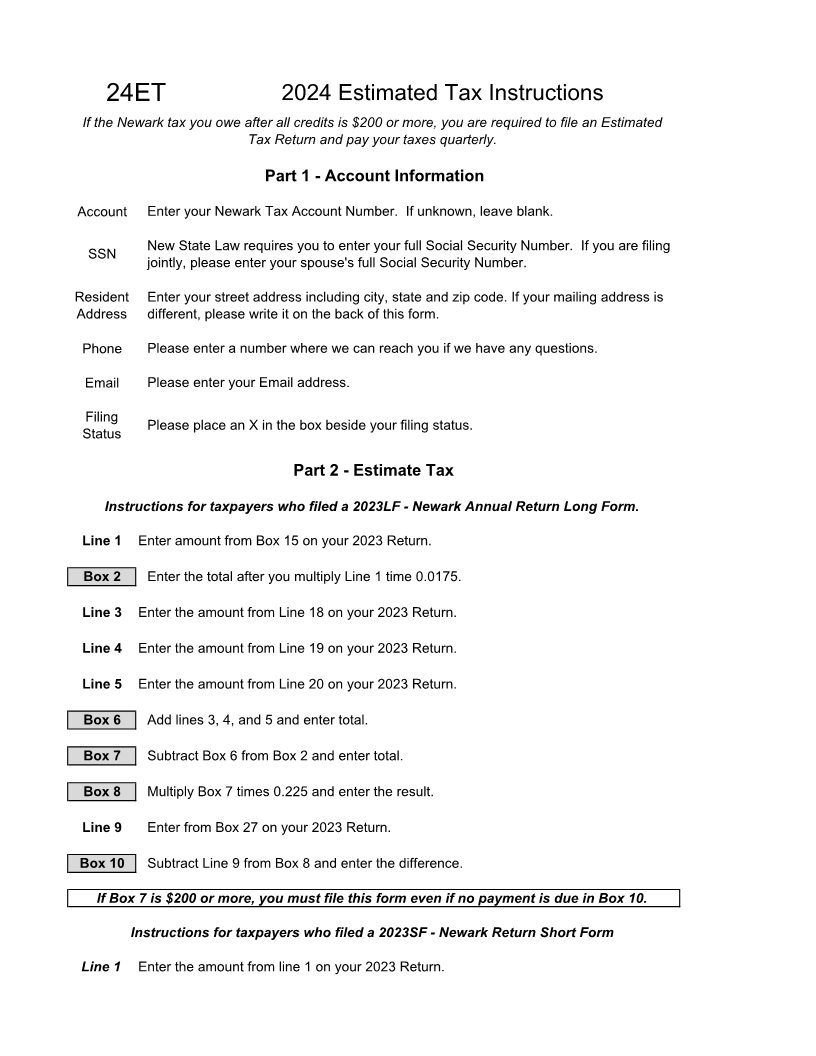

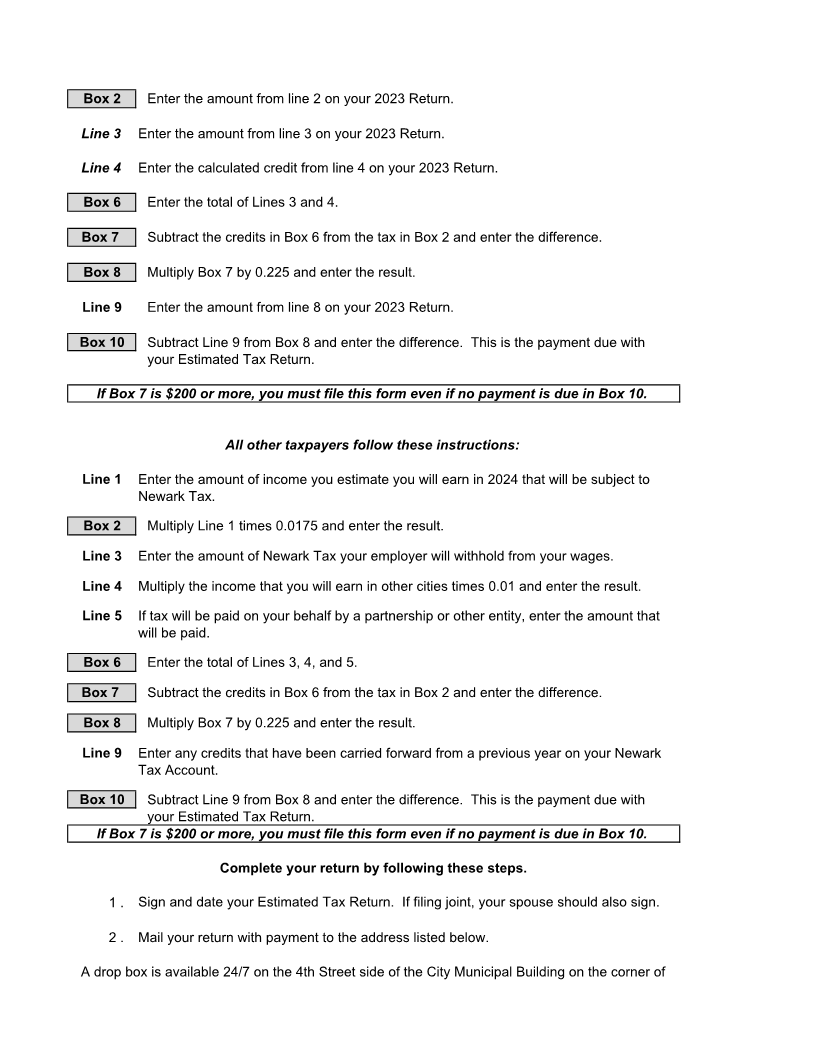

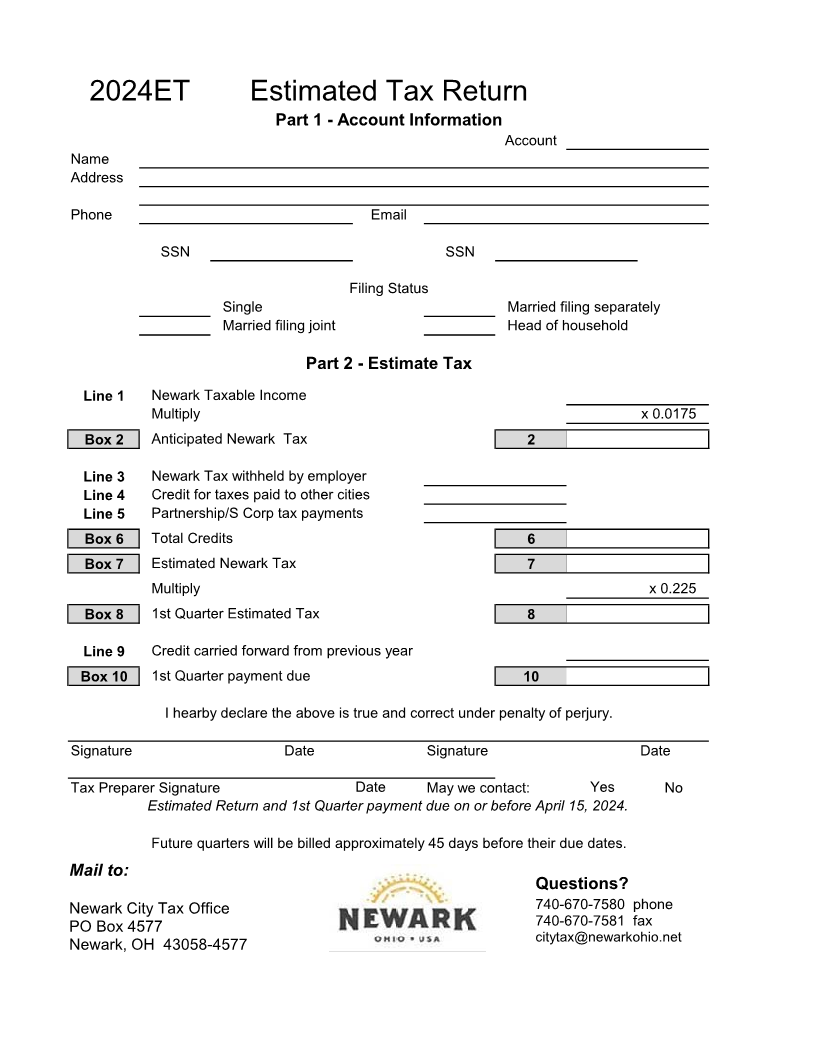

2024ET Estimated Tax Return Part 1 - Account Information Account Name Address Phone Email SSN SSN Filing Status Single Married filing separately Married filing joint Head of household Part 2 - Estimate Tax Line 1 Newark Taxable Income Multiply x 0.0175 Box 2 Anticipated Newark Tax 2 Line 3 Newark Tax withheld by employer Line 4 Credit for taxes paid to other cities Line 5 Partnership/S Corp tax payments Box 6 Total Credits 6 Box 7 Estimated Newark Tax 7 Multiply x 0.225 Box 8 1st Quarter Estimated Tax 8 Line 9 Credit carried forward from previous year Box 10 1st Quarter payment due 10 I hearby declare the above is true and correct under penalty of perjury. Signature Date Signature Date Tax Preparer Signature Date May we contact: Yes No Estimated Return and 1st Quarter payment due on or before April 15, 2024. Future quarters will be billed approximately 45 days before their due dates. Mail to: Questions? Newark City Tax Office 740-670-7580 phone PO Box 4577 740-670-7581 fax citytax@newarkohio.net Newark, OH 43058-4577